Enlarge image

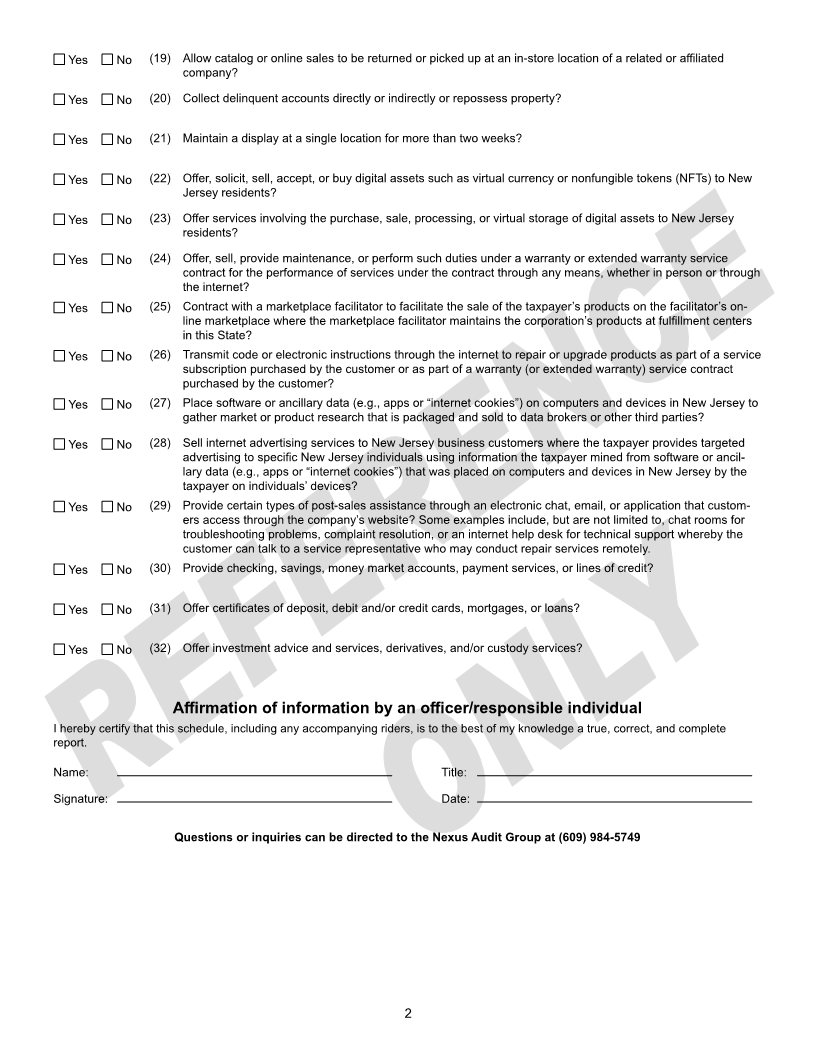

Schedule N Nexus – Immune Activity Declaration\

(10-23)

For tax year beginning , and ending ,

Corporation Name Federal ID Number Unitary ID Number, if applicable

NU

Read the instructions before completing this schedule.

During the period covered by this return, was this corporation:

Yes No (1) A member of a combined group that files a New Jersey combined return? If the entity is a member of a New

Jersey combined group filing, provide the Managerial Member name and NU number.

Did this corporation (member), during the period covered by this return, perform any of the following activities in New Jersey:

Yes No (2) Own, lease, or rent any real property in New Jersey?

Yes No (3) Lease tangible property to others for use in New Jersey?

Yes No (4) Own or lease vehicles registered in New Jersey that are provided to people who are not sales people?

Yes No (5) Own, lease, or rent any type of property located in New Jersey (consignments, inventory, drop shipments, or

like transactions)?

Yes No (6) License the use of any intangible rights from which royalties, licensing fees, etc., are derived from the use of

these rights in New Jersey (e.g., without limitations, software licenses, trademarks)?

Yes No (7) Solicit in New Jersey for services through the use of employees, officers, agents, and/or independent con -

tractors or representatives?

Yes No (8) Perform any type of service in New Jersey (other than solicitation) such as constructing, erecting, install-

ing, repairing, consulting, training, conducting seminars or meetings, or administering credit investigations

through the use of employees, agents, subcontractors, and/or independent contractors or representatives?

Yes No (9) Provide any technical assistance or expertise that is performed in New Jersey through the use of employees,

agents, subcontractors, and/or independent contractors or representatives?

Yes No (10) Perform any detail work in New Jersey without limitations such as taking inventory, stocking shelves, main-

taining displays, arranging delivery through the use of employees, agents, subcontractors, and/or indepen-

dent contractors or representatives?

Yes No (11) Carry goods, merchandise, inventory, or other property including samples into New Jersey for direct sale to

customers in New Jersey?

Yes No (12) Pick up and/or replace damaged, returned, or repossessed goods from New Jersey customers with

company-owned vehicles or through contract carriers?

Yes No (13) Pick up or deliver to points in New Jersey with company-owned vehicles or through contract carriers for any

other company other than itself?

Yes No (14) Provide any type of maintenance program that is performed in New Jersey by either this entity or an inde-

pendent contractor?

Yes No (15) Have sales representatives who have the authority to accept or approve sales orders from customers lo-

cated in New Jersey in which acceptance/approval takes place in New Jersey and not from an out-of-State

location?

Yes No (16) Have employees, independent contractors, or representatives with in-home offices in New Jersey for which

they are reimbursed for expenses other than telephone or travel or have employees working from home

telecommuting on a regular basis for the convenience of the taxpayer?

Yes No (17) Own an interest in either a partnership or LLC doing business in New Jersey? If yes, identify the name and

address of the partnership or LLC.

Yes No (18) Secure deposits for sales or payment for sales and/or deliveries?

1