Enlarge image

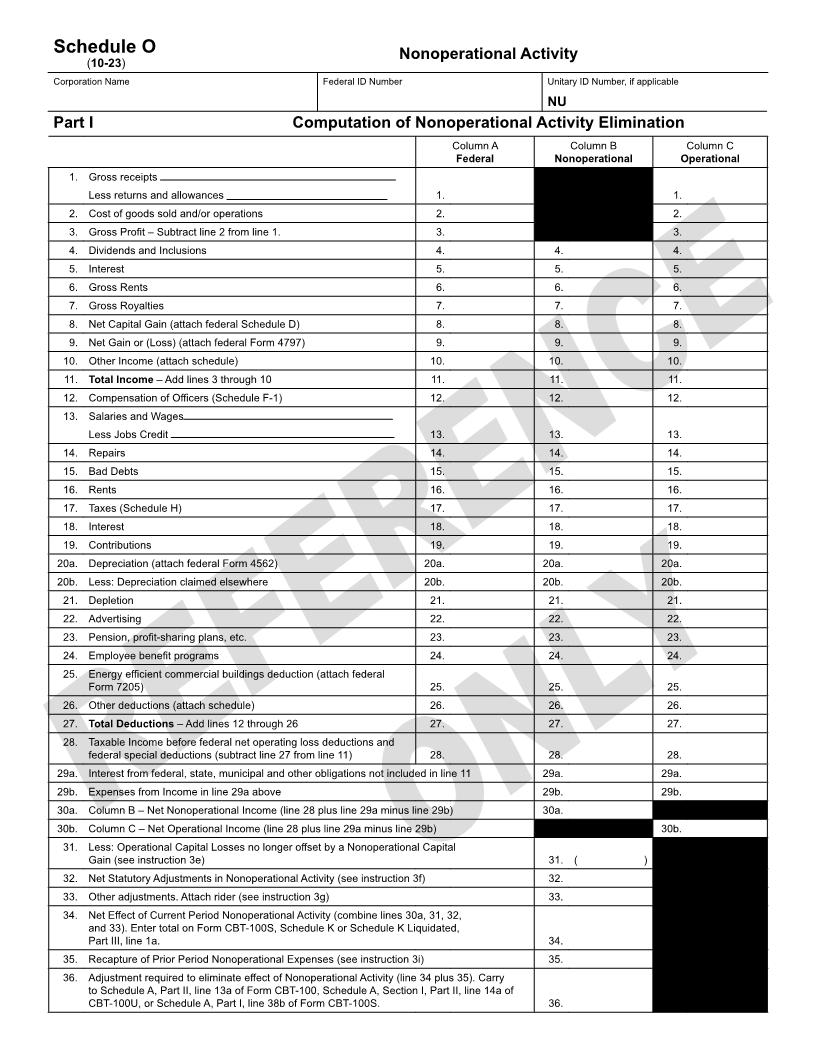

Schedule O Nonoperational Activity

(10-23)

Corporation Name Federal ID Number Unitary ID Number, if applicable

NU

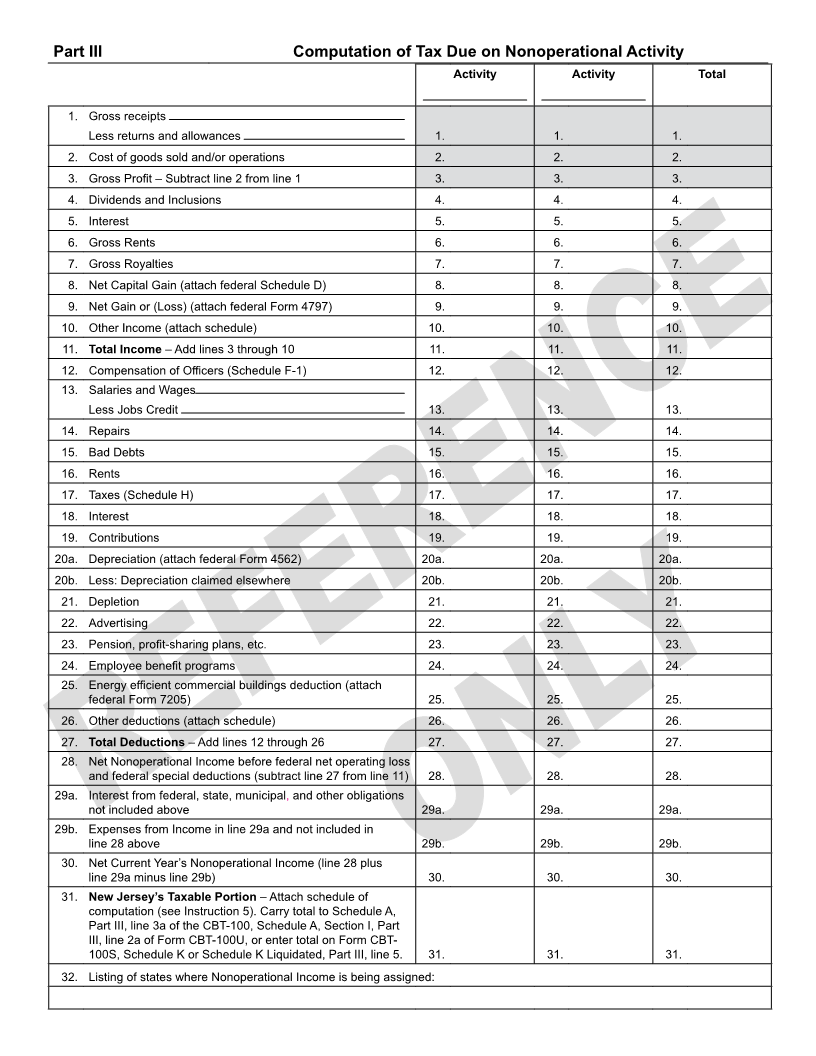

Part I Computation of Nonoperational Activity Elimination

Column A Column B Column C

Federal Nonoperational Operational

1. Gross receipts

Less returns and allowances 1. 1. 1.

2. Cost of goods sold and/or operations 2. 2. 2.

3. Gross Profit – Subtract line 2 from line 1. 3. 3. 3.

4. Dividends and Inclusions 4. 4. 4.

5. Interest 5. 5. 5.

6. Gross Rents 6. 6. 6.

7. Gross Royalties 7. 7. 7.

8. Net Capital Gain (attach federal Schedule D) 8. 8. 8.

9. Net Gain or (Loss) (attach federal Form 4797) 9. 9. 9.

10. Other Income (attach schedule) 10. 10. 10.

11. Total Income – Add lines 3 through 10 11. 11. 11.

12. Compensation of Officers (Schedule F-1) 12. 12. 12.

13. Salaries and Wages

Less Jobs Credit 13. 13. 13.

14. Repairs 14. 14. 14.

15. Bad Debts 15. 15. 15.

16. Rents 16. 16. 16.

17. Taxes (Schedule H) 17. 17. 17.

18. Interest 18. 18. 18.

19. Contributions 19. 19. 19.

20a. Depreciation (attach federal Form 4562) 20a. 20a. 20a.

20b. Less: Depreciation claimed elsewhere 20b. 20b. 20b.

21. Depletion 21. 21. 21.

22. Advertising 22. 22. 22.

23. Pension, profit-sharing plans, etc. 23. 23. 23.

24. Employee benefit programs 24. 24. 24.

25. Energy efficient commercial buildings deduction (attach federal

Form 7205) 25. 25. 25.

26. Other deductions (attach schedule) 26. 26. 26.

27. Total Deductions – Add lines 12 through 26 27. 27. 27.

28. Taxable Income before federal net operating loss deductions and

federal special deductions (subtract line 27 from line 11) 28. 28. 28.

29a. Interest from federal, state, municipal and other obligations not included in line 11 29a. 29a.

29b. Expenses from Income in line 29a above 29b. 29b.

30a. Column B – Net Nonoperational Income (line 28 plus line 29a minus line 29b) 30a.

30b. Column C – Net Operational Income (line 28 plus line 29a minus line 29b) 30b.

31. Less: Operational Capital Losses no longer offset by a Nonoperational Capital

Gain (see instruction 3e) (31. ) 31.

32. Net Statutory Adjustments in Nonoperational Activity (see instruction 3f) 32. 32.

33. Other adjustments. Attach rider (see instruction 3g) 33. 33.

34. Net Effect of Current Period Nonoperational Activity (combine lines 30a, 31, 32,

and 33). Enter total on Form CBT-100S, Schedule K or Schedule K Liquidated,

Part III, line 1a. 34. 34.

35. Recapture of Prior Period Nonoperational Expenses (see instruction 3i) 35. 35.

36. Adjustment required to eliminate effect of Nonoperational Activity (line 34 plus 35). Carry

to Schedule A, Part II, line 13a of Form CBT-100, Schedule A, Section I, Part II, line 14a of

CBT-100U, or Schedule A, Part I, line 38b of Form CBT-100S. 36. 36.