Enlarge image

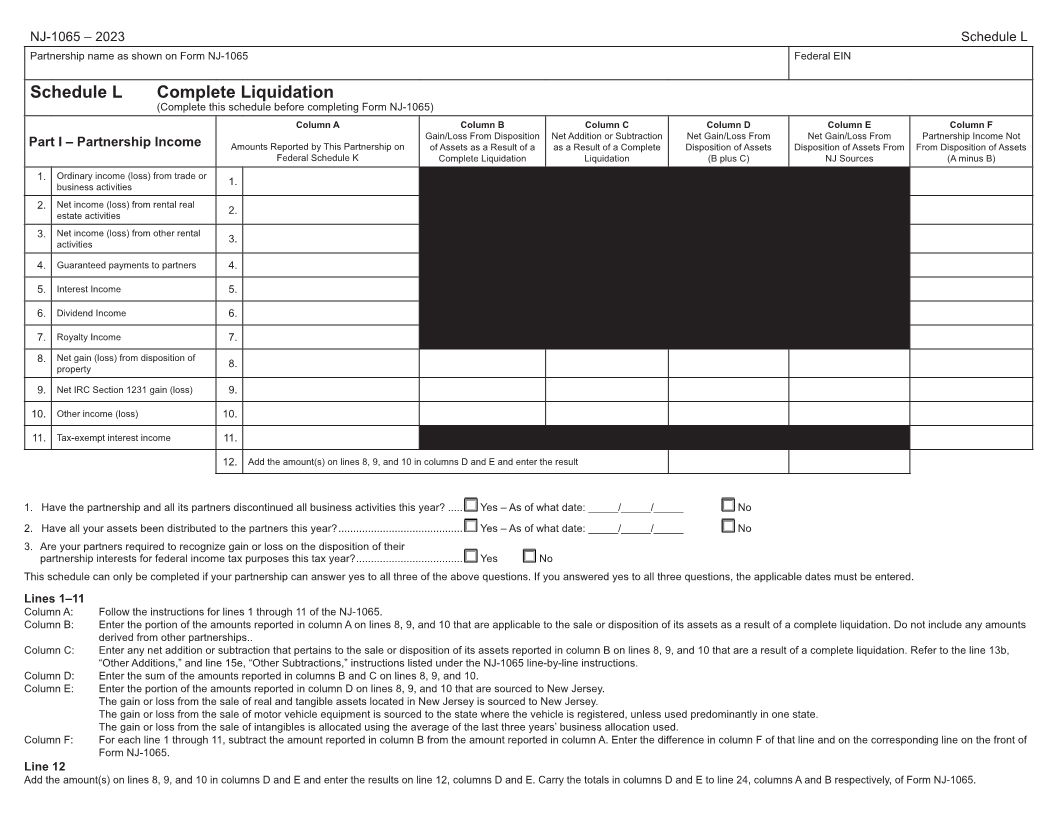

NJ-1065 – 2023 Schedule L

Partnership name as shown on Form NJ-1065 Federal EIN

Schedule L Complete Liquidation

(Complete this schedule before completing Form NJ-1065)

Column A Column B Column C Column D Column E Column F

Gain/Loss From Disposition Net Addition or Subtraction Net Gain/Loss From Net Gain/Loss From Partnership Income Not

Part I – Partnership Income Amounts Reported by This Partnership on of Assets as a Result of a as a Result of a Complete Disposition of Assets Disposition of Assets From From Disposition of Assets

Federal Schedule K Complete Liquidation Liquidation (B plus C) NJ Sources (A minus B)

1. Ordinary income (loss) from trade or 1.

business activities

2. Net income (loss) from rental real 2.

estate activities

3. Net income (loss) from other rental 3.

activities

4. Guaranteed payments to partners 4.

5. Interest Income 5.

6. Dividend Income 6.

7. Royalty Income 7.

8. Net gain (loss) from disposition of 8.

property

9. Net IRC Section 1231 gain (loss) 9.

10. Other income (loss) 10.

11. Tax-exempt interest income 11.

12. Add the amount(s) on lines 8, 9, and 10 in columns D and E and enter the result

1. Have the partnership and all its partners discontinued all business activities this year? ..... Yes – As of what date: _____/_____/_____ No

2. Have all your assets been distributed to the partners this year? .......................................... Yes – As of what date: _____/_____/_____ No

3. Are your partners required to recognize gain or loss on the disposition of their

partnership interests for federal income tax purposes this tax year? .................................... Yes No

This schedule can only be completed if your partnership can answer yes to all three of the above questions. If you answered yes to all three questions, the applicable dates must be entered.

Lines 1–11

Column A: Follow the instructions for lines 1 through 11 of the NJ-1065.

Column B: Enter the portion of the amounts reported in column A on lines 8, 9, and 10 that are applicable to the sale or disposition of its assets as a result of a complete liquidation. Do not include any amounts

derived from other partnerships..

Column C: Enter any net addition or subtraction that pertains to the sale or disposition of its assets reported in column B on lines 8, 9, and 10 that are a result of a complete liquidation. Refer to the line 13b,

“Other Additions,” and line 15e, “Other Subtractions,” instructions listed under the NJ-1065 line-by-line instructions.

Column D: Enter the sum of the amounts reported in columns B and C on lines 8, 9, and 10.

Column E: Enter the portion of the amounts reported in column D on lines 8, 9, and 10 that are sourced to New Jersey.

The gain or loss from the sale of real and tangible assets located in New Jersey is sourced to New Jersey.

The gain or loss from the sale of motor vehicle equipment is sourced to the state where the vehicle is registered, unless used predominantly in one state.

The gain or loss from the sale of intangibles is allocated using the average of the last three years’ business allocation used.

Column F: For each line 1 through 11, subtract the amount reported in column B from the amount reported in column A. Enter the difference in column F of that line and on the corresponding line on the front of

Form NJ-1065.

Line 12

Add the amount(s) on lines 8, 9, and 10 in columns D and E and enter the results on line 12, columns D and E. Carry the totals in columns D and E to line 24, columns A and B respectively, of Form NJ-1065.