Enlarge image

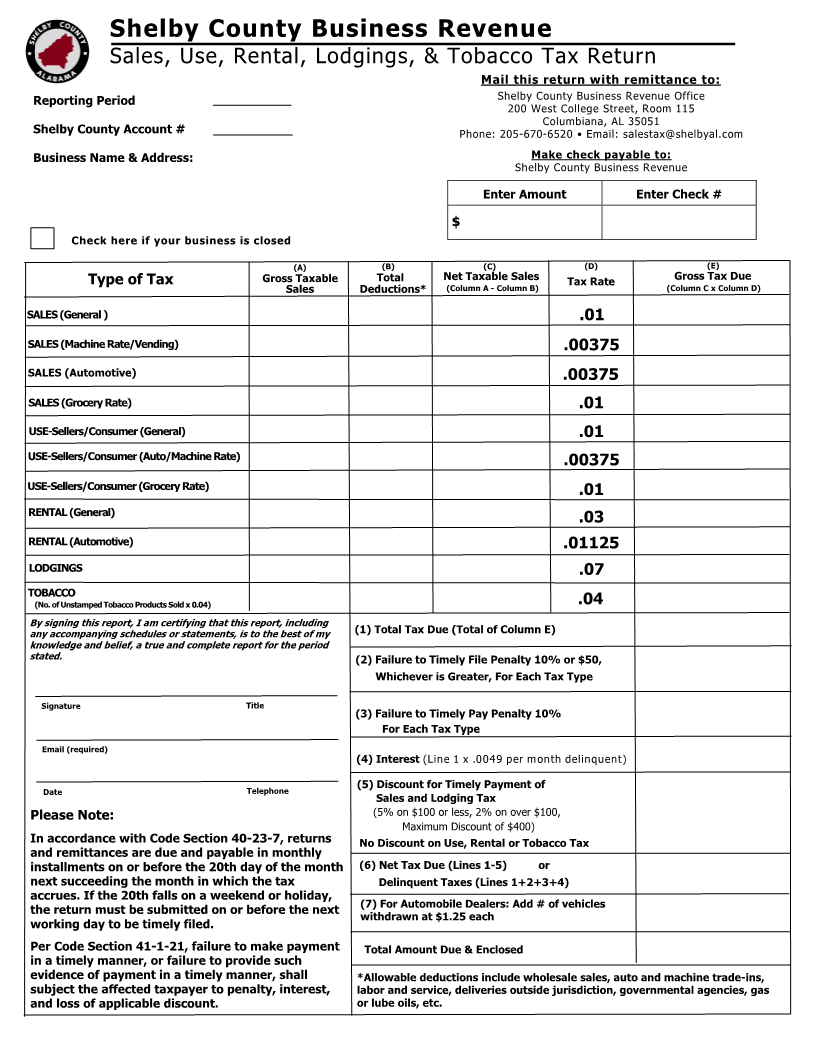

Shelby County Business Revenue

Sales, Use, Rental, Lodgings, & Tobacco Tax Return

Mail this return with remittance to:

Reporting Period Shelby County Business Revenue Office

200 West College Street, Room 115

Columbiana, AL 35051

Shelby County Account # Phone: 205-670-6520 • Email: salestax@shelbyal.com

Business Name & Address: Make check payable to:

Shelby County Business Revenue

Enter Amount Enter Check #

$

Check here if your business is closed

(A) (B) (C) (D) (E)

Type of Tax Gross Taxable Total Net Taxable Sales Tax Rate Gross Tax Due

Sales Deductions* (Column A - Column B) (Column C x Column D)

SALES (General ) .01

SALES (Machine Rate/Vending) .00375

SALES (Automotive) .00375

SALES (Grocery Rate) .01

USE-Sellers/Consumer (General) .01

USE-Sellers/Consumer (Auto/Machine Rate) .00375

USE-Sellers/Consumer (Grocery Rate) .01

RENTAL (General)

.03

RENTAL (Automotive) .01125

LODGINGS .07

TOBACCO

(No. of Unstamped Tobacco Products Sold x 0.04) .04

By signing this report, I am certifying that this report, including

any accompanying schedules or statements, is to the best of my (1) Total Tax Due (Total of Column E)

knowledge and belief, a true and complete report for the period

stated. (2) Failure toTimely File Penalty 10% or $50,

Whichever is Greater , For Each Tax Type

Signature Title

(3) Failure to Timely Pay Penalty 10%

For Each Tax Type

Email (required)

(4) Interest (Line 1 x .0049 per month delinquent)

Date Telephone (5) Discount for Timely Payment of

Sales and Lodging Tax

Please Note: (5% on $100 or less, 2% on over $100,

Maximum Discount of $400)

In accordance with Code Section 40-23-7, returns No Discount on Use, Rental or Tobacco Tax

and remittances are due and payable in monthly

installments on or before the 20th day of the month (6) Net Tax Due (Lines 1-5) or

next succeeding the month in which the tax Delinquent Taxes (Lines 1+2+3+4)

accrues. If the 20th falls on a weekend or holiday,

the return must be submitted on or before the next (7) For Automobile Dealers: Add # of vehicles

withdrawn at $1.25 each

working day to be timely filed.

Per Code Section 41-1-21, failure to make payment Total Amount Due & Enclosed

in a timely manner, or failure to provide such

evidence of payment in a timely manner, shall *Allowable deductions include wholesale sales, auto and machine trade-ins,

subject the affected taxpayer to penalty, interest, labor and service, deliveries outside jurisdiction, governmental agencies, gas

and loss of applicable discount. or lube oils, etc.