Enlarge image

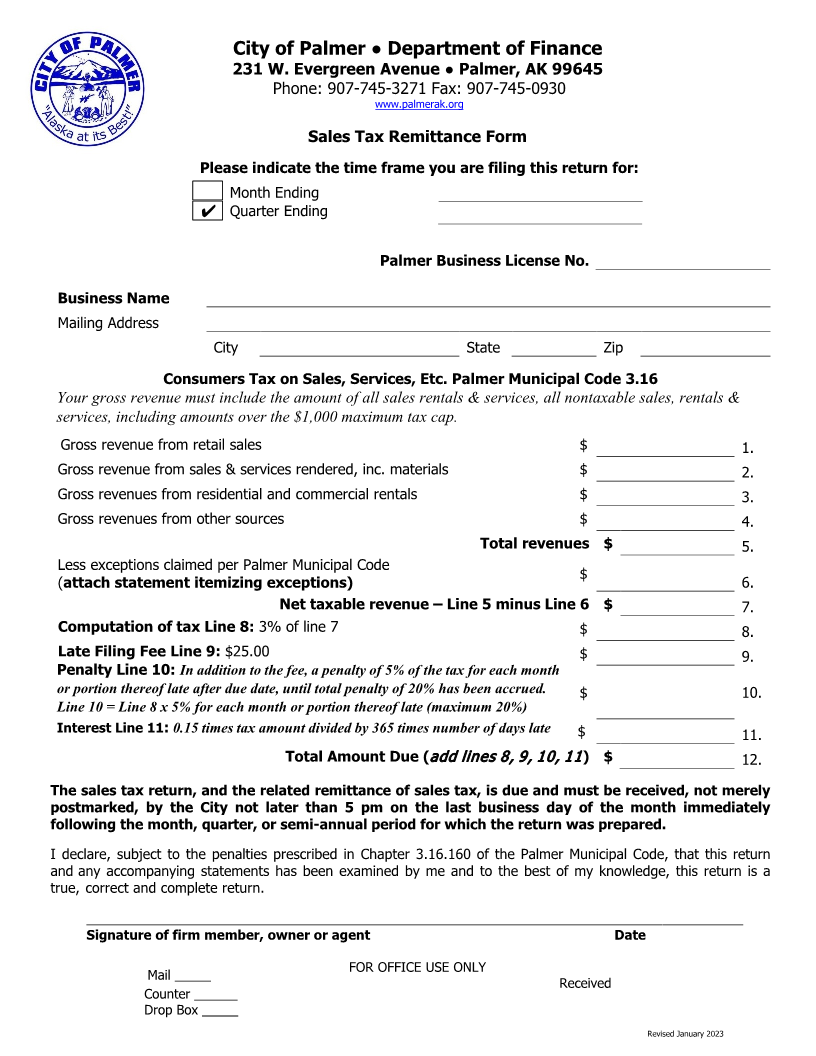

City of Palmer ● Department of Finance

231 W. Evergreen Avenue ● Palmer, AK 99645

Phone: 907-745-3271 Fax: 907-745-0930

www.palmerak.org

Sales Tax Remittance Form

Please indicate the time frame you are filing this return for:

Month Ending

4 Quarter Ending

Palmer Business License No.

Business Name

Mailing Address

City State Zip

Consumers Tax on Sales, Services, Etc. Palmer Municipal Code 3.16

Your gross revenue must include the amount of all sales rentals & services, all nontaxable sales, rentals &

services, including amounts over the $1,000 maximum tax cap.

Gross revenue from retail sales $ 1.

Gross revenue from sales & services rendered, inc. materials $ 2.

Gross revenues from residential and commercial rentals $ 3.

Gross revenues from other sources $ 4.

Total revenues $ 5.

Less exceptions claimed per Palmer Municipal Code

$

(attach statement itemizing exceptions) 6.

Net taxable revenue – Line 5 minus Line 6 $ 7.

Computation of tax Line 8: 3% of line 7 $ 8.

Late Filing Fee Line 9: $25.00 $ 9.

Penalty Line 10: In addition to the fee, a penalty of 5% of the tax for each month

or portion thereof late after duedate, until total penalty of 20% has been accrued. $ 10.

Line 10 =Line 8 x 5% for eachmonth or portion thereof late (maximum 20%)

Interest Line 11: 0.15 times tax amount divided by 365 times number of days late

$ 11.

Total Amount Due (add lines 8, 9, 10, 11 ) $ 12.

The sales tax return, and the related remittance of sales tax, is due and must be received, not merely

postmarked, by the City not later than 5 pm on the last business day of the month immediately

following the month, quarter, or semi-annual period for which the return was prepared.

I declare, subject to the penalties prescribed in Chapter 3.16.160 of the Palmer Municipal Code, that this return

and any accompanying statements has been examined by me and to the best of my knowledge, this return is a

true, correct and complete return.

__________________________________________________________________________________

Signature of firm member, owner or agent Date

FOR OFFICE USE ONLY

Mail _____ Received

Counter ______

Drop Box _____

Revised January 2023