Enlarge image

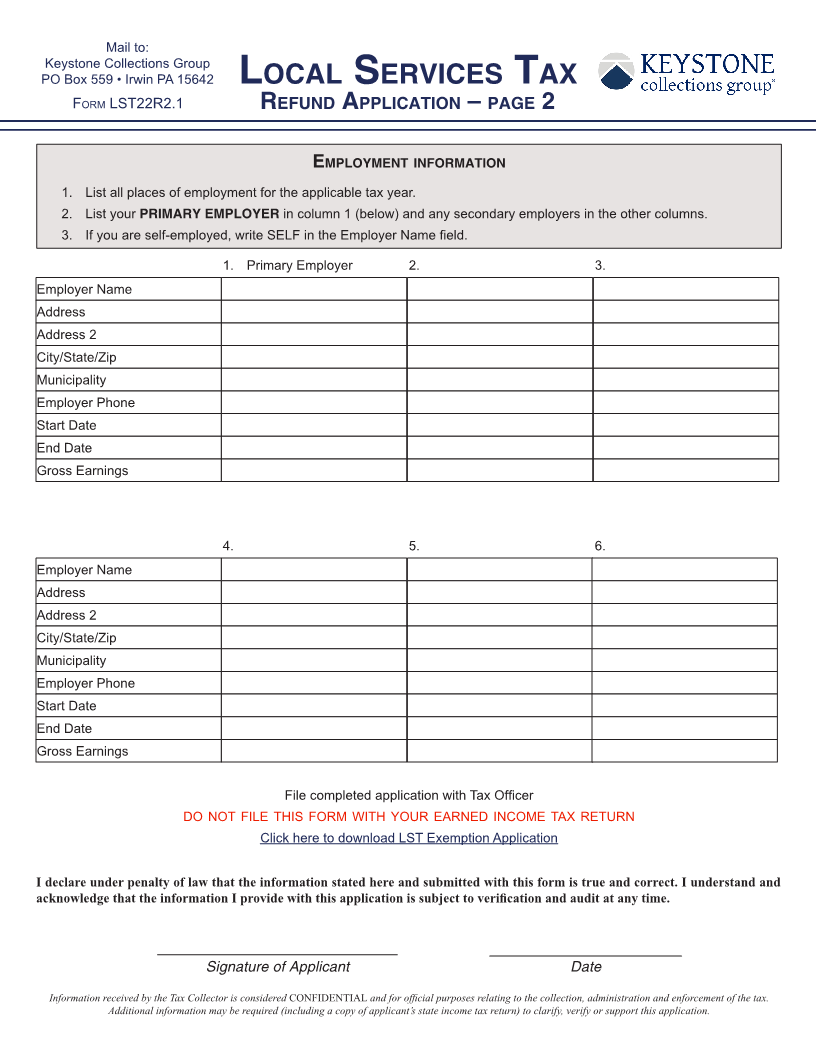

Mail to:

Keystone Collections Group

PO Box 559 • Irwin PA 15642

LocaL ServiceS Tax

Form LST22r2.1 efund appLicaTion

r

File completed application with Tax Officer

do noT FiLe ThiS Form wiTh your earned income Tax reTurn

Click here to download LST Exemption Application

Name Tax Year

Address SSN

City/State Phone

Zip

Reason for Refund (check all that apply)

Overpaid by more than $1

Exempt but withheld in error

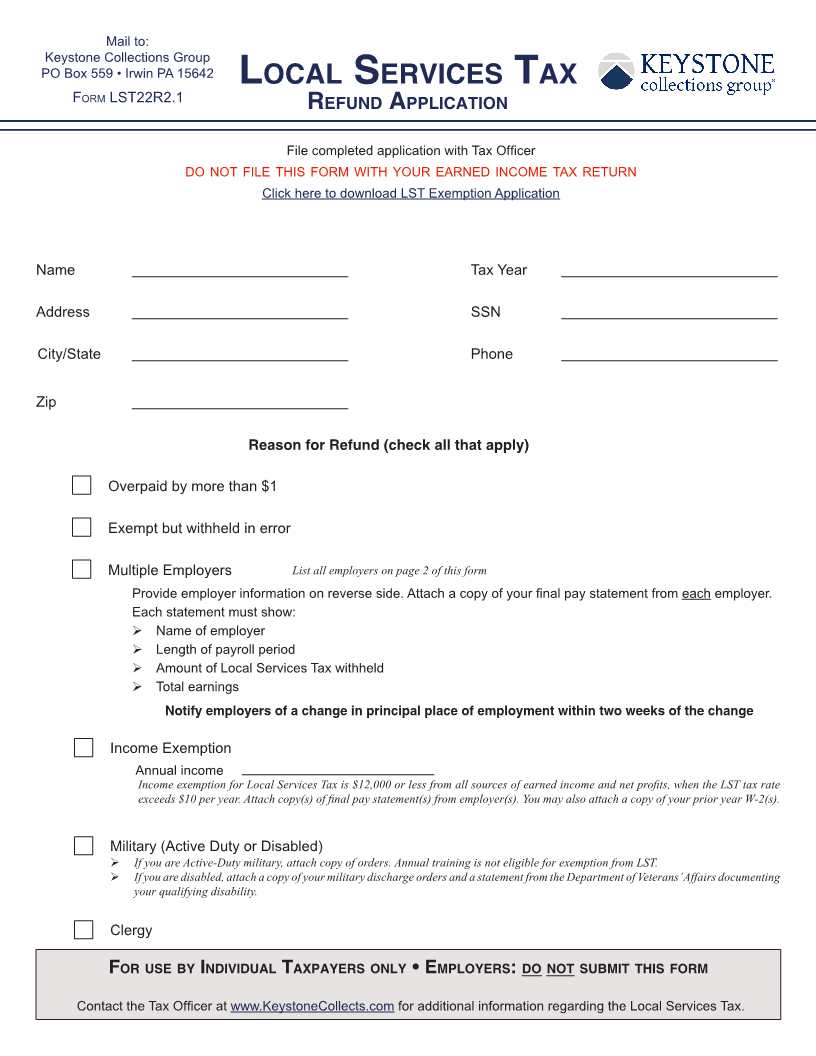

Multiple Employers List all employers on page 2 of this form

Provide employer information on reverse side. Attach a copy of your final pay statement from each employer.

Each statement must show:

¾ Name of employer

¾ Length of payroll period

¾ Amount of Local Services Tax withheld

¾ Total earnings

Notify employers of a change in principal place of employment within two weeks of the change

Income Exemption

Annual income

Income exemption for Local Services Tax is $12,000 or less from all sources of earned income and net profits, when the LST tax rate

exceeds $10 per year. Attach copy(s) of final pay statement(s) from employer(s). You may also attach a copy of your prior year W-2(s).

Military (Active Duty or Disabled)

¾ If you are Active-Duty military, attach copy of orders. Annual training is not eligible for exemption from LST.

¾ If you are disabled, attach a copy of your military discharge orders and a statement from the Department of Veterans’ Affairs documenting

your qualifying disability.

Clergy

for uSe by ndividuaL i TaxpayerS onLy • empLoyerS do noT SubmiT ThiS form:

Contact the Tax Officer at www.KeystoneCollects.com for additional information regarding the Local Services Tax.