Enlarge image

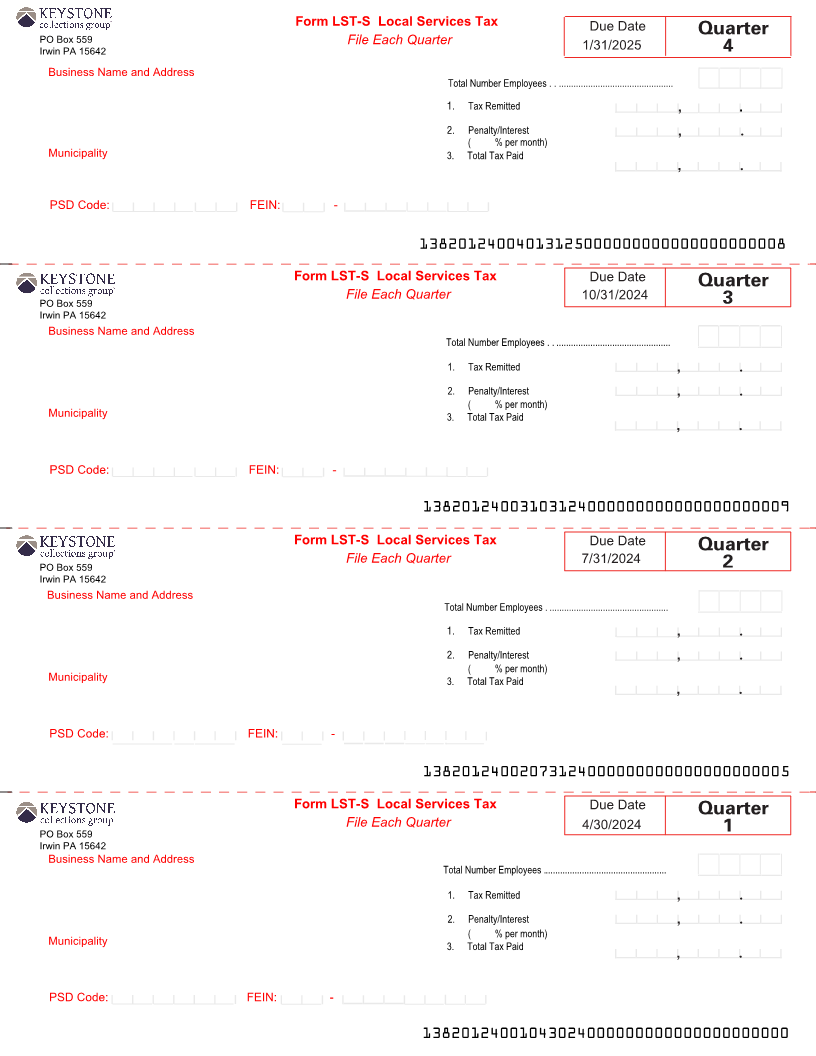

Form LSTS Local Services Tax

Due Date Quarter

PO Box 559 File Each Quarter

Irwin PA 15642 1/31/2025 4

Business Name and Address

Total Number Employees . . ...............................................

1. Tax Remitted , .

2. Penalty/Interest , .

( % per month)

Municipality 3. Total Tax Paid

, .

PSD Code: FEIN:

1382012 00401312 000000000000000000004 5 8

Form LSTS Local Services Tax Due Date Quarter

PO Box 559 File Each Quarter 10/31/2024 3

Irwin PA 15642

Business Name and Address

Total Number Employees . . ...............................................

1. Tax Remitted , .

2. Penalty/Interest , .

( % per month)

Municipality 3. Total Tax Paid

, .

PSD Code: FEIN:

1382012 00310312 00000000000000000000 4 4 9

Form LSTS Local Services Tax Due Date Quarter

PO Box 559 File Each Quarter 7/31/2024 2

Irwin PA 15642

Business Name and Address

Total Number Employees . .................................................

1. Tax Remitted , .

2. Penalty/Interest , .

( % per month)

Municipality 3. Total Tax Paid

, .

PSD Code: FEIN:

1382012 00207312 00000000000000000000 4 4 5

Form LSTS Local Services Tax Due Date Quarter

File Each Quarter 4/30/2024 1

PO Box 559

Irwin PA 15642

Business Name and Address

Total Number Employees ...................................................

1. Tax Remitted , .

2. Penalty/Interest , .

( % per month)

Municipality 3. Total Tax Paid

, .

PSD Code: FEIN:

1382012 00104302 000000000000000000004 4 0