Enlarge image

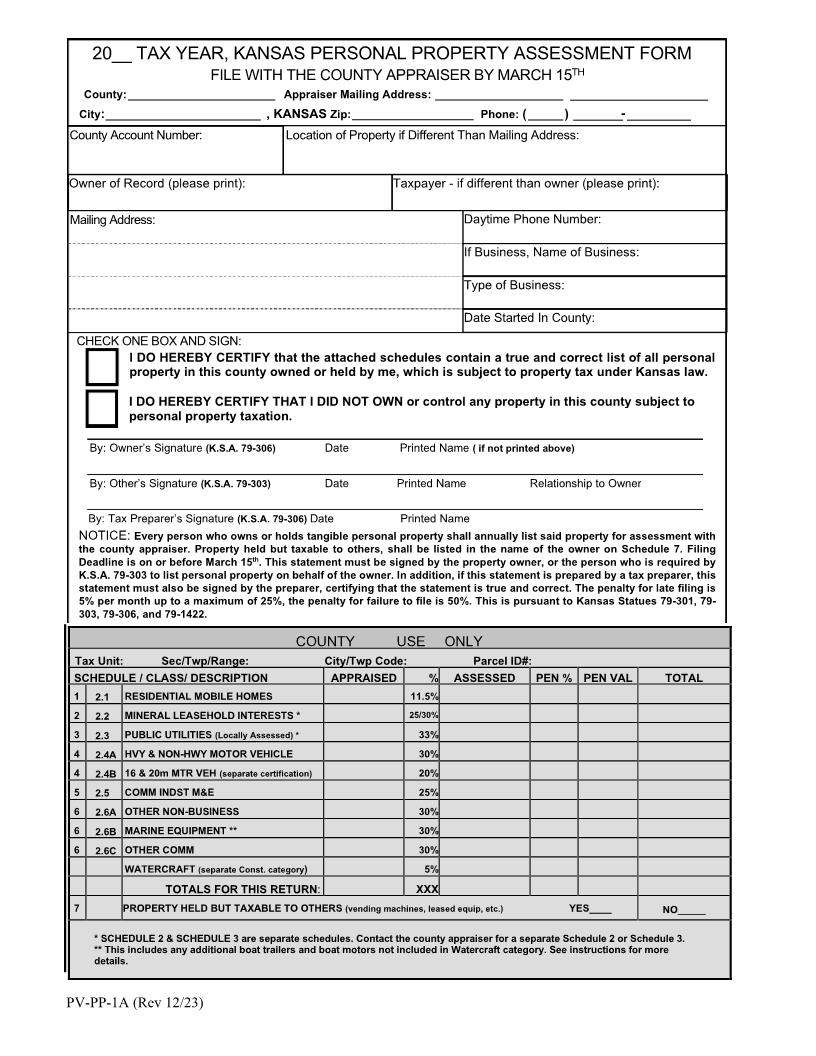

20__ TAX YEAR, KANSAS PERSONAL PROPERTY ASSESSMENT FORM

FILE WITH THE COUNTY APPRAISER BY MARCHTH15

County: _______________________ Appraiser Mailing Address: ____________________

City: ______________________ , KANSAS Zip: ___________________ Phone: ( _____ ) -

County Account Number: Location of Property if Different Than Mailing Address:

Owner of Record (please print): Taxpayer - if different than owner (please print):

Mailing Address: Daytime Phone Number:

If Business, Name of Business:

Type of Business:

Date Started In County:

CHECK ONE BOX AND SIGN:

I DO HEREBY CERTIFY that the attached schedules contain a true and correct list of all personal

property in this county owned or held by me, which is subject to property tax under Kansas law.

I DO HEREBY CERTIFY THAT I DID NOT OWN or control any property in this county subject to

personal property taxation.

By: Owner’s Signature (K.S.A. 79-306) Date Printed Name ( if not printed above)

By: Other’s Signature (K.S.A. 79-303) Date Printed Name Relationship to Owner

By: Tax Preparer’s Signature (K.S.A. 79-306) Date Printed Name

NOTICE: Every person who owns or holds tangible personal property shall annually list said property for assessment with

the county appraiser. Property held but taxable to others, shall be listed in the name of the owner on Schedule 7. Filing

Deadline is on or before March 15th. This statement must be signed by the property owner, or the person who is required by

K.S.A. 79-303 to list personal property on behalf of the owner. In addition, if this statement is prepared by a tax preparer, this

statement must also be signed by the preparer, certifying that the statement is true and correct. The penalty for late filing is

5% per month up to a maximum of 25%, the penalty for failure to file is 50%. This is pursuant to Kansas Statues 79-301, 79-

303, 79-306, and 79-1422.

COUNTY USE ONLY

Tax Unit: Sec/Twp/Range: City/Twp Code: Parcel ID#:

SCHEDULE / CLASS/ DESCRIPTION APPRAISED % ASSESSED PEN % PEN VAL TOTAL

1 2.1 RESIDENTIAL MOBILE HOMES 11.5%

2 2.2 MINERAL LEASEHOLD INTERESTS * 25/30%

3 2.3 PUBLIC UTILITIES (Locally Assessed) * 33%

4 2.4A HVY & NON-HWY MOTOR VEHICLE 30%

4 2.4B 16 & 20m MTR VEH (separate certification) 20%

5 2.5 COMM INDST M&E 25%

6 2.6A OTHER NON-BUSINESS 30%

6 2.6B MARINE EQUIPMENT ** 30%

6 2.6C OTHER COMM 30%

WATERCRAFT (separate Const. category) 5%

TOTALS FOR THIS RETURN: XXX

7 PROPERTY HELD BUT TAXABLE TO OTHERS (vending machines, leased equip, etc.) YES____ NO_____

* SCHEDULE 2 & SCHEDULE 3 are separate schedules. Contact the county appraiser for a separate Schedule 2 or Schedule 3.

** This includes any additional boat trailers and boat motors not included in Watercraft category. See instructions for more

details.

PV-PP-1A (Rev 12/23)