Enlarge image

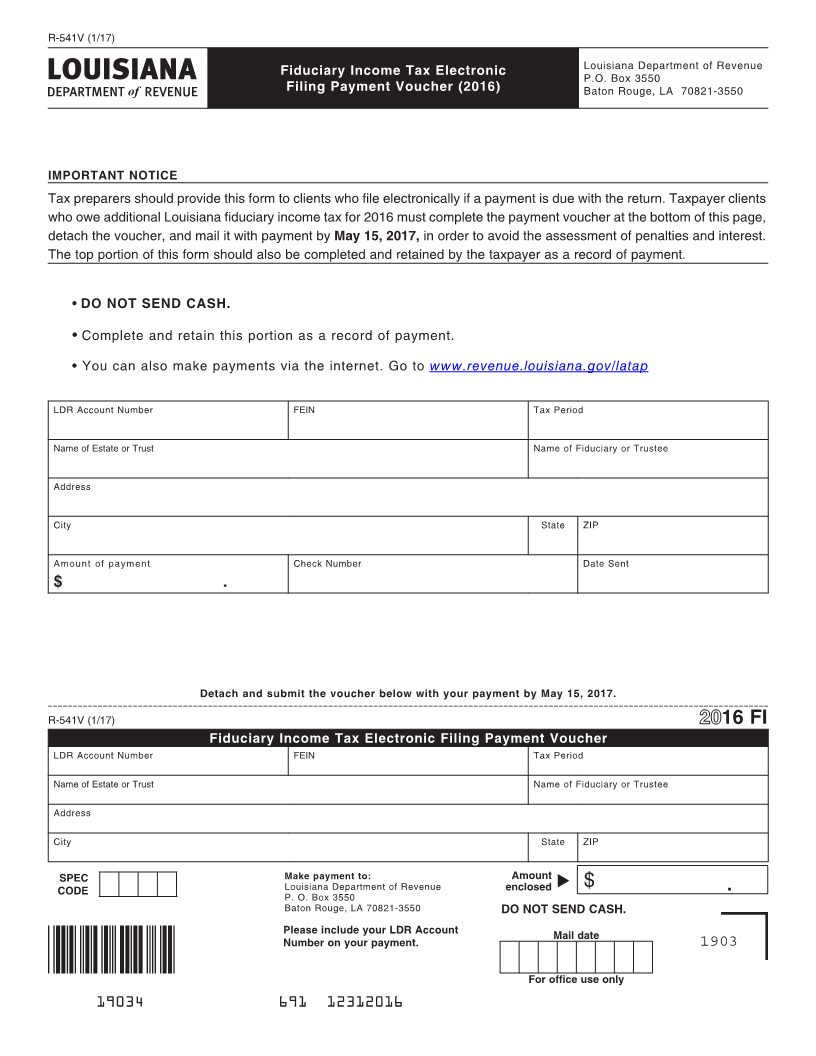

R-541V (1/17)

Fiduciary Income Tax Electronic Louisiana Department of Revenue

P.O. Box 3550

Filing Payment Voucher (2016) Baton Rouge, LA 70821-3550

IMPORTANT NOTICE

Tax preparers should provide this form to clients who file electronically if a payment is due with the return. Taxpayer clients

who owe additional Louisiana fiduciary income tax for 2016 must complete the payment voucher at the bottom of this page,

detach the voucher, and mail it with payment by May 15, 2017, in order to avoid the assessment of penalties and interest.

The top portion of this form should also be completed and retained by the taxpayer as a record of payment.

• DO NOT SEND CASH.

• Complete and retain this portion as a record of payment.

• You can also make payments via the internet. Go to www.revenue.louisiana.gov/latap

LDR Account Number FEIN Tax Period

Name of Estate or Trust Name of Fiduciary or Trustee

Address

City State ZIP

Amount of payment Check Number Date Sent

$ .

Detach and submit the voucher below with your payment by May 15, 2017.

R-541V (1/17) 16 FI

Fiduciary Income Tax Electronic Filing Payment Voucher

LDR Account Number FEIN Tax Period

Name of Estate or Trust Name of Fiduciary or Trustee

Address

City State ZIP

SPEC Make payment to: Amount

CODE Louisiana Department of Revenue enclosed u $

P. O. Box 3550 .

Baton Rouge, LA 70821-3550 DO NOT SEND CASH.

Please include your LDR Account Mail date

Number on your payment. 1903

For office use only

19034 691 12312016