Enlarge image

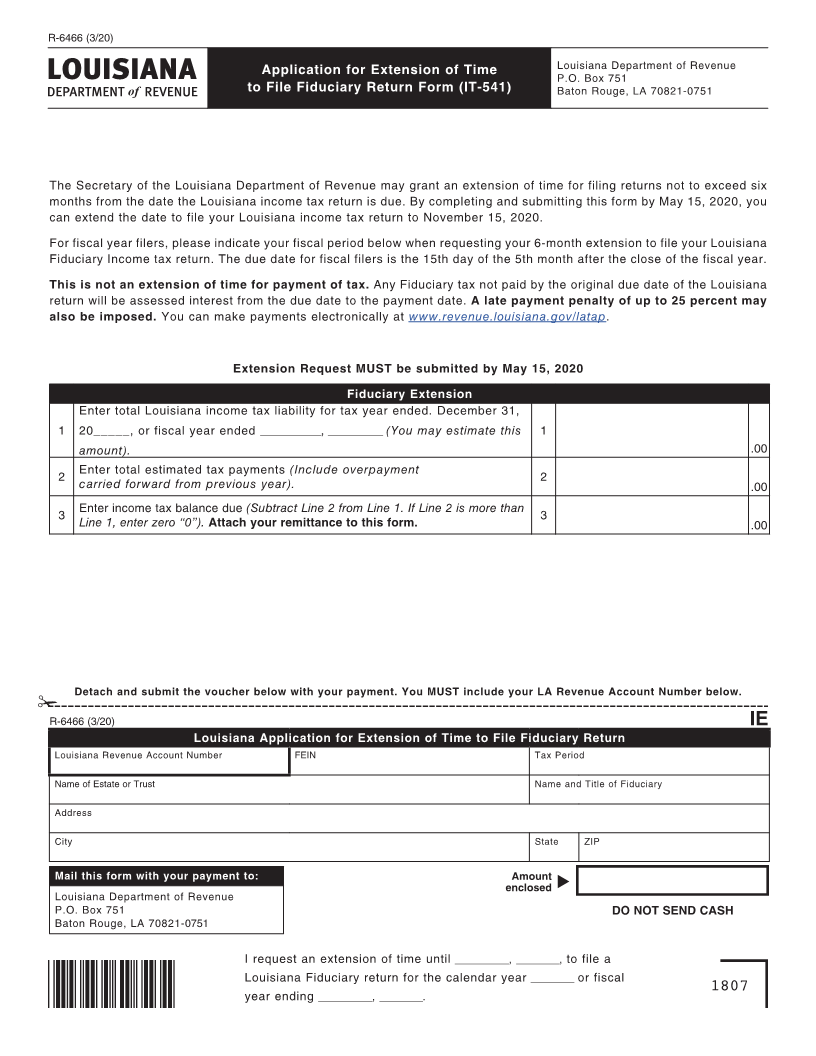

R-6466 (3/20)

Application for Extension of Time Louisiana Department of Revenue

P.O. Box 751

to File Fiduciary Return Form (IT-541) Baton Rouge, LA 70821-0751

The Secretary of the Louisiana Department of Revenue may grant an extension of time for filing returns not to exceed six

months from the date the Louisiana income tax return is due. By completing and submitting this form by May 15, 2020, you

can extend the date to file your Louisiana income tax return to November 15, 2020.

For fiscal year filers, please indicate your fiscal period below when requesting your 6-month extension to file your Louisiana

Fiduciary Income tax return. The due date for fiscal filers is the 15th day of the 5th month after the close of the fiscal year.

This is not an extension of time for payment of tax. Any Fiduciary tax not paid by the original due date of the Louisiana

return will be assessed interest from the due date to the payment date. A late payment penalty of up to 25 percent may

also be imposed. You can make payments electronically at www.revenue.louisiana.gov/latap.

Extension Request MUST be submitted by May 15, 2020

Fiduciary Extension

Enter total Louisiana income tax liability for tax year ended. December 31,

1 20_____, or fiscal year ended __________, _________ (You may estimate this 1

amount). .00

Enter total estimated tax payments (Include overpayment

2 2

carried forward from previous year). .00

Enter income tax balance due (Subtract Line 2 from Line 1. If Line 2 is more than

3 3

Line 1, enter zero “0”). Attach your remittance to this form. .00

Detach and submit the voucher below with your payment. You MUST include your LA Revenue Account Number below.

!

R-6466 (3/20) IE

Louisiana Application for Extension of Time to File Fiduciary Return

Louisiana Revenue Account Number FEIN Tax Period

Name of Estate or Trust Name and Title of Fiduciary

Address

City State ZIP

Mail this form with your payment to: Amount

enclosed u

Louisiana Department of Revenue

P.O. Box 751 DO NOT SEND CASH

Baton Rouge, LA 70821-0751

I request an extension of time until __________, ________, to file a

Louisiana Fiduciary return for the calendar year ________ or fiscal

year ending __________, ________. 1807