Enlarge image

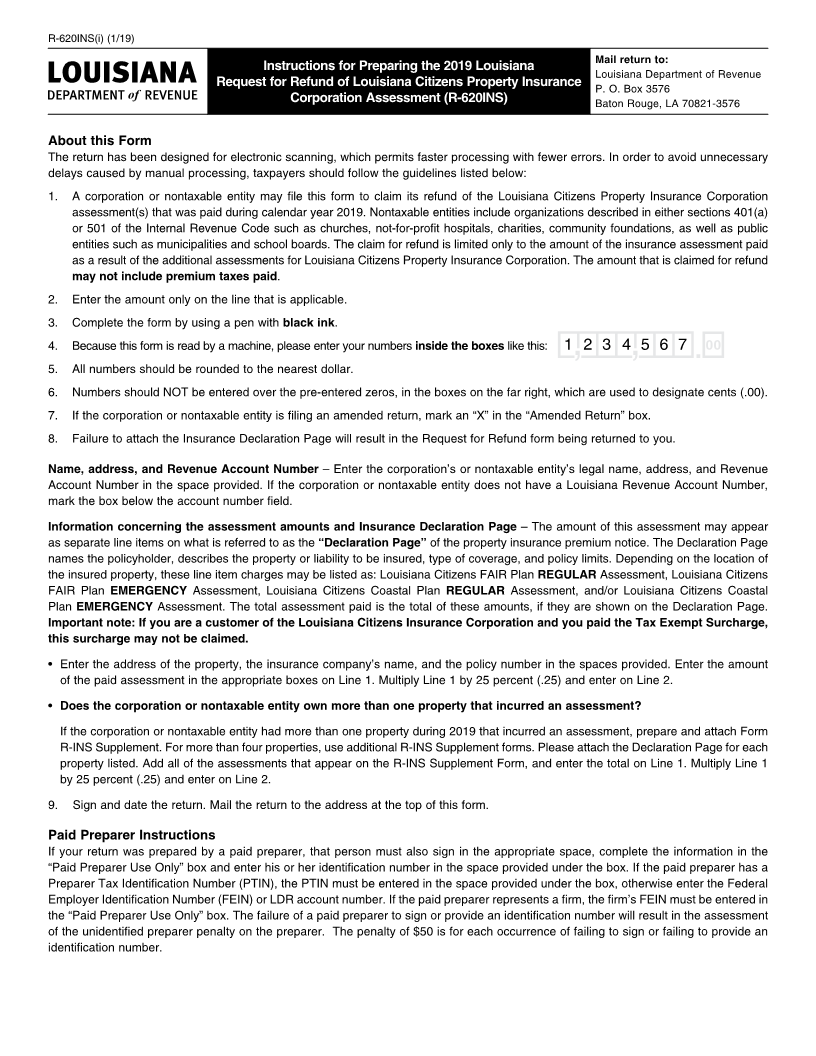

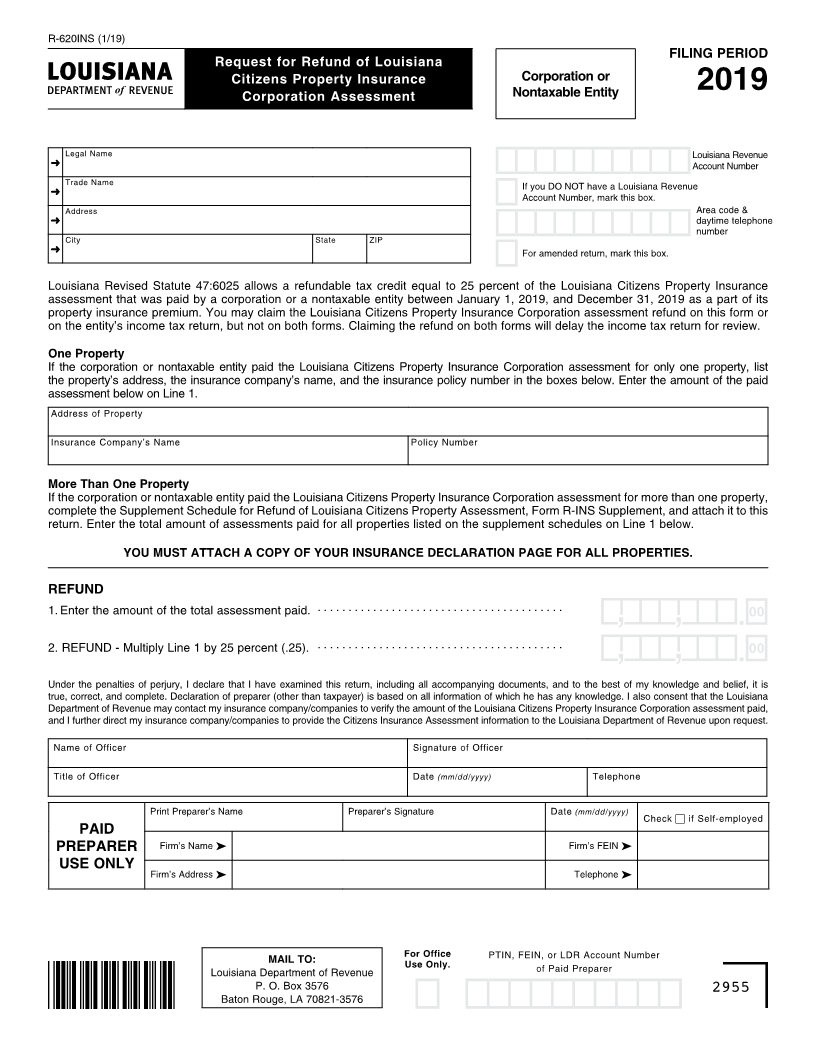

R-620INS (1/19)

FILING PERIOD

Request for Refund of Louisiana

Citizens Property Insurance Corporation or

Corporation Assessment Nontaxable Entity 2019

Legal Name Louisiana Revenue

➜ Account Number

Trade Name

➜ If you DO NOT have a Louisiana Revenue

Account Number, mark this box.

Address Area code &

➜ daytime telephone

number

City State ZIP

➜ For amended return, mark this box.

Louisiana Revised Statute 47:6025 allows a refundable tax credit equal to 25 percent of the Louisiana Citizens Property Insurance

assessment that was paid by a corporation or a nontaxable entity between January 1, 2019, and December 31, 2019 as a part of its

property insurance premium. You may claim the Louisiana Citizens Property Insurance Corporation assessment refund on this form or

on the entity’s income tax return, but not on both forms. Claiming the refund on both forms will delay the income tax return for review.

One Property

If the corporation or nontaxable entity paid the Louisiana Citizens Property Insurance Corporation assessment for only one property, list

the property’s address, the insurance company’s name, and the insurance policy number in the boxes below. Enter the amount of the paid

assessment below on Line 1.

Address of Property

Insurance Company’s Name Policy Number

More Than One Property

If the corporation or nontaxable entity paid the Louisiana Citizens Property Insurance Corporation assessment for more than one property,

complete the Supplement Schedule for Refund of Louisiana Citizens Property Assessment, Form R-INS Supplement, and attach it to this

return. Enter the total amount of assessments paid for all properties listed on the supplement schedules on Line 1 below.

YOU MUST ATTACH A COPY OF YOUR INSURANCE DECLARATION PAGE FOR ALL PROPERTIES.

REFUND

1. Enter the amount of the total assessment paid. ........................................

2. REFUND - Multiply Line 1 by 25 percent (.25). ........................................

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which he has any knowledge. I also consent that the Louisiana

Department of Revenue may contact my insurance company/companies to verify the amount of the Louisiana Citizens Property Insurance Corporation assessment paid,

and I further direct my insurance company/companies to provide the Citizens Insurance Assessment information to the Louisiana Department of Revenue upon request.

Name of Officer Signature of Officer

Title of Officer Date (mm/dd/yyyy) Telephone

Print Preparer’s Name Preparer’s Signature Date (mm/dd/yyyy)

Check ■ if Self-employed

PAID

PREPARER Firm’s Name ➤ Firm’s FEIN ➤

USE ONLY

Firm’s Address ➤ Telephone ➤

MAIL TO: For Office PTIN, FEIN, or LDR Account Number

Louisiana Department of Revenue Use Only. of Paid Preparer

P. O. Box 3576 2955

Baton Rouge, LA 70821-3576