Enlarge image

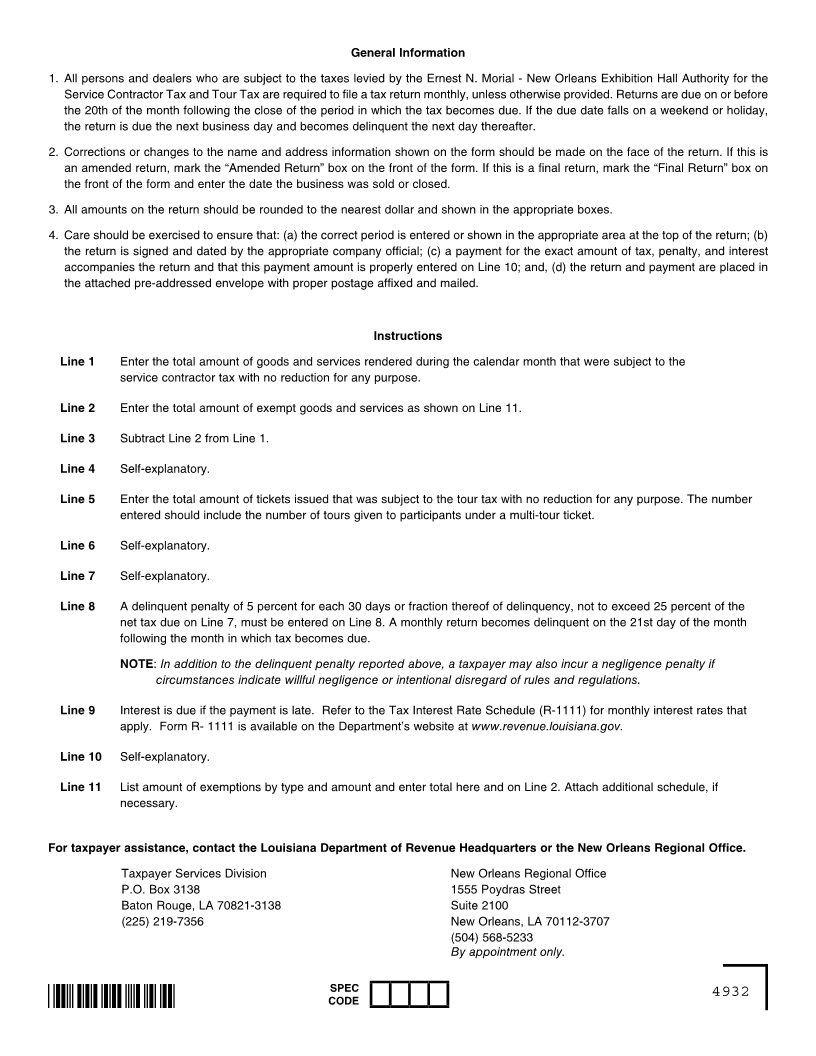

R-1030 (7/09)

Ernest N. Morial Convention Center

Service Contractor Tax Return

Tour Tax Return

Mail Return To:

Louisiana Department of Revenue

Taxpayer Services Division

P.O. Box 3138

Baton Rouge, LA 70821-3138

Use return envelope provided.

Filing

Period_____________________

MM/YY PLEASE PRINT OR TYPE.

Service Contractor Tax

1 Contract Price of Goods and/or Services Furnished .00

2 Less Total Exemptions (from Line 11) .00

3 Taxable Amount (Subtract Line 2 from Line 1.) .00

4 Gross Tax Due (Multiply amount on Line 3 by 2%.) .00

Tour Tax

5 Number of Tour Participants

6 Gross Tax Due (Multiply amount on Line 5 by $1.) .00

7 Net Tax Due (Add Line 4 plus Line 6.) .00

(5% of tax for each 30 days or fraction thereof of delinquency, not to

8 Delinquent penalty exceed 25% in the aggregate) .00

9 Interest (See instructions.) .00

10 Total Tax, Penalty, and Interest Make payment to:

Department of Revenue. PAY THIS AMOUNT. .00

(Add Lines 7 through 9.) Do not send cash.

11 Exemptions (Please specify.) Type Amount

TOTAL

This return is due on or before the 20th day following the taxable period and becomes delinquent on the first day thereafter. If the due

date falls on a weekend or holiday, the return is due the next business day and becomes delinquent the first day thereafter.

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of

my knowledge and belief, it is true, correct, and complete.

Date (mm/dd/yyyy) Taxpayer Signature

Signature of preparer other than taxpayer Telephone

■ Amended Return ■ Business Closed ■ Final Return Date Business Discontinued _____________________

FOR OFFICE USE ONLY

Amount paid with this return Check # Routing #

SPEC 4931

CODE