Enlarge image

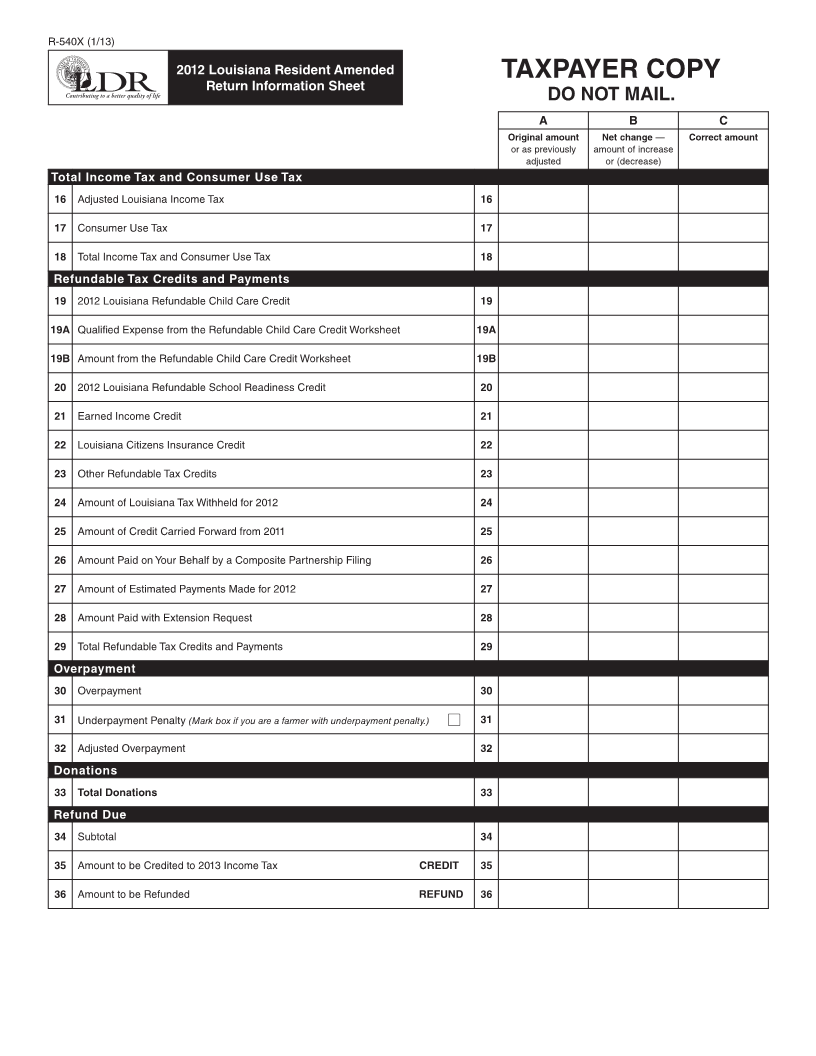

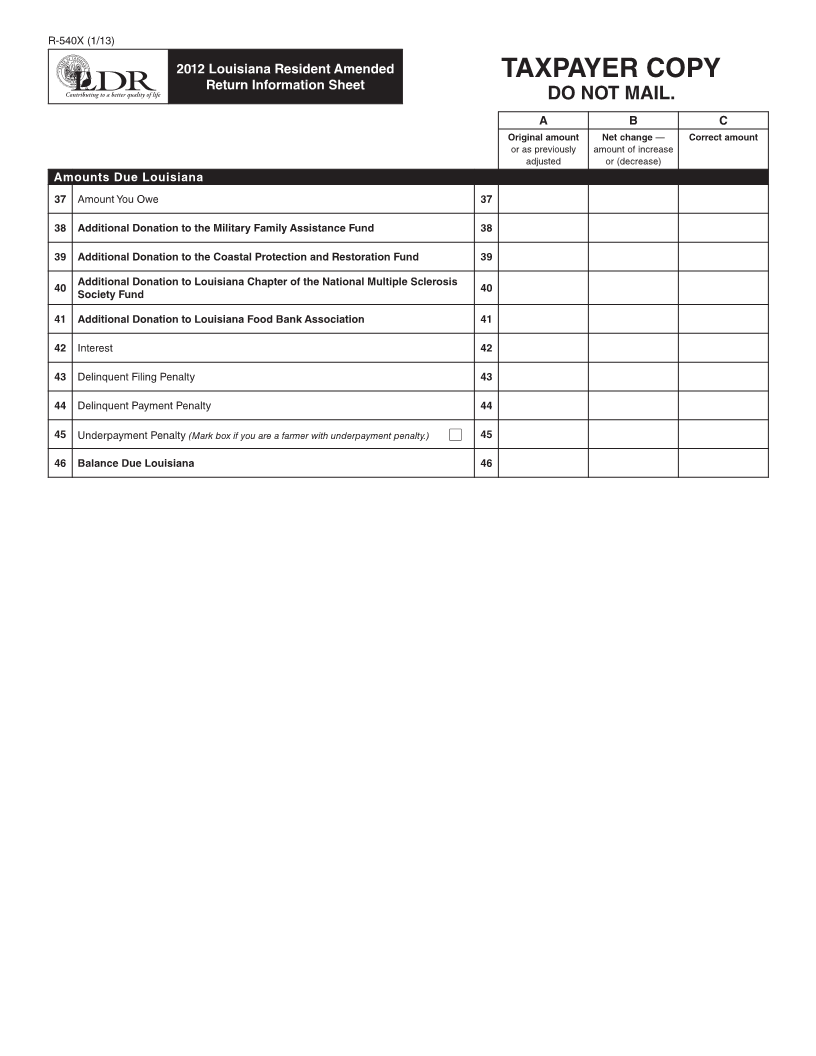

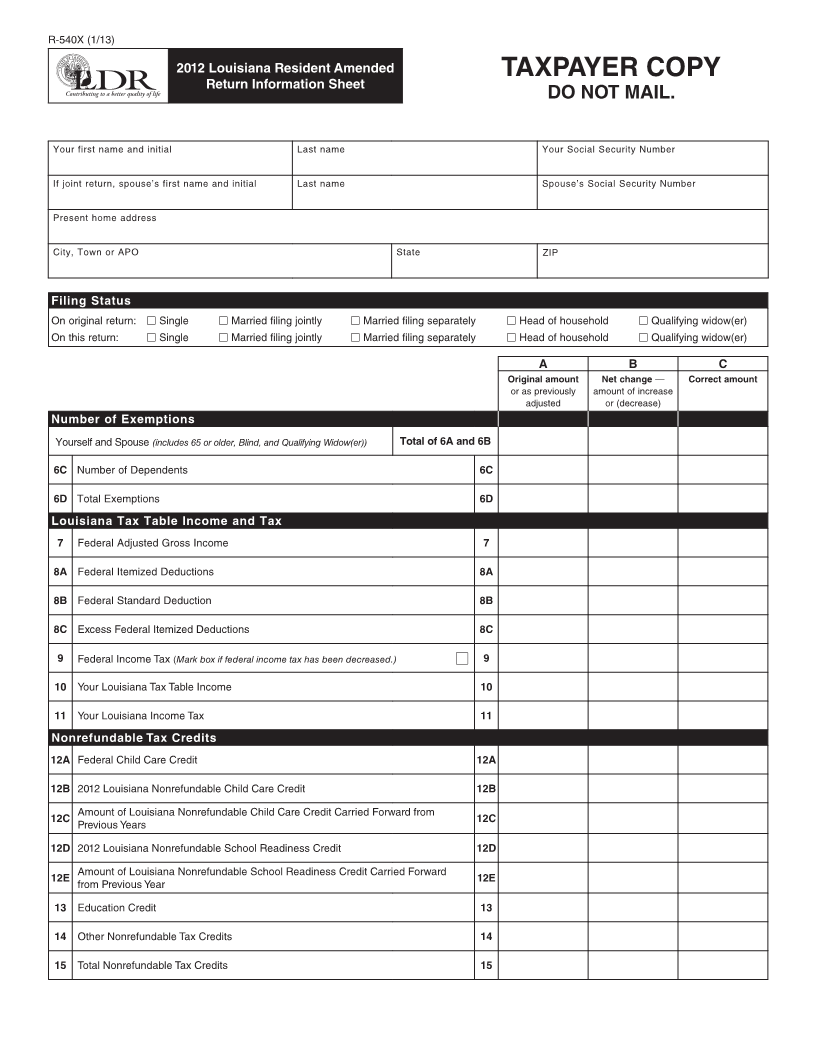

R-540X (1/13)

2012 Louisiana Resident Amended TAXPAYER COPY

Return Information Sheet

DO NOT MAIL.

Your first name and initial Last name Your Social Security Number

If joint return, spouse’s first name and initial Last name Spouse’s Social Security Number

Present home address

City, Town or APO State ZIP

Filing Status

On original return: ■ Single ■ Married filing jointly ■ Married filing separately ■ Head of household ■ Qualifying widow(er)

On this return: ■ Single ■ Married filing jointly ■ Married filing separately ■ Head of household ■ Qualifying widow(er)

A B C

Original amount Net change — Correct amount

or as previously amount of increase

adjusted or (decrease)

Number of Exemptions

Yourself and Spouse (includes 65 or older, Blind, and Qualifying Widow(er)) Total of 6A and 6B

6C Number of Dependents 6C

6D Total Exemptions 6D

Louisiana Tax Table Income and Tax

7 Federal Adjusted Gross Income 7

8A Federal Itemized Deductions 8A

8B Federal Standard Deduction 8B

8C Excess Federal Itemized Deductions 8C

9 Federal Income Tax (Mark box if federal income tax has been decreased.) ■ 9

10 Your Louisiana Tax Table Income 10

11 Your Louisiana Income Tax 11

Nonrefundable Tax Credits

12A Federal Child Care Credit 12A

12B 2012 Louisiana Nonrefundable Child Care Credit 12B

12C Amount of Louisiana Nonrefundable Child Care Credit Carried Forward from 12C

Previous Years

12D 2012 Louisiana Nonrefundable School Readiness Credit 12D

12E Amount of Louisiana Nonrefundable School Readiness Credit Carried Forward 12E

from Previous Year

13 Education Credit 13

14 Other Nonrefundable Tax Credits 14

15 Total Nonrefundable Tax Credits 15