Enlarge image

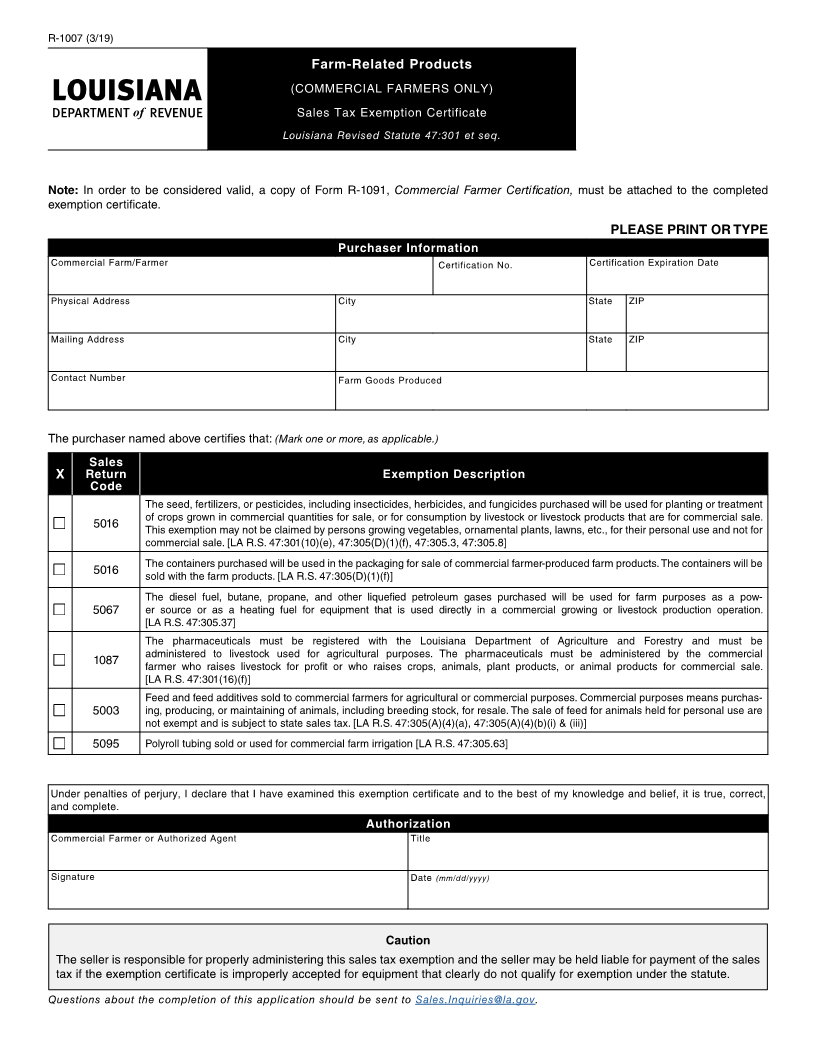

R-1007 (3/19)

Farm-Related Products

(COMMERCIAL FARMERS ONLY)

Sales Tax Exemption Certificate

Louisiana Revised Statute 47:301 et seq.

Note: In order to be considered valid, a copy of Form R-1091, Commercial Farmer Certification, must be attached to the completed

exemption certificate.

PLEASE PRINT OR TYPE

Purchaser Information

Commercial Farm/Farmer Certification No. Certification Expiration Date

Physical Address City State ZIP

Mailing Address City State ZIP

Contact Number Farm Goods Produced

The purchaser named above certifies that: (Mark one or more, as applicable.)

Sales

X Return Exemption Description

Code

The seed, fertilizers, or pesticides, including insecticides, herbicides, and fungicides purchased will be used for planting or treatment

of crops grown in commercial quantities for sale, or for consumption by livestock or livestock products that are for commercial sale.

5016 This exemption may not be claimed by persons growing vegetables, ornamental plants, lawns, etc., for their personal use and not for

commercial sale. [LA R.S. 47:301(10)(e), 47:305(D)(1)(f), 47:305.3, 47:305.8]

The containers purchased will be used in the packaging for sale of commercial farmer-produced farm products. The containers will be

5016 sold with the farm products. [LA R.S. 47:305(D)(1)(f)]

The diesel fuel, butane, propane, and other liquefied petroleum gases purchased will be used for farm purposes as a pow-

5067 er source or as a heating fuel for equipment that is used directly in a commercial growing or livestock production operation.

[LA R.S. 47:305.37]

The pharmaceuticals must be registered with the Louisiana Department of Agriculture and Forestry and must be

administered to livestock used for agricultural purposes. The pharmaceuticals must be administered by the commercial

1087 farmer who raises livestock for profit or who raises crops, animals, plant products, or animal products for commercial sale.

[LA R.S. 47:301(16)(f)]

Feed and feed additives sold to commercial farmers for agricultural or commercial purposes. Commercial purposes means purchas-

5003 ing, producing, or maintaining of animals, including breeding stock, for resale. The sale of feed for animals held for personal use are

not exempt and is subject to state sales tax. [LA R.S. 47:305(A)(4)(a), 47:305(A)(4)(b)(i) & (iii)]

5095 Polyroll tubing sold or used for commercial farm irrigation [LA R.S. 47:305.63]

Under penalties of perjury, I declare that I have examined this exemption certificate and to the best of my knowledge and belief, it is true, correct,

and complete.

Authorization

Commercial Farmer or Authorized Agent Title

Signature Date (mm/dd/yyyy)

Caution

The seller is responsible for properly administering this sales tax exemption and the seller may be held liable for payment of the sales

tax if the exemption certificate is improperly accepted for equipment that clearly do not qualify for exemption under the statute.

Questions about the completion of this application should be sent to Sales.Inquiries@la.gov.