Enlarge image

R-540CRW (7/15)

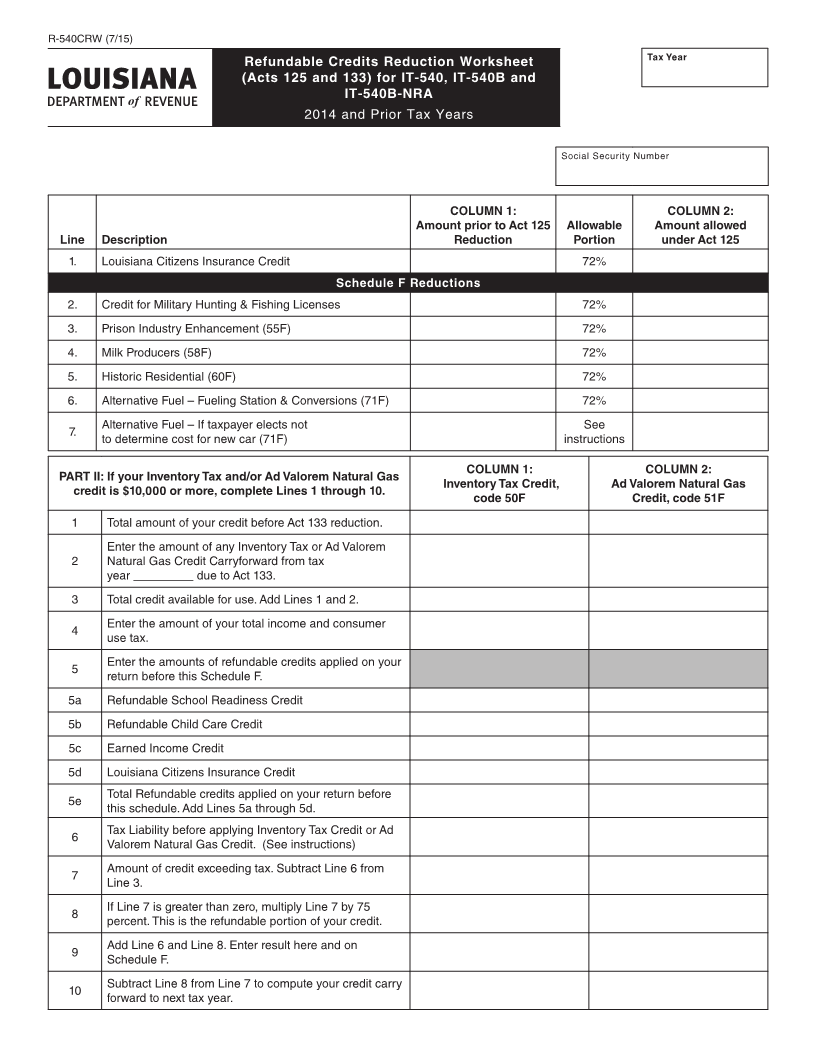

Refundable Credits Reduction Worksheet Tax Year

(Acts 125 and 133) for IT-540, IT-540B and

IT-540B-nRA

2014 and Prior Tax Years

Social Security Number

CoLumn 1: CoLumn 2:

Amount prior to Act 125 Allowable Amount allowed

Line Description Reduction Portion under Act 125

1. Louisiana Citizens Insurance Credit 72%

Schedule F Reductions

2. Credit for Military Hunting & Fishing Licenses 72%

3. Prison Industry Enhancement (55F) 72%

4. Milk Producers (58F) 72%

5. Historic Residential (60F) 72%

6. Alternative Fuel – Fueling Station & Conversions (71F) 72%

Alternative Fuel – If taxpayer elects not See

7.

to determine cost for new car (71F) instructions

CoLumn 1: CoLumn 2:

PART II: If your Inventory Tax and/or Ad Valorem natural Gas

Inventory Tax Credit, Ad Valorem natural Gas

credit is $10,000 or more, complete Lines 1 through 10.

code 50F Credit, code 51F

1 Total amount of your credit before Act 133 reduction.

Enter the amount of any Inventory Tax or Ad Valorem

2 Natural Gas Credit Carryforward from tax

year _________ due to Act 133.

3 Total credit available for use. Add Lines 1 and 2.

Enter the amount of your total income and consumer

4

use tax.

Enter the amounts of refundable credits applied on your

5

return before this Schedule F.

5a Refundable School Readiness Credit

5b Refundable Child Care Credit

5c Earned Income Credit

5d Louisiana Citizens Insurance Credit

Total Refundable credits applied on your return before

5e

this schedule. Add Lines 5a through 5d.

Tax Liability before applying Inventory Tax Credit or Ad

6

Valorem Natural Gas Credit. (See instructions)

Amount of credit exceeding tax. Subtract Line 6 from

7

Line 3.

If Line 7 is greater than zero, multiply Line 7 by 75

8

percent. This is the refundable portion of your credit.

Add Line 6 and Line 8. Enter result here and on

9

Schedule F.

Subtract Line 8 from Line 7 to compute your credit carry

10

forward to next tax year.