Enlarge image

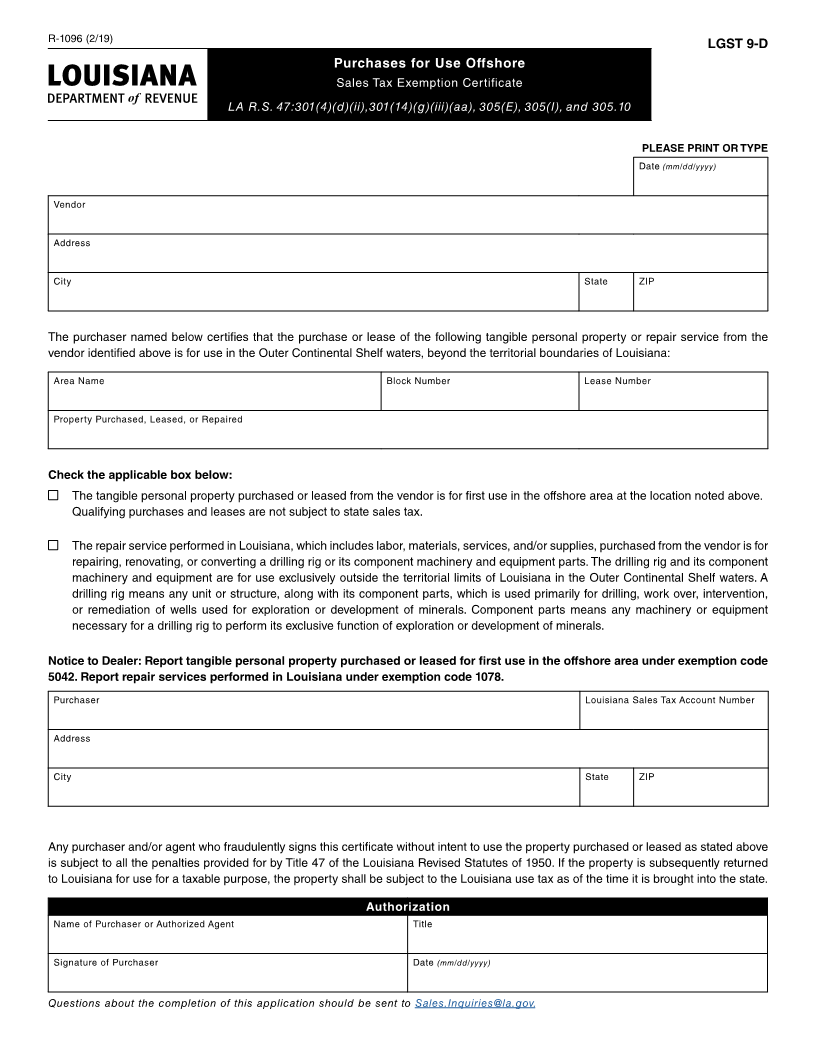

R-1096 (2/19)

LGST 9-D

Purchases for Use Offshore

Sales Tax Exemption Certificate

LA R.S. 47:301(4)(d)(ii),301(14)(g)(iii)(aa), 305(E), 305(I), and 305.10

PLEASE PRINT OR TYPE

Date (mm/dd/yyyy)

Vendor

Address

City State ZIP

The purchaser named below certifies that the purchase or lease of the following tangible personal property or repair service from the

vendor identified above is for use in the Outer Continental Shelf waters, beyond the territorial boundaries of Louisiana:

Area Name Block Number Lease Number

Property Purchased, Leased, or Repaired

Check the applicable box below:

The tangible personal property purchased or leased from the vendor is for first use in the offshore area at the location noted above.

Qualifying purchases and leases are not subject to state sales tax.

The repair service performed in Louisiana, which includes labor, materials, services, and/or supplies, purchased from the vendor is for

repairing, renovating, or converting a drilling rig or its component machinery and equipment parts. The drilling rig and its component

machinery and equipment are for use exclusively outside the territorial limits of Louisiana in the Outer Continental Shelf waters. A

drilling rig means any unit or structure, along with its component parts, which is used primarily for drilling, work over, intervention,

or remediation of wells used for exploration or development of minerals. Component parts means any machinery or equipment

necessary for a drilling rig to perform its exclusive function of exploration or development of minerals.

Notice to Dealer: Report tangible personal property purchased or leased for first use in the offshore area under exemption code

5042. Report repair services performed in Louisiana under exemption code 1078.

Purchaser Louisiana Sales Tax Account Number

Address

City State ZIP

Any purchaser and/or agent who fraudulently signs this certificate without intent to use the property purchased or leased as stated above

is subject to all the penalties provided for by Title 47 of the Louisiana Revised Statutes of 1950. If the property is subsequently returned

to Louisiana for use for a taxable purpose, the property shall be subject to the Louisiana use tax as of the time it is brought into the state.

Authorization

Name of Purchaser or Authorized Agent Title

Signature of Purchaser Date (mm/dd/yyyy)

Questions about the completion of this application should be sent to Sales.Inquiries@la.gov.