- 3 -

Enlarge image

|

R -10610-ITEi (1/21)

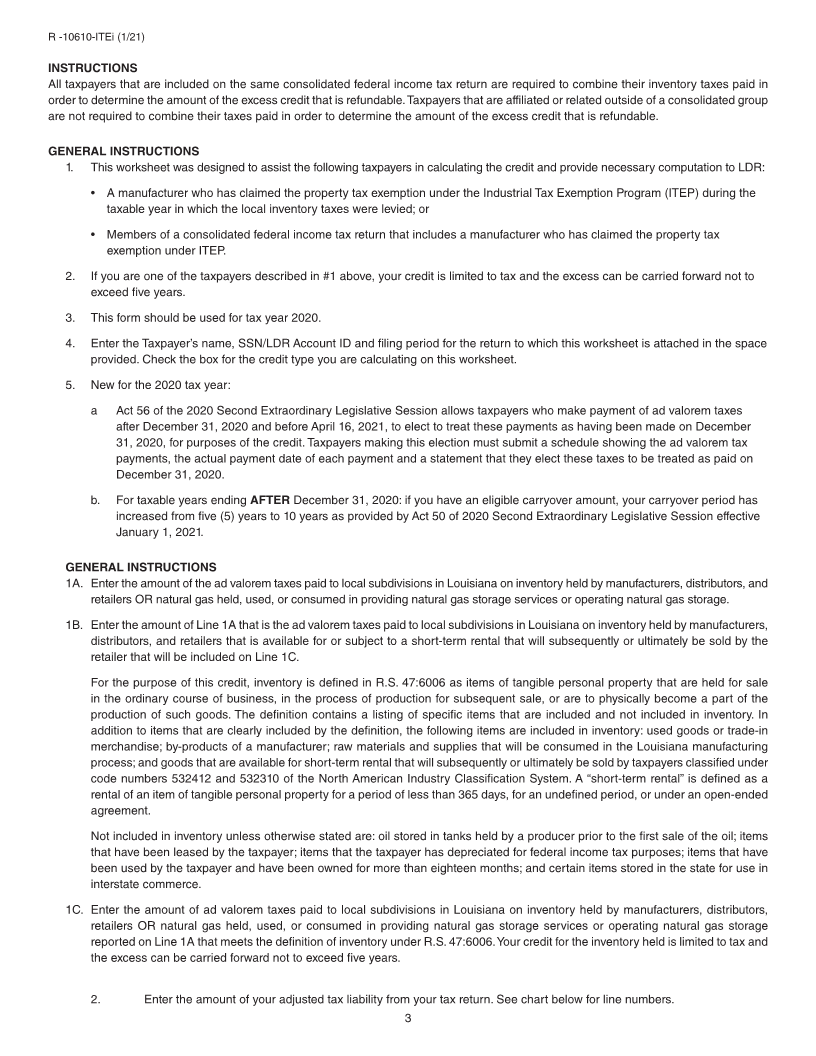

INSTRUCTIONS

All taxpayers that are included on the same consolidated federal income tax return are required to combine their inventory taxes paid in

order to determine the amount of the excess credit that is refundable. Taxpayers that are affiliated or related outside of a consolidated group

are not required to combine their taxes paid in order to determine the amount of the excess credit that is refundable.

GENERAL INSTRUCTIONS

1. This worksheet was designed to assist the following taxpayers in calculating the credit and provide necessary computation to LDR:

• A manufacturer who has claimed the property tax exemption under the Industrial Tax Exemption Program (ITEP) during the

taxable year in which the local inventory taxes were levied; or

• Members of a consolidated federal income tax return that includes a manufacturer who has claimed the property tax

exemption under ITEP.

2. If you are one of the taxpayers described in #1 above, your credit is limited to tax and the excess can be carried forward not to

exceed five years.

3. This form should be used for tax year 2020.

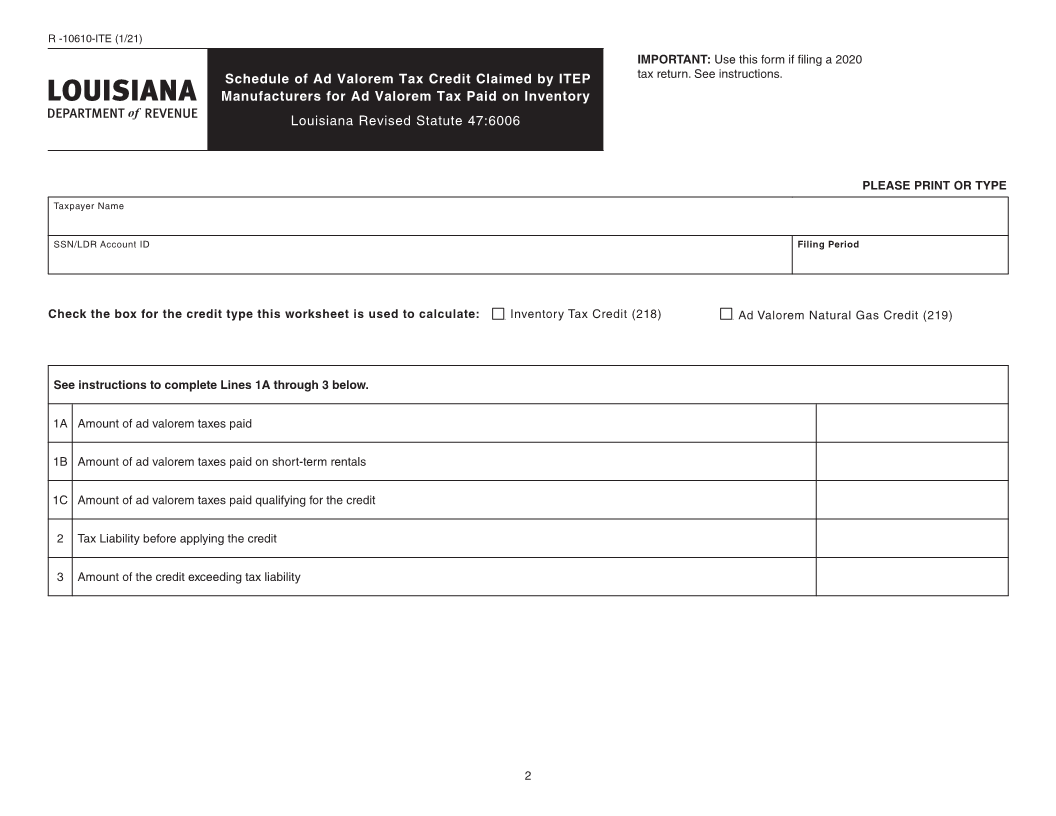

4. Enter the Taxpayer’s name, SSN/LDR Account ID and filing period for the return to which this worksheet is attached in the space

provided. Check the box for the credit type you are calculating on this worksheet.

5. New for the 2020 tax year:

a Act 56 of the 2020 Second Extraordinary Legislative Session allows taxpayers who make payment of ad valorem taxes

after December 31, 2020 and before April 16, 2021, to elect to treat these payments as having been made on December

31, 2020, for purposes of the credit. Taxpayers making this election must submit a schedule showing the ad valorem tax

payments, the actual payment date of each payment and a statement that they elect these taxes to be treated as paid on

December 31, 2020.

b. For taxable years ending AFTER December 31, 2020: if you have an eligible carryover amount, your carryover period has

increased from five (5) years to 10 years as provided by Act 50 of 2020 Second Extraordinary Legislative Session effective

January 1, 2021.

GENERAL INSTRUCTIONS

1A. Enter the amount of the ad valorem taxes paid to local subdivisions in Louisiana on inventory held by manufacturers, distributors, and

retailers OR natural gas held, used, or consumed in providing natural gas storage services or operating natural gas storage.

1B. Enter the amount of Line 1A that is the ad valorem taxes paid to local subdivisions in Louisiana on inventory held by manufacturers,

distributors, and retailers that is available for or subject to a short-term rental that will subsequently or ultimately be sold by the

retailer that will be included on Line 1C.

For the purpose of this credit, inventory is defined in R.S. 47:6006 as items of tangible personal property that are held for sale

in the ordinary course of business, in the process of production for subsequent sale, or are to physically become a part of the

production of such goods. The definition contains a listing of specific items that are included and not included in inventory. In

addition to items that are clearly included by the definition, the following items are included in inventory: used goods or trade-in

merchandise; by-products of a manufacturer; raw materials and supplies that will be consumed in the Louisiana manufacturing

process; and goods that are available for short-term rental that will subsequently or ultimately be sold by taxpayers classified under

code numbers 532412 and 532310 of the North American Industry Classification System. A “short-term rental” is defined as a

rental of an item of tangible personal property for a period of less than 365 days, for an undefined period, or under an open-ended

agreement.

Not included in inventory unless otherwise stated are: oil stored in tanks held by a producer prior to the first sale of the oil; items

that have been leased by the taxpayer; items that the taxpayer has depreciated for federal income tax purposes; items that have

been used by the taxpayer and have been owned for more than eighteen months; and certain items stored in the state for use in

interstate commerce.

1C. Enter the amount of ad valorem taxes paid to local subdivisions in Louisiana on inventory held by manufacturers, distributors,

retailers OR natural gas held, used, or consumed in providing natural gas storage services or operating natural gas storage

reported on Line 1A that meets the definition of inventory under R.S. 47:6006. Your credit for the inventory held is limited to tax and

the excess can be carried forward not to exceed five years.

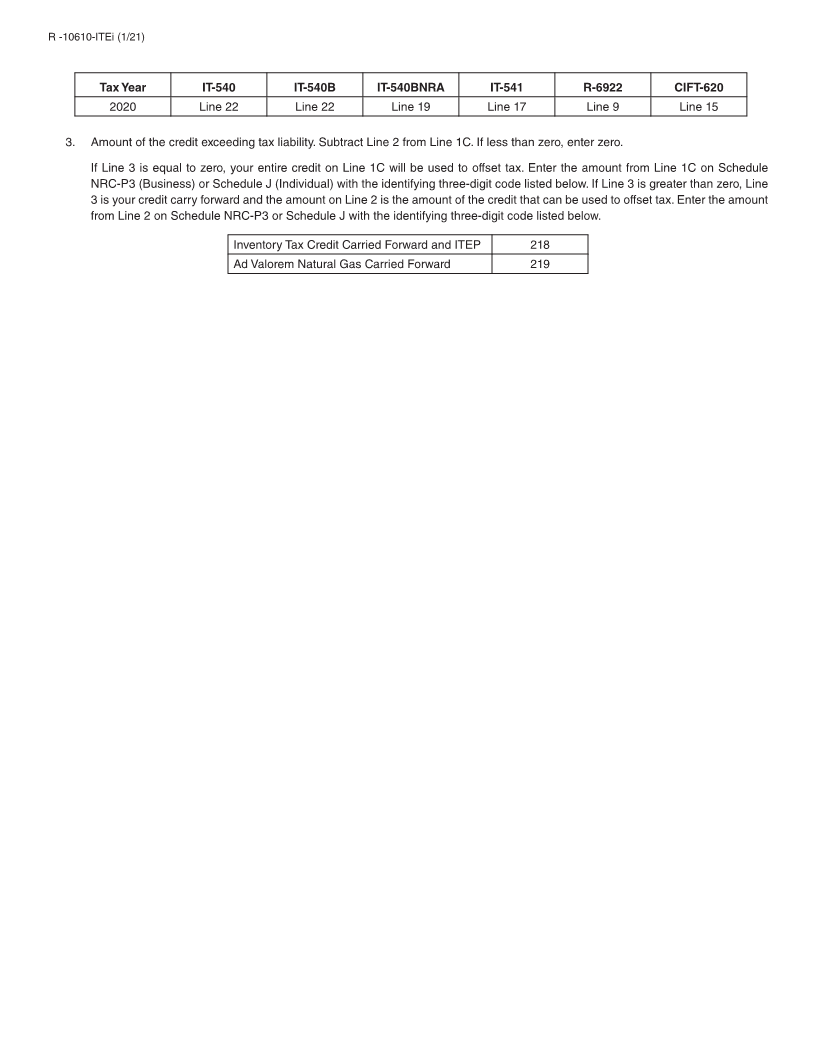

2. Enter the amount of your adjusted tax liability from your tax return. See chart below for line numbers.

3

|