Enlarge image

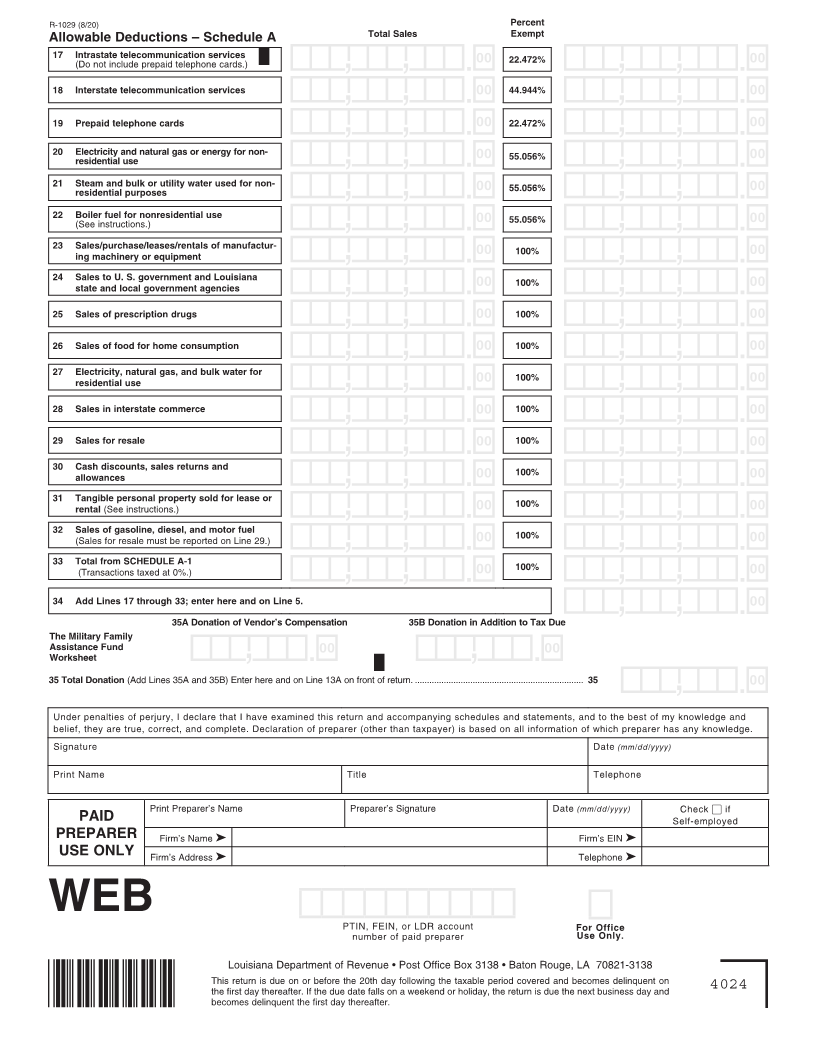

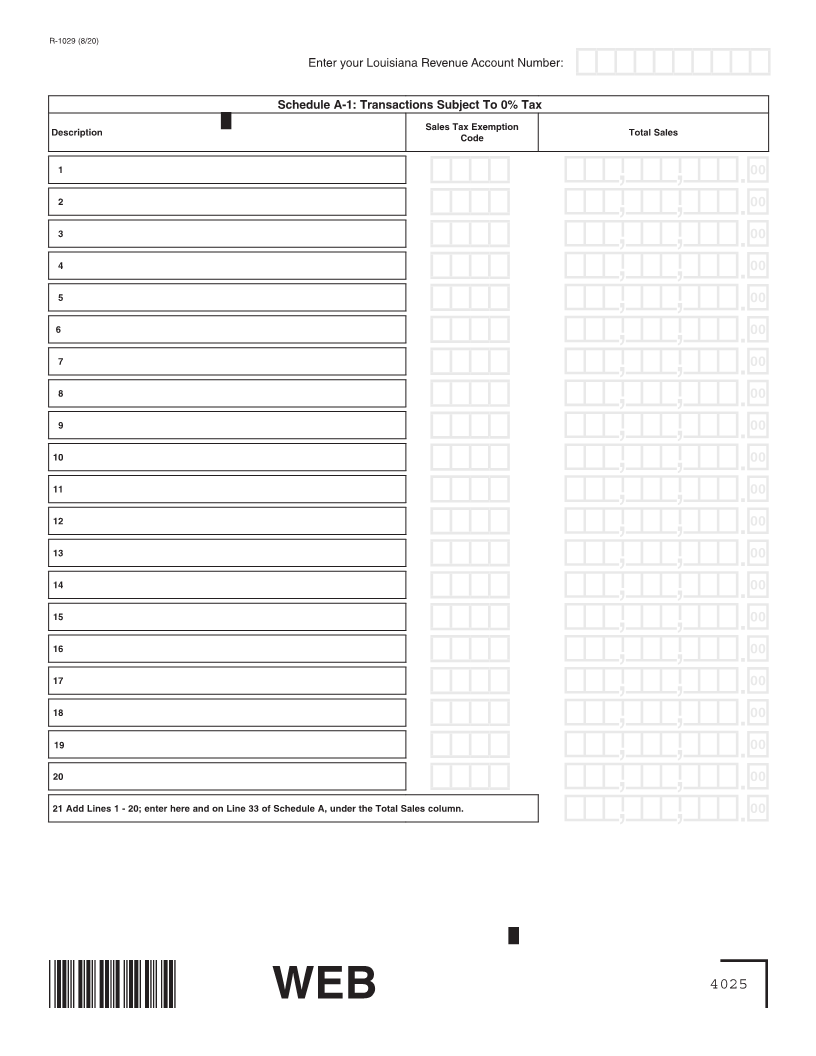

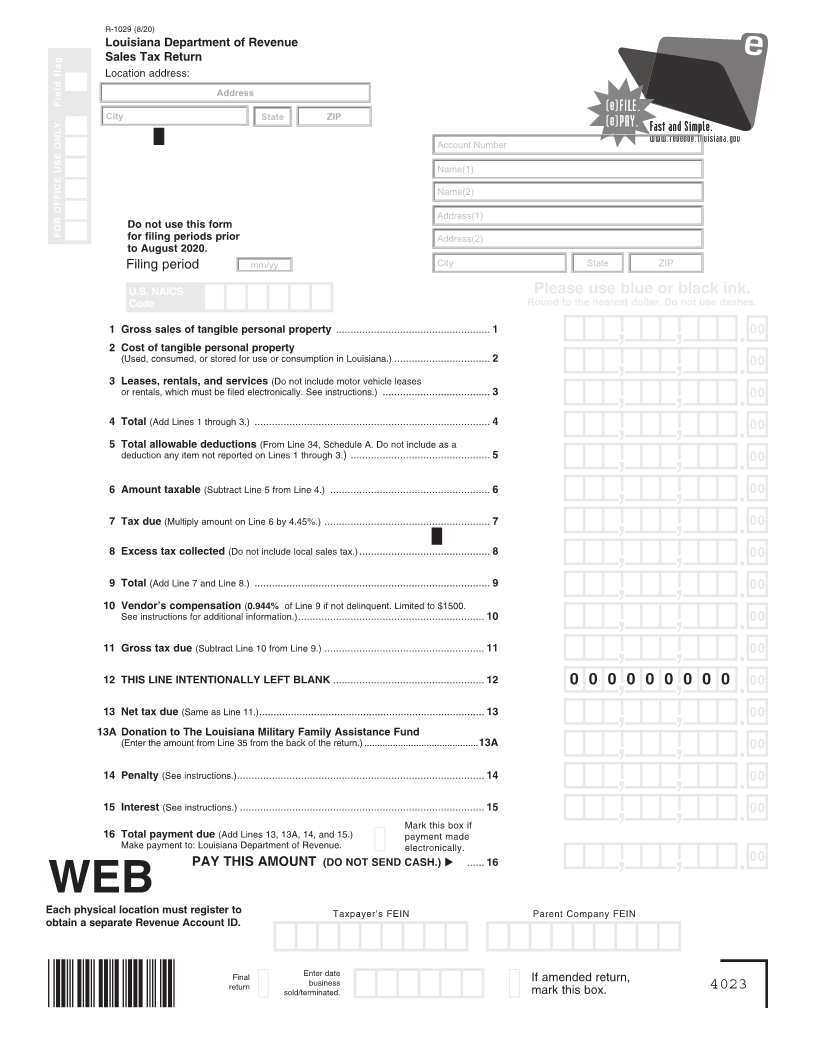

R-1029 (8/20)

Louisiana Department of Revenue

Sales Tax Return

Location address:

Address

Field flag

City State ZIP

Account Number

Name(1)

Name(2)

Address(1)

Do not use this form

FOR OFFICE USE ONLY. for filing periods prior Address(2)

to August 2020.

Filing period mm/yy City State ZIP

U.S. NAICS Please use blue or black ink.

Code Round to the nearest dollar. Do not use dashes.

1 Gross sales of tangible personal property ..................................................... 1

2 Cost of tangible personal property

(Used, consumed, or stored for use or consumption in Louisiana.) ................................. 2

3 Leases, rentals, and services (Do not include motor vehicle leases

or rentals, which must be filed electronically. See instructions.) ..................................... 3

4 Total (Add Lines 1 through 3.) ................................................................................. 4

5 Total allowable deductions (From Line 34, Schedule A. Do not include as a

deduction any item not reported on Lines 1 through 3.) ................................................ 5

6 Amount taxable (Subtract Line 5 from Line 4.) ....................................................... 6

7 Tax due (Multiply amount on Line 6 by 4.45%.) ......................................................... 7

8 Excess tax collected (Do not include local sales tax.) ............................................. 8

9 Total (Add Line 7 and Line 8.) ................................................................................. 9

10 Vendor’s compensation (0.944% of Line 9 if not delinquent. Limited to $1500.

See instructions for additional information.) ................................................................ 10

11 Gross tax due (Subtract Line 10 from Line 9.) ....................................................... 11

12 THIS LINE INTENTIONALLY LEFT BLANK .................................................... 12 0 0 0 0 0 0 0 0 0

13 Net tax due (Same as Line 11.) .............................................................................. 13

13A Donation to The Louisiana Military Family Assistance Fund

(Enter the amount from Line 35 from the back of the return.) ............................................13A

14 Penalty (See instructions.) ..................................................................................... 14

15 Interest (See instructions.) .................................................................................... 15

Mark this box if

16 Total payment due (Add Lines 13, 13A, 14, and 15.) payment made

Make payment to: Louisiana Department of Revenue. electronically.

PAY THIS AMOUNT (DO NOT SEND CASH.) u ...... 16

WEB

Each physical location must register to Taxpayer’s FEIN Parent Company FEIN

obtain a separate Revenue Account ID.

Final Enter date If amended return,

business

return sold/terminated. mark this box. 4023