Enlarge image

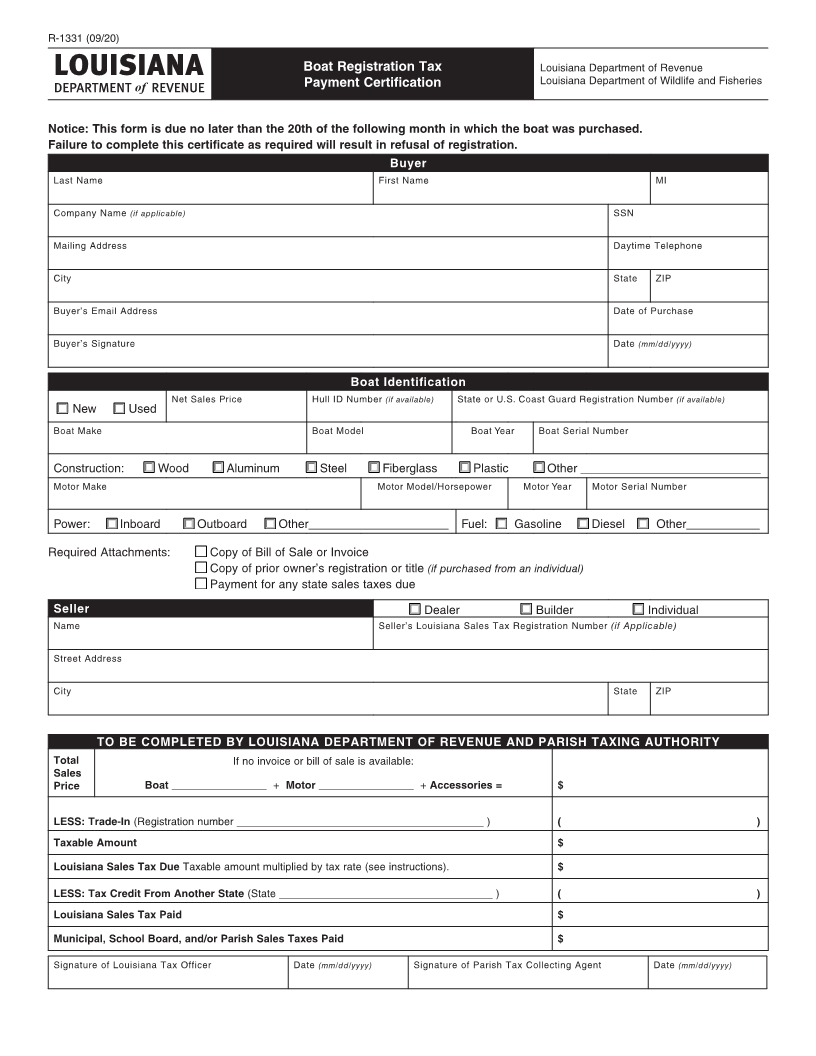

R-1331 (09/20)

Boat Registration Tax Louisiana Department of Revenue

Payment Certification Louisiana Department of Wildlife and Fisheries

Notice: This form is due no later than the 20th of the following month in which the boat was purchased.

Failure to complete this certificate as required will result in refusal of registration.

Buyer

Last Name First Name MI

Company Name (if applicable) SSN

Mailing Address Daytime Telephone

City State ZIP

Buyer’s Email Address Date of Purchase

Buyer’s Signature Date (mm/dd/yyyy)

Boat Identification

Net Sales Price Hull ID Number (if available) State or U.S. Coast Guard Registration Number (if available)

n n New n n Used

Boat Make Boat Model Boat Year Boat Serial Number

Construction: nn Wood nn Aluminum nn Steel nn Fiberglass nn Plastic nn Other ___________________________

Motor Make Motor Model/Horsepower Motor Year Motor Serial Number

Power: n n Inboard nn Outboard n n Other_____________________ Fuel: n n Gasoline n n Diesel n n Other___________

Required Attachments: nn Copy of Bill of Sale or Invoice

nn Copy of prior owner’s registration or title (if purchased from an individual)

nn Payment for any state sales taxes due

Seller n n Dealer nn Builder nn Individual

Name Seller’s Louisiana Sales Tax Registration Number (if Applicable)

Street Address

City State ZIP

TO BE COMPLETED BY LOUISIANA DEPARTMENT OF REVENUE AND PARISH TAXING AUTHORITY

Total If no invoice or bill of sale is available:

Sales

Price Boat ________________ + Motor ________________ + Accessories = $

LESS: Trade-In (Registration number __________________________________________ ) ( )

Taxable Amount $

Louisiana Sales Tax Due Taxable amount multiplied by tax rate (see instructions). $

LESS: Tax Credit From Another State (State ____________________________________ ) ( )

Louisiana Sales Tax Paid $

Municipal, School Board, and/or Parish Sales Taxes Paid $

Signature of Louisiana Tax Officer Date (mm/dd/yyyy) Signature of Parish Tax Collecting Agent Date (mm/dd/yyyy)