Enlarge image

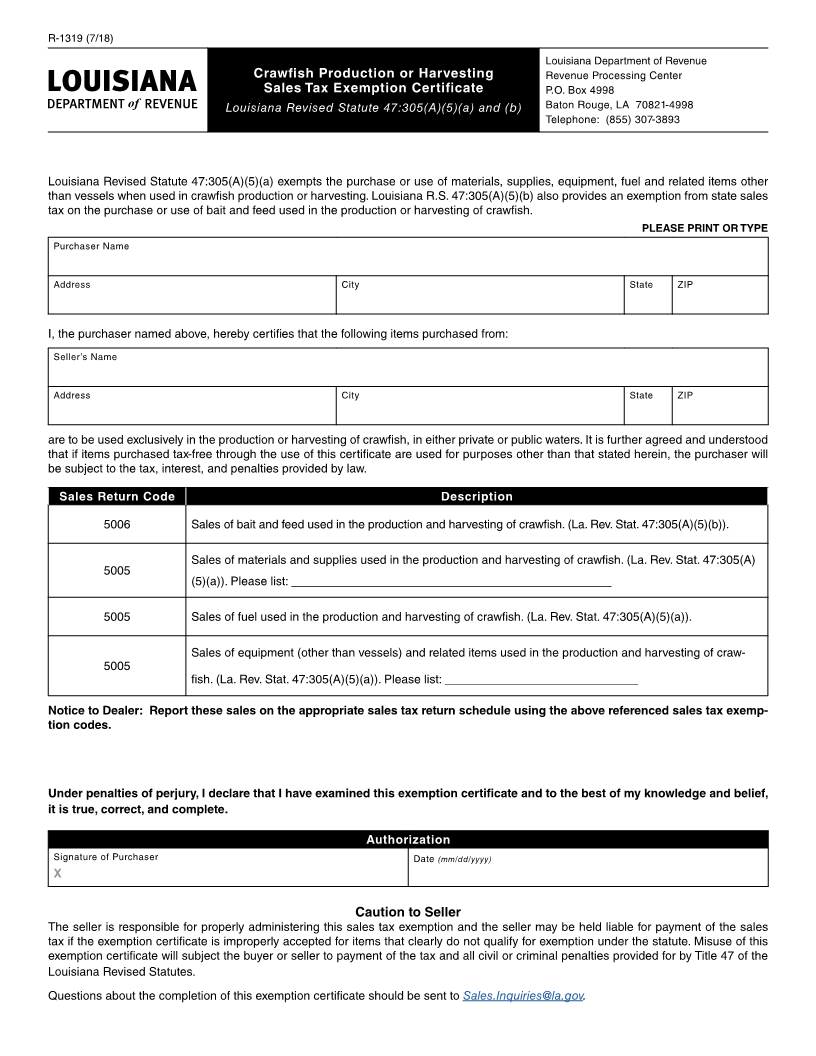

R-1319 (7/18)

Louisiana Department of Revenue

Crawfish Production or Harvesting Revenue Processing Center

Sales Tax Exemption Certificate P.O. Box 4998

Louisiana Revised Statute 47:305(A)(5)(a) and (b) Baton Rouge, LA 70821-4998

Telephone: (855) 307-3893

Louisiana Revised Statute 47:305(A)(5)(a) exempts the purchase or use of materials, supplies, equipment, fuel and related items other

than vessels when used in crawfish production or harvesting. Louisiana R.S. 47:305(A)(5)(b) also provides an exemption from state sales

tax on the purchase or use of bait and feed used in the production or harvesting of crawfish.

PLEASE PRINT OR TYPE

Purchaser Name

Address City State ZIP

I, the purchaser named above, hereby certifies that the following items purchased from:

Seller’s Name

Address City State ZIP

are to be used exclusively in the production or harvesting of crawfish, in either private or public waters. It is further agreed and understood

that if items purchased tax-free through the use of this certificate are used for purposes other than that stated herein, the purchaser will

be subject to the tax, interest, and penalties provided by law.

Sales Return Code Description

5006 Sales of bait and feed used in the production and harvesting of crawfish. (La. Rev. Stat. 47:305(A)(5)(b)).

Sales of materials and supplies used in the production and harvesting of crawfish. (La. Rev. Stat. 47:305(A)

5005

(5)(a)). Please list: ________________________________________________

5005 Sales of fuel used in the production and harvesting of crawfish. (La. Rev. Stat. 47:305(A)(5)(a)).

Sales of equipment (other than vessels) and related items used in the production and harvesting of craw-

5005

fish. (La. Rev. Stat. 47:305(A)(5)(a)). Please list: _____________________________

Notice to Dealer: Report these sales on the appropriate sales tax return schedule using the above referenced sales tax exemp-

tion codes.

Under penalties of perjury, I declare that I have examined this exemption certificate and to the best of my knowledge and belief,

it is true, correct, and complete.

Authorization

Signature of Purchaser Date (mm/dd/yyyy)

X

Caution to Seller

The seller is responsible for properly administering this sales tax exemption and the seller may be held liable for payment of the sales

tax if the exemption certificate is improperly accepted for items that clearly do not qualify for exemption under the statute. Misuse of this

exemption certificate will subject the buyer or seller to payment of the tax and all civil or criminal penalties provided for by Title 47 of the

Louisiana Revised Statutes.

Questions about the completion of this exemption certificate should be sent to Sales.Inquiries@la.gov.