Enlarge image

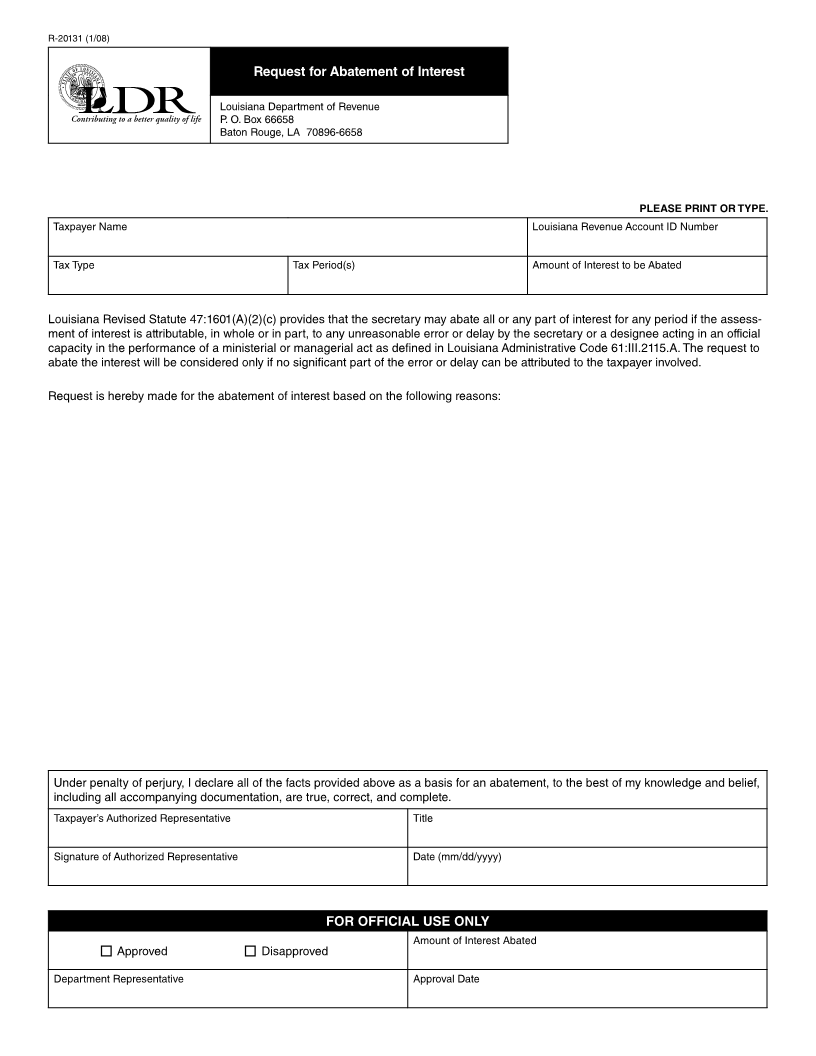

R-20131 (1/08)

Request for Abatement of Interest

Louisiana Department of Revenue

P. O. Box 66658

Baton Rouge, LA 70896-6658

PLEASE PRINT OR TYPE.

Taxpayer Name Louisiana Revenue Account ID Number

Tax Type Tax Period(s) Amount of Interest to be Abated

Louisiana Revised Statute 47:1601(A)(2)(c) provides that the secretary may abate all or any part of interest for any period if the assess-

ment of interest is attributable, in whole or in part, to any unreasonable error or delay by the secretary or a designee acting in an official

capacity in the performance of a ministerial or managerial act as defined in Louisiana Administrative Code 61:III.2115.A. The request to

abate the interest will be considered only if no significant part of the error or delay can be attributed to the taxpayer involved.

Request is hereby made for the abatement of interest based on the following reasons:

Under penalty of perjury, I declare all of the facts provided above as a basis for an abatement, to the best of my knowledge and belief,

including all accompanying documentation, are true, correct, and complete.

Taxpayer’s Authorized Representative Title

Signature of Authorized Representative Date (mm/dd/yyyy)

FOR OFFICIAL USE ONLY

Amount of Interest Abated

■ Approved ■ Disapproved

Department Representative Approval Date