Enlarge image

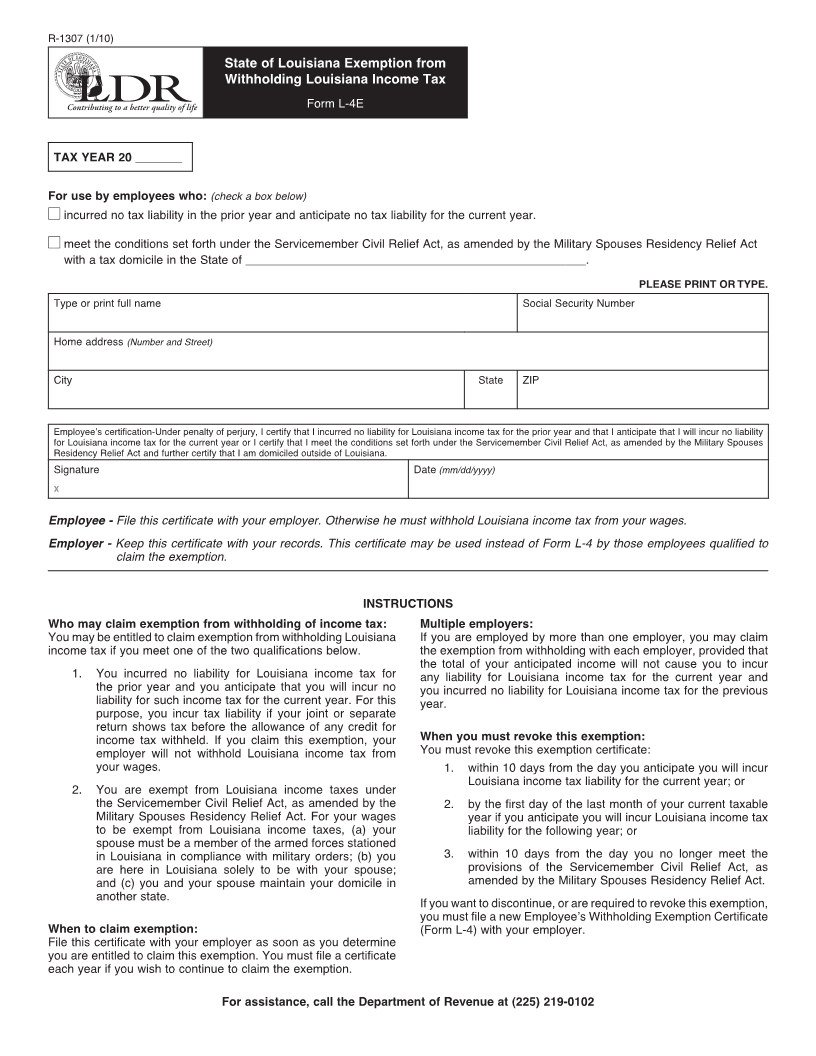

R-1307 (1/10)

State of Louisiana Exemption from

Withholding Louisiana Income Tax

Form L-4E

TAX YEAR 20 _______

For use by employees who: (check a box below)

■ incurred no tax liability in the prior year and anticipate no tax liability for the current year.

■ meet the conditions set forth under the Servicemember Civil Relief Act, as amended by the Military Spouses Residency Relief Act

with a tax domicile in the State of ___________________________________________________.

PLEASE PRINT OR TYPE.

Type or print full name Social Security Number

Home address (Number and Street)

City State ZIP

Employee’s certification-Under penalty of perjury, I certify that I incurred no liability for Louisiana income tax for the prior year and that I anticipate that I will incur no liability

for Louisiana income tax for the current year or I certify that I meet the conditions set forth under the Servicemember Civil Relief Act, as amended by the Military Spouses

Residency Relief Act and further certify that I am domiciled outside of Louisiana.

Signature Date (mm/dd/yyyy)

X

Employee - File this certificate with your employer. Otherwise he must withhold Louisiana income tax from your wages.

Employer - Keep this certificate with your records. This certificate may be used instead of Form L-4 by those employees qualified to

claim the exemption.

INSTRUCTIONS

Who may claim exemption from withholding of income tax: Multiple employers:

You may be entitled to claim exemption from withholding Louisiana If you are employed by more than one employer, you may claim

income tax if you meet one of the two qualifications below. the exemption from withholding with each employer, provided that

the total of your anticipated income will not cause you to incur

1. You incurred no liability for Louisiana income tax for any liability for Louisiana income tax for the current year and

the prior year and you anticipate that you will incur no you incurred no liability for Louisiana income tax for the previous

liability for such income tax for the current year. For this year.

purpose, you incur tax liability if your joint or separate

return shows tax before the allowance of any credit for

income tax withheld. If you claim this exemption, your When you must revoke this exemption:

employer will not withhold Louisiana income tax from You must revoke this exemption certificate:

your wages. 1. within 10 days from the day you anticipate you will incur

Louisiana income tax liability for the current year; or

2. You are exempt from Louisiana income taxes under

the Servicemember Civil Relief Act, as amended by the 2. by the first day of the last month of your current taxable

Military Spouses Residency Relief Act. For your wages year if you anticipate you will incur Louisiana income tax

to be exempt from Louisiana income taxes, (a) your liability for the following year; or

spouse must be a member of the armed forces stationed

in Louisiana in compliance with military orders; (b) you 3. within 10 days from the day you no longer meet the

are here in Louisiana solely to be with your spouse; provisions of the Servicemember Civil Relief Act, as

and (c) you and your spouse maintain your domicile in amended by the Military Spouses Residency Relief Act.

another state.

If you want to discontinue, or are required to revoke this exemption,

you must file a new Employee’s Withholding Exemption Certificate

When to claim exemption: (Form L-4) with your employer.

File this certificate with your employer as soon as you determine

you are entitled to claim this exemption. You must file a certificate

each year if you wish to continue to claim the exemption.

For assistance, call the Department of Revenue at (225) 219-0102