Enlarge image

R-620GIW (7/15)

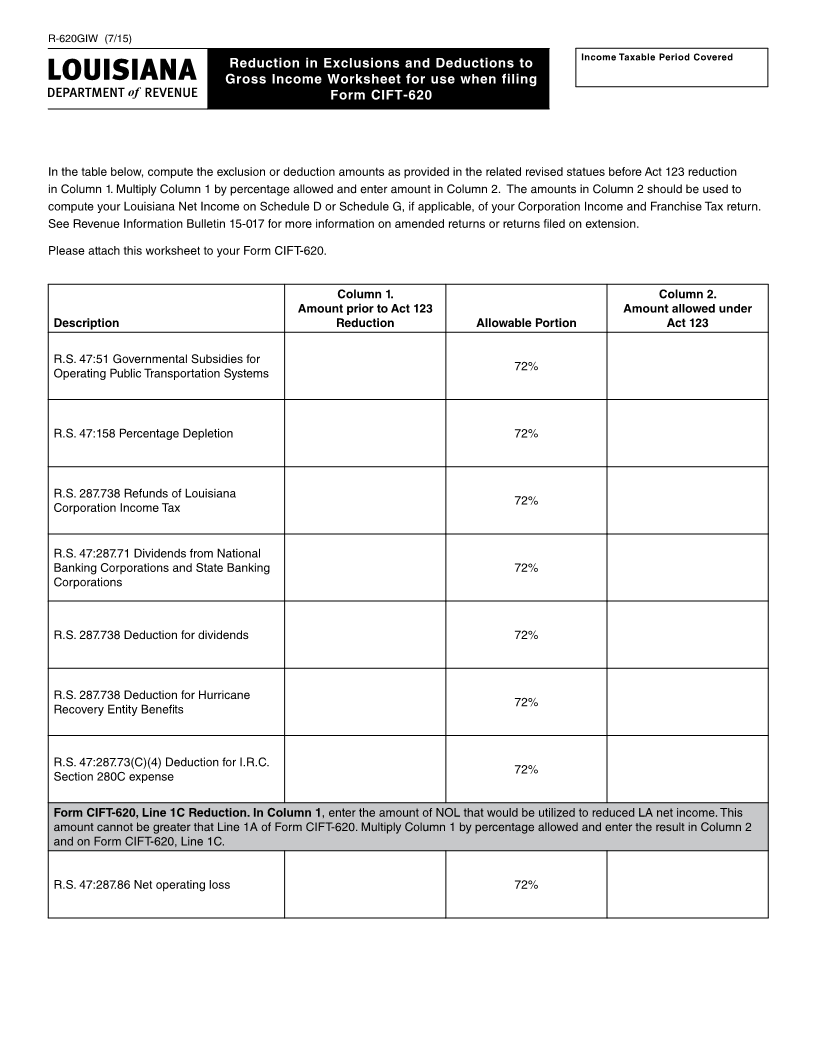

Income Taxable Period Covered

Reduction in Exclusions and Deductions to

Gross Income Worksheet for use when filing

Form CIFT-620

In the table below, compute the exclusion or deduction amounts as provided in the related revised statues before Act 123 reduction

in Column 1. Multiply Column 1 by percentage allowed and enter amount in Column 2. The amounts in Column 2 should be used to

compute your Louisiana Net Income on Schedule D or Schedule G, if applicable, of your Corporation Income and Franchise Tax return.

See Revenue Information Bulletin 15-017 for more information on amended returns or returns filed on extension.

Please attach this worksheet to your Form CIFT-620.

Column 1. Column 2.

Amount prior to Act 123 Amount allowed under

Description Reduction Allowable Portion Act 123

R.S. 47:51 Governmental Subsidies for

72%

Operating Public Transportation Systems

R.S. 47:158 Percentage Depletion 72%

R.S. 287.738 Refunds of Louisiana

72%

Corporation Income Tax

R.S. 47:287.71 Dividends from National

Banking Corporations and State Banking 72%

Corporations

R.S. 287.738 Deduction for dividends 72%

R.S. 287.738 Deduction for Hurricane

72%

Recovery Entity Benefits

R.S. 47:287.73(C)(4) Deduction for I.R.C.

72%

Section 280C expense

Form CIFT-620, Line 1C Reduction. In Column 1, enter the amount of NOL that would be utilized to reduced LA net income. This

amount cannot be greater that Line 1A of Form CIFT-620. Multiply Column 1 by percentage allowed and enter the result in Column 2

and on Form CIFT-620, Line 1C.

R.S. 47:287.86 Net operating loss 72%