Enlarge image

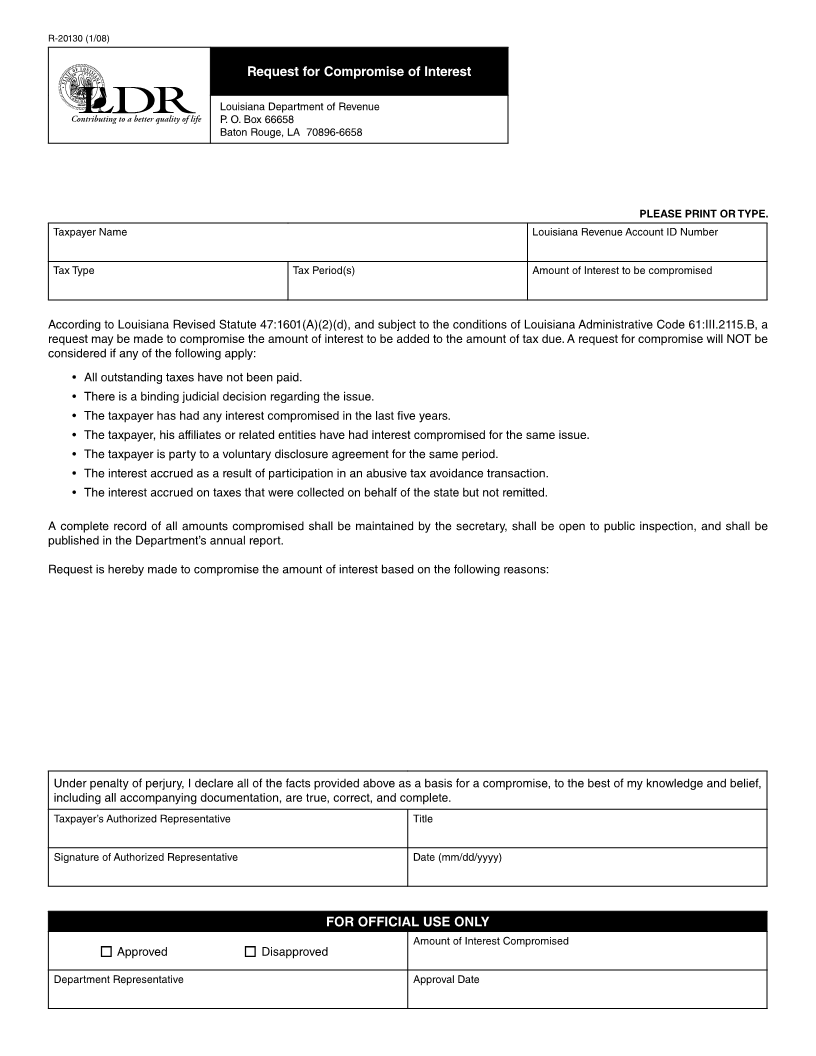

R-20130 (1/08)

Request for Compromise of Interest

Louisiana Department of Revenue

P. O. Box 66658

Baton Rouge, LA 70896-6658

PLEASE PRINT OR TYPE.

Taxpayer Name Louisiana Revenue Account ID Number

Tax Type Tax Period(s) Amount of Interest to be compromised

According to Louisiana Revised Statute 47:1601(A)(2)(d), and subject to the conditions of Louisiana Administrative Code 61:III.2115.B, a

request may be made to compromise the amount of interest to be added to the amount of tax due. A request for compromise will NOT be

considered if any of the following apply:

• All outstanding taxes have not been paid.

• There is a binding judicial decision regarding the issue.

• The taxpayer has had any interest compromised in the last five years.

• The taxpayer, his affiliates or related entities have had interest compromised for the same issue.

• The taxpayer is party to a voluntary disclosure agreement for the same period.

• The interest accrued as a result of participation in an abusive tax avoidance transaction.

• The interest accrued on taxes that were collected on behalf of the state but not remitted.

A complete record of all amounts compromised shall be maintained by the secretary, shall be open to public inspection, and shall be

published in the Department’s annual report.

Request is hereby made to compromise the amount of interest based on the following reasons:

Under penalty of perjury, I declare all of the facts provided above as a basis for a compromise, to the best of my knowledge and belief,

including all accompanying documentation, are true, correct, and complete.

Taxpayer’s Authorized Representative Title

Signature of Authorized Representative Date (mm/dd/yyyy)

FOR OFFICIAL USE ONLY

Amount of Interest Compromised

■ Approved ■ Disapproved

Department Representative Approval Date