Enlarge image

R-7004i (12/16)

General Information

Purpose of Form—Use Form R-7004 to request one or more copies of a tax return, or to authorize an individual, corporation, firm, organization, or

partnership to receive your confidential information for the type of tax and for the years or periods that you list on the form. The authorization is only

effective for disclosure of the specific tax matters listed in Section 3.

This form only authorizes the one-time release of information to your appointee. It does not provide for the continuous release of information to your

appointee or authorize your appointee to advocate your position with respect to the state tax laws; to execute waivers, consents, or settlement agreements;

or to otherwise represent you before the Louisiana Department of Revenue. If you want to authorize an individual to represent you on an ongoing basis

in matters regarding state tax law, use Form R-7006, Power of Attorney.

Where to file. Mail your Tax Information Disclosure Authorization Form R-7004 and payment, if applicable, to the attention of the LDR division or

employee handling your tax matter at P.O. Box 201, Baton Rouge, LA 70821. To ensure proper receipt, you may obtain the specific division and/or office

location, or fax number from the employee assisting you.

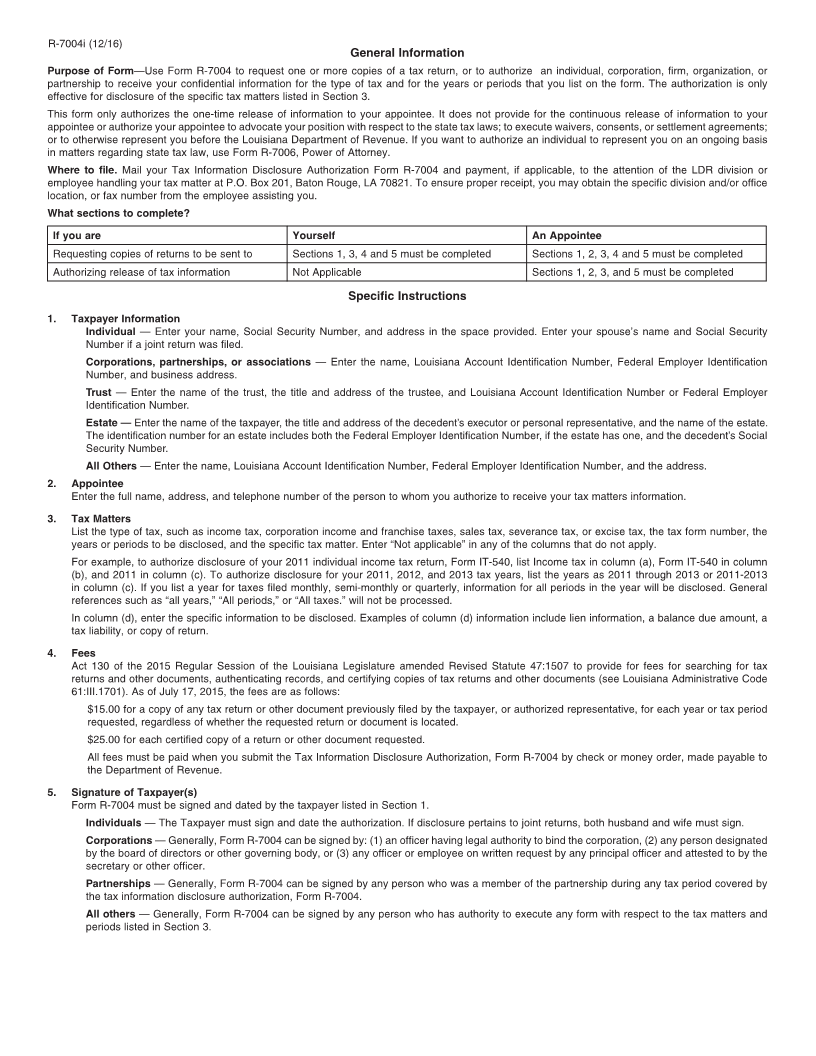

What sections to complete?

If you are Yourself An Appointee

Requesting copies of returns to be sent to Sections 1, 3, 4 and 5 must be completed Sections 1, 2, 3, 4 and 5 must be completed

Authorizing release of tax information Not Applicable Sections 1, 2, 3, and 5 must be completed

Specific Instructions

1. Taxpayer Information

Individual — Enter your name, Social Security Number, and address in the space provided. Enter your spouse’s name and Social Security

Number if a joint return was filed.

Corporations, partnerships, or associations — Enter the name, Louisiana Account Identification Number, Federal Employer Identification

Number, and business address.

Trust — Enter the name of the trust, the title and address of the trustee, and Louisiana Account Identification Number or Federal Employer

Identification Number.

Estate — Enter the name of the taxpayer, the title and address of the decedent’s executor or personal representative, and the name of the estate.

The identification number for an estate includes both the Federal Employer Identification Number, if the estate has one, and the decedent’s Social

Security Number.

All Others — Enter the name, Louisiana Account Identification Number, Federal Employer Identification Number, and the address.

2. Appointee

Enter the full name, address, and telephone number of the person to whom you authorize to receive your tax matters information.

3. Tax Matters

List the type of tax, such as income tax, corporation income and franchise taxes, sales tax, severance tax, or excise tax, the tax form number, the

years or periods to be disclosed, and the specific tax matter. Enter “Not applicable” in any of the columns that do not apply.

For example, to authorize disclosure of your 2011 individual income tax return, Form IT-540, list Income tax in column (a), Form IT-540 in column

(b), and 2011 in column (c). To authorize disclosure for your 2011, 2012, and 2013 tax years, list the years as 2011 through 2013 or 2011-2013

in column (c). If you list a year for taxes filed monthly, semi-monthly or quarterly, information for all periods in the year will be disclosed. General

references such as “all years,” “All periods,” or “All taxes.” will not be processed.

In column (d), enter the specific information to be disclosed. Examples of column (d) information include lien information, a balance due amount, a

tax liability, or copy of return.

4. Fees

Act 130 of the 2015 Regular Session of the Louisiana Legislature amended Revised Statute 47:1507 to provide for fees for searching for tax

returns and other documents, authenticating records, and certifying copies of tax returns and other documents (see Louisiana Administrative Code

61:III.1701). As of July 17, 2015, the fees are as follows:

$15.00 for a copy of any tax return or other document previously filed by the taxpayer, or authorized representative, for each year or tax period

requested, regardless of whether the requested return or document is located.

$25.00 for each certified copy of a return or other document requested.

All fees must be paid when you submit the Tax Information Disclosure Authorization, Form R-7004 by check or money order, made payable to

the Department of Revenue.

5. Signature of Taxpayer(s)

Form R-7004 must be signed and dated by the taxpayer listed in Section 1.

Individuals — The Taxpayer must sign and date the authorization. If disclosure pertains to joint returns, both husband and wife must sign.

Corporations — Generally, Form R-7004 can be signed by: (1) an officer having legal authority to bind the corporation, (2) any person designated

by the board of directors or other governing body, or (3) any officer or employee on written request by any principal officer and attested to by the

secretary or other officer.

Partnerships — Generally, Form R-7004 can be signed by any person who was a member of the partnership during any tax period covered by

the tax information disclosure authorization, Form R-7004.

All others — Generally, Form R-7004 can be signed by any person who has authority to execute any form with respect to the tax matters and

periods listed in Section 3.