Enlarge image

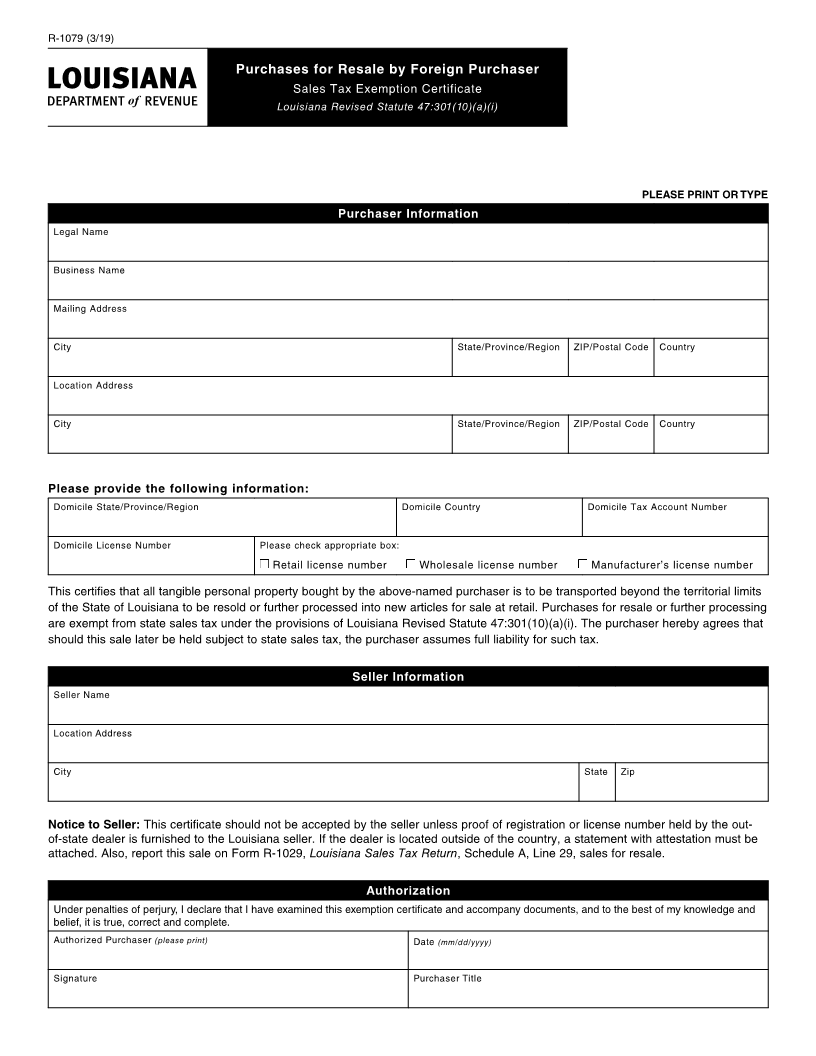

R-1079 (3/19)

Purchases for Resale by Foreign Purchaser

Sales Tax Exemption Certificate

Louisiana Revised Statute 47:301(10)(a)(i)

PLEASE PRINT OR TYPE

Purchaser Information

Legal Name

Business Name

Mailing Address

City State/Province/Region ZIP/Postal Code Country

Location Address

City State/Province/Region ZIP/Postal Code Country

Please provide the following information:

Domicile State/Province/Region Domicile Country Domicile Tax Account Number

Domicile License Number Please check appropriate box:

Retail license number Wholesale license number Manufacturer’s license number

This certifies that all tangible personal property bought by the above-named purchaser is to be transported beyond the territorial limits

of the State of Louisiana to be resold or further processed into new articles for sale at retail. Purchases for resale or further processing

are exempt from state sales tax under the provisions of Louisiana Revised Statute 47:301(10)(a)(i). The purchaser hereby agrees that

should this sale later be held subject to state sales tax, the purchaser assumes full liability for such tax.

Seller Information

Seller Name

Location Address

City State Zip

Notice to Seller: This certificate should not be accepted by the seller unless proof of registration or license number held by the out-

of-state dealer is furnished to the Louisiana seller. If the dealer is located outside of the country, a statement with attestation must be

attached. Also, report this sale on Form R-1029, Louisiana Sales Tax Return, Schedule A, Line 29, sales for resale.

Authorization

Under penalties of perjury, I declare that I have examined this exemption certificate and accompany documents, and to the best of my knowledge and

belief, it is true, correct and complete.

Authorized Purchaser (please print) Date (mm/dd/yyyy)

Signature Purchaser Title