Enlarge image

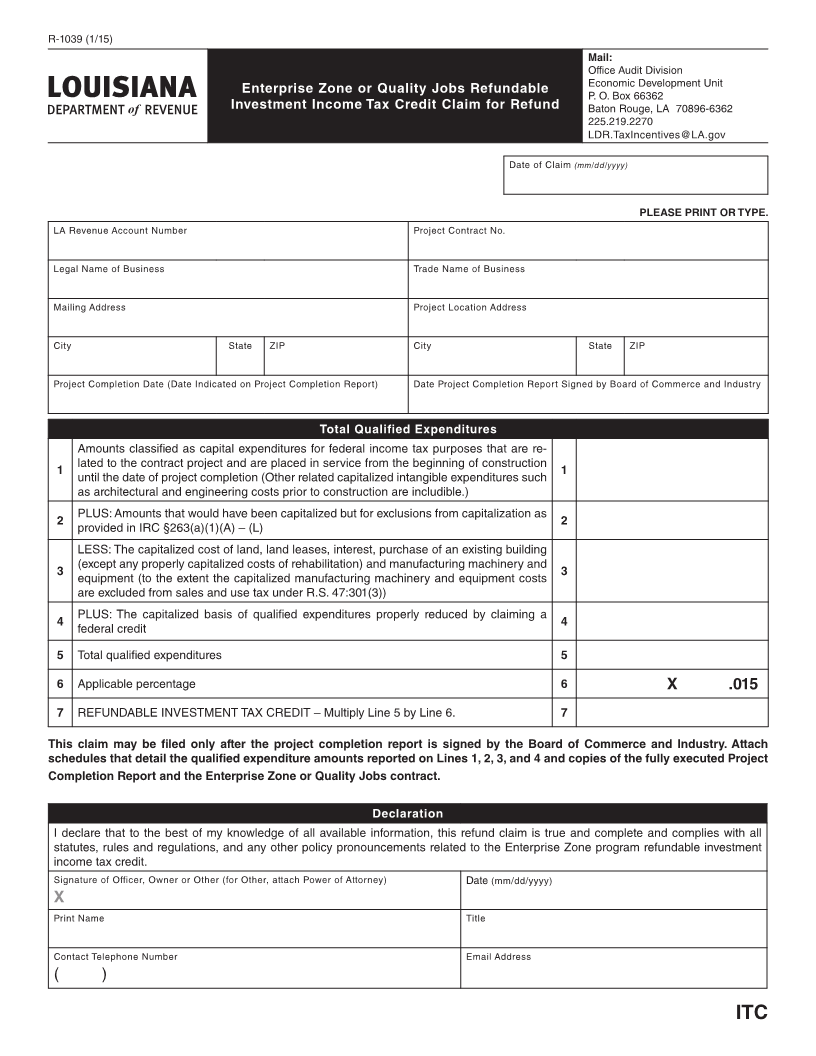

R-1039 (1/15)

Mail:

Office Audit Division

Enterprise Zone or Quality Jobs Refundable Economic Development Unit

P. O. Box 66362

Investment Income Tax Credit Claim for Refund Baton Rouge, LA 70896-6362

225.219.2270

LDR.TaxIncentives@LA.gov

Date of Claim (mm/dd/yyyy)

PLEASE PRINT OR TYPE.

LA Revenue Account Number Project Contract No.

Legal Name of Business Trade Name of Business

Mailing Address Project Location Address

City State ZIP City State ZIP

Project Completion Date (Date Indicated on Project Completion Report) Date Project Completion Report Signed by Board of Commerce and Industry

Total Qualified Expenditures

Amounts classified as capital expenditures for federal income tax purposes that are re-

lated to the contract project and are placed in service from the beginning of construction

1 1

until the date of project completion (Other related capitalized intangible expenditures such

as architectural and engineering costs prior to construction are includible.)

PLUS: Amounts that would have been capitalized but for exclusions from capitalization as

2 2

provided in IRC §263(a)(1)(A) – (L)

LESS: The capitalized cost of land, land leases, interest, purchase of an existing building

(except any properly capitalized costs of rehabilitation) and manufacturing machinery and

3 3

equipment (to the extent the capitalized manufacturing machinery and equipment costs

are excluded from sales and use tax under R.S. 47:301(3))

PLUS: The capitalized basis of qualified expenditures properly reduced by claiming a

4 4

federal credit

5 Total qualified expenditures 5

6 Applicable percentage 6 X .015

7 REFUNDABLE INVESTMENT TAX CREDIT – Multiply Line 5 by Line 6. 7

This claim may be filed only after the project completion report is signed by the Board of Commerce and Industry. Attach

schedules that detail the qualified expenditure amounts reported on Lines 1, 2, 3, and 4 and copies of the fully executed Project

Completion Report and the Enterprise Zone or Quality Jobs contract.

Declaration

I declare that to the best of my knowledge of all available information, this refund claim is true and complete and complies with all

statutes, rules and regulations, and any other policy pronouncements related to the Enterprise Zone program refundable investment

income tax credit.

Signature of Officer, Owner or Other (for Other, attach Power of Attorney) Date (mm/dd/yyyy)

X

Print Name Title

Contact Telephone Number Email Address

( )

ITC