Enlarge image

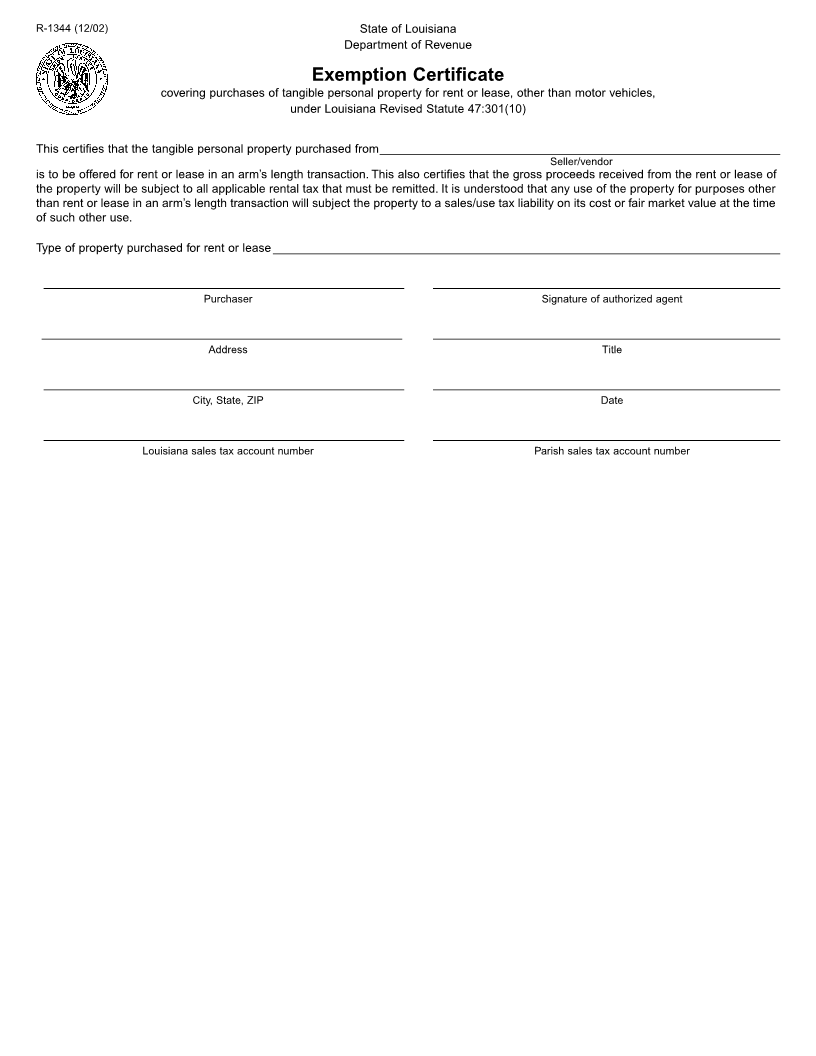

R-1344 (12/02) State of Louisiana

Department of Revenue

Exemption Certificate

covering purchases of tangible personal property for rent or lease, other than motor vehicles,

under Louisiana Revised Statute 47:301(10)

This certifies that the tangible personal property purchased from____________________________________________________________

Seller/vendor

is to be offered for rent or lease in an arm’s length transaction. This also certifies that the gross proceeds received from the rent or lease of

the property will be subject to all applicable rental tax that must be remitted. It is understood that any use of the property for purposes other

than rent or lease in an arm’s length transaction will subject the property to a sales/use tax liability on its cost or fair market value at the time

of such other use.

Type of property purchased for rent or lease ____________________________________________________________________________

______________________________________________________ ____________________________________________________

Purchaser Signature of authorized agent

______________________________________________________ ____________________________________________________

Address Title

______________________________________________________ ____________________________________________________

City, State, ZIP Date

______________________________________________________ ____________________________________________________

Louisiana sales tax account number Parish sales tax account number