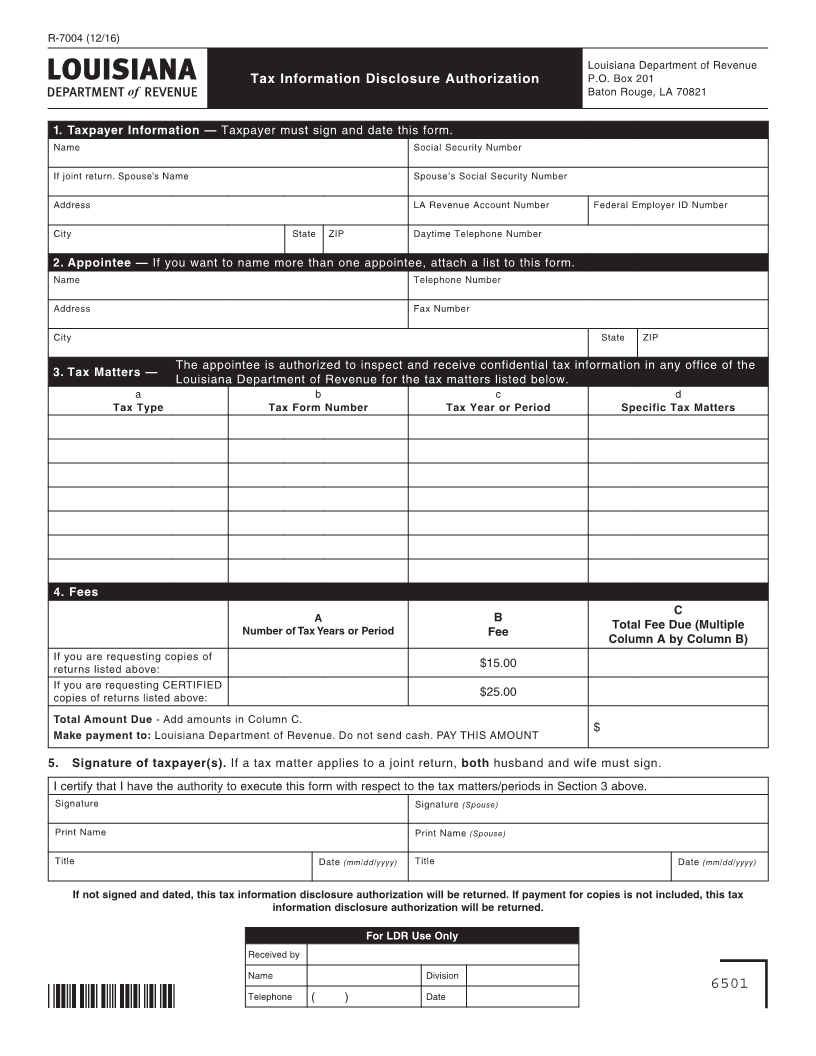

Enlarge image

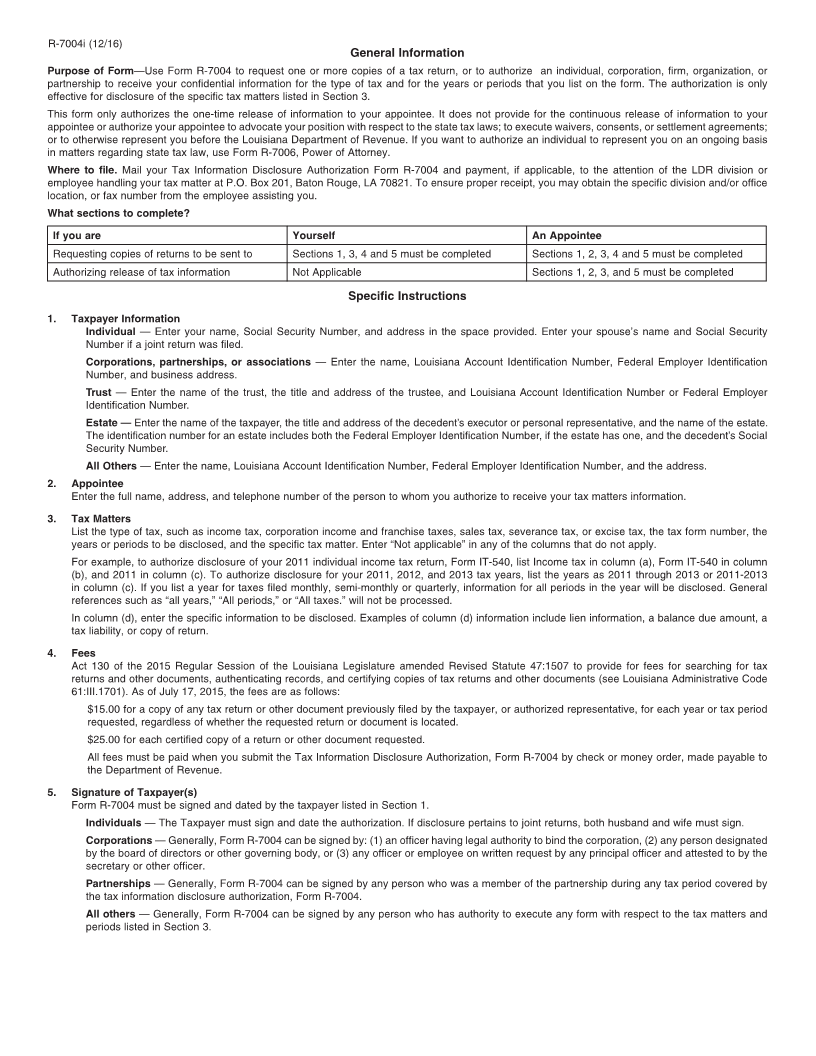

R-7004 (12/16)

Louisiana Department of Revenue

Tax Information Disclosure Authorization P.O. Box 201

Baton Rouge, LA 70821

1. Taxpayer Information — Taxpayer must sign and date this form.

Name Social Security Number

If joint return. Spouse’s Name Spouse’s Social Security Number

Address LA Revenue Account Number Federal Employer ID Number

City State ZIP Daytime Telephone Number

2. Appointee — If you want to name more than one appointee, attach a list to this form.

Name Telephone Number

Address Fax Number

City State ZIP

The appointee is authorized to inspect and receive confidential tax information in any office of the

3. Tax Matters —

Louisiana Department of Revenue for the tax matters listed below.

a b c d

Tax Type Tax Form Number Tax Year or Period Specific Tax Matters

4. Fees

C

A B

Total Fee Due (Multiple

Number of Tax Years or Period Fee

Column A by Column B)

If you are requesting copies of

returns listed above: $15.00

If you are requesting CERTIFIED

copies of returns listed above: $25.00

Total Amount Due - Add amounts in Column C.

$

Make payment to: Louisiana Department of Revenue. Do not send cash. PAY THIS AMOUNT

5. Signature of taxpayer(s). If a tax matter applies to a joint return, both husband and wife must sign.

I certify that I have the authority to execute this form with respect to the tax matters/periods in Section 3 above.

Signature Signature (Spouse)

Print Name Print Name (Spouse)

Title Date (mm/dd/yyyy) Title Date (mm/dd/yyyy)

If not signed and dated, this tax information disclosure authorization will be returned. If payment for copies is not included, this tax

information disclosure authorization will be returned.

For LDR Use Only

Received by

Name Division

6501

Telephone ( ) Date