Enlarge image

R-6922 (1/13)

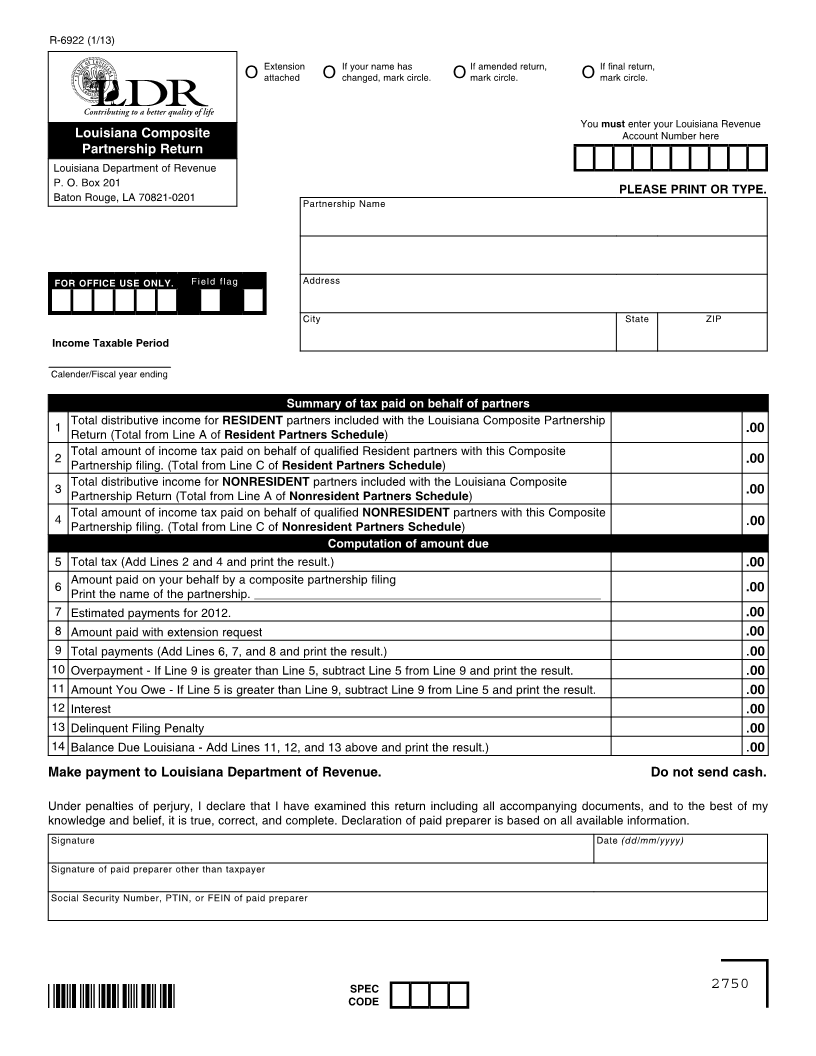

Extension If your name has If amended return, If final return,

O attached O changed, mark circle. O mark circle. O mark circle.

You must enter your Louisiana Revenue

Louisiana Composite Account Number here

Partnership Return

Louisiana Department of Revenue

P. O. Box 201

PLEASE PRINT OR TYPE.

Baton Rouge, LA 70821-0201 Partnership Name

FOR OFFICE USE ONLY. Field flag Address

City State ZIP

Income Taxable Period

Calender/Fiscal year ending

Summary of tax paid on behalf of partners

Total distributive income for RESIDENT partners included with the Louisiana Composite Partnership

1 .00

Return (Total from Line A of Resident Partners Schedule)

Total amount of income tax paid on behalf of qualified Resident partners with this Composite

2 .00

Partnership filing. (Total from Line C of Resident Partners Schedule)

Total distributive income for NONRESIDENT partners included with the Louisiana Composite

3 .00

Partnership Return (Total from Line A of Nonresident Partners Schedule)

Total amount of income tax paid on behalf of qualified NONRESIDENT partners with this Composite

4 .00

Partnership filing. (Total from Line C of Nonresident Partners Schedule)

Computation of amount due

5 Total tax (Add Lines 2 and 4 and print the result.) .00

Amount paid on your behalf by a composite partnership filing

6 ____________________________________________________________________ .00

Print the name of the partnership.

7 Estimated payments for 2012. .00

8 Amount paid with extension request .00

9 Total payments (Add Lines 6, 7, and 8 and print the result.) .00

10 Overpayment - If Line 9 is greater than Line 5, subtract Line 5 from Line 9 and print the result. .00

11 Amount You Owe - If Line 5 is greater than Line 9, subtract Line 9 from Line 5 and print the result. .00

12 Interest .00

13 Delinquent Filing Penalty .00

14 Balance Due Louisiana - Add Lines 11, 12, and 13 above and print the result.) .00

Make payment to Louisiana Department of Revenue. Do not send cash.

Under penalties of perjury, I declare that I have examined this return including all accompanying documents, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of paid preparer is based on all available information.

Signature Date (dd/mm/yyyy)

Signature of paid preparer other than taxpayer

Social Security Number, PTIN, or FEIN of paid preparer

SPEC 2750

CODE