Enlarge image

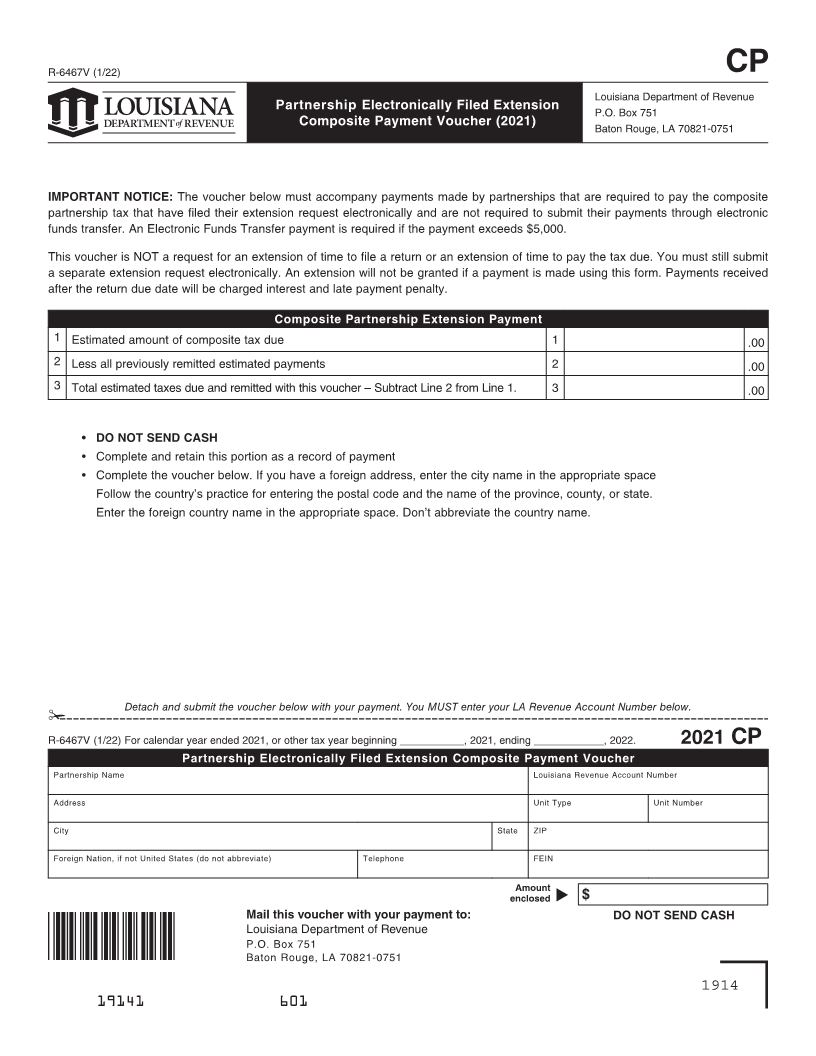

R-6467V (1/22) CP

Louisiana Department of Revenue

Partnership Electronically Filed Extension P.O. Box 751

Composite Payment Voucher (2021) Baton Rouge, LA 70821-0751

IMPORTANT NOTICE: The voucher below must accompany payments made by partnerships that are required to pay the composite

partnership tax that have filed their extension request electronically and are not required to submit their payments through electronic

funds transfer. An Electronic Funds Transfer payment is required if the payment exceeds $5,000.

This voucher is NOT a request for an extension of time to file a return or an extension of time to pay the tax due. You must still submit

a separate extension request electronically. An extension will not be granted if a payment is made using this form. Payments received

after the return due date will be charged interest and late payment penalty.

Composite Partnership Extension Payment

1 Estimated amount of composite tax due 1 .00

2 Less all previously remitted estimated payments 2 .00

3 Total estimated taxes due and remitted with this voucher – Subtract Line 2 from Line 1. 3 .00

• DO NOT SEND CASH

• Complete and retain this portion as a record of payment

• Complete the voucher below. If you have a foreign address, enter the city name in the appropriate space

Follow the country’s practice for entering the postal code and the name of the province, county, or state.

Enter the foreign country name in the appropriate space. Don’t abbreviate the country name.

Detach and submit the voucher below with your payment. You MUST enter your LA Revenue Account Number below.

✁

R-6467V (1/22) For calendar year ended 2021, or other tax year beginning ___________, 2021, ending ____________, 2022. 2021 CP

Partnership Electronically Filed Extension Composite Payment Voucher

Partnership Name Louisiana Revenue Account Number

Address Unit Type Unit Number

City State ZIP

Foreign Nation, if not United States (do not abbreviate) Telephone FEIN

Amount

enclosed u $

Mail this voucher with your payment to: DO NOT SEND CASH

Louisiana Department of Revenue

P.O. Box 751

Baton Rouge, LA 70821-0751

1914

19141 601