Enlarge image

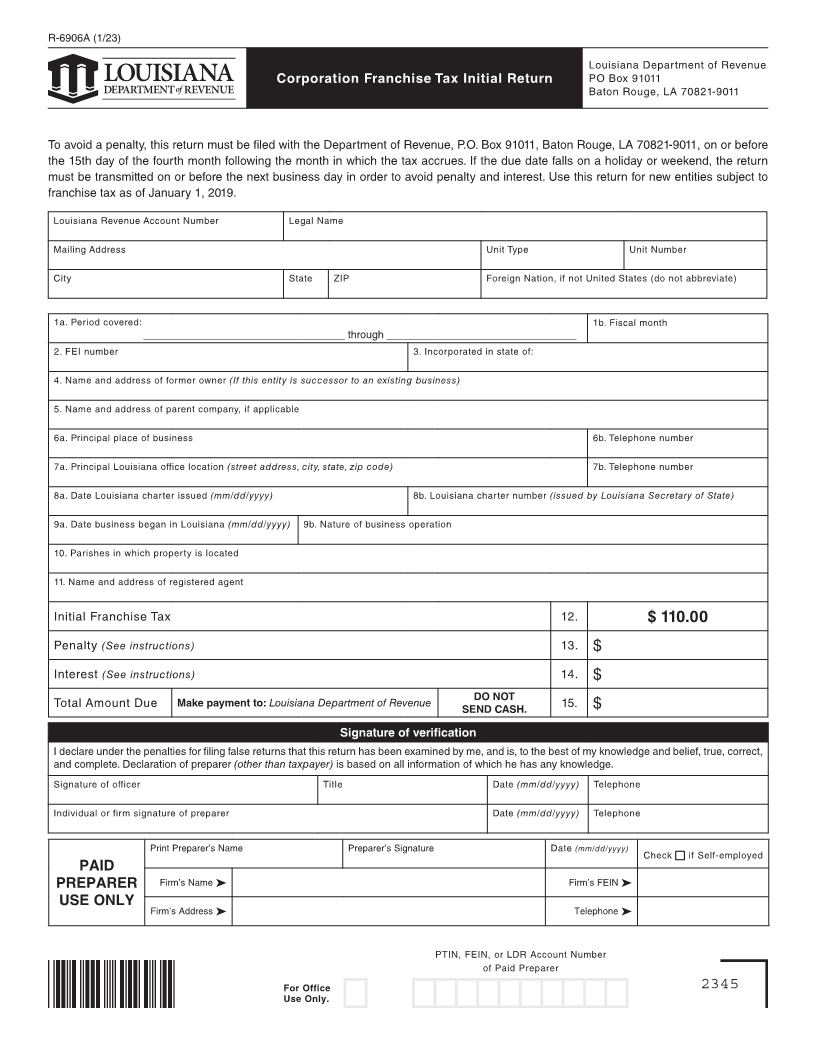

R-6906A (1/23)

Louisiana Department of Revenue

Corporation Franchise Tax Initial Return PO Box 91011

Baton Rouge, LA 70821-9011

To avoid a penalty, this return must be filed with the Department of Revenue, P.O. Box 91011, Baton Rouge, LA 70821-9011, on or before

the 15th day of the fourth month following the month in which the tax accrues. If the due date falls on a holiday or weekend, the return

must be transmitted on or before the next business day in order to avoid penalty and interest. Use this return for new entities subject to

franchise tax as of January 1, 2019.

Louisiana Revenue Account Number Legal Name

Mailing Address Unit Type Unit Number

City State ZIP Foreign Nation, if not United States (do not abbreviate)

1a. Period covered: 1b. Fiscal month

__________________________________ through ________________________________

2. FEI number 3. Incorporated in state of:

4. Name and address of former owner (If this entity is successor to an existing business)

5. Name and address of parent company, if applicable

6a. Principal place of business 6b. Telephone number

7a. Principal Louisiana office location (street address, city, state, zip code) 7b. Telephone number

8a. Date Louisiana charter issued (mm/dd/yyyy) 8b. Louisiana charter number (issued by Louisiana Secretary of State)

9a. Date business began in Louisiana (mm/dd/yyyy) 9b. Nature of business operation

10. Parishes in which property is located

11. Name and address of registered agent

Initial Franchise Tax 12. $ 110.00

Penalty (See instructions) 13. $

Interest (See instructions) 14. $

Total Amount Due Make payment to: Louisiana Department of Revenue DO NOT

SEND CASH. 15. $

Signature of verification

I declare under the penalties for filing false returns that this return has been examined by me, and is, to the best of my knowledge and belief, true, correct,

and complete. Declaration of preparer (other than taxpayer) is based on all information of which he has any knowledge.

Signature of officer Title Date (mm/dd/yyyy) Telephone

Individual or firm signature of preparer Date (mm/dd/yyyy) Telephone

Print Preparer’s Name Preparer’s Signature Date (mm/dd/yyyy)

Check ■■ if Self-employed

PAID

PREPARER Firm’s Name ➤ Firm’s FEIN ➤

USE ONLY

Firm’s Address ➤ Telephone ➤

PTIN, FEIN, or LDR Account Number

of Paid Preparer

For Office 2345

Use Only.