Enlarge image

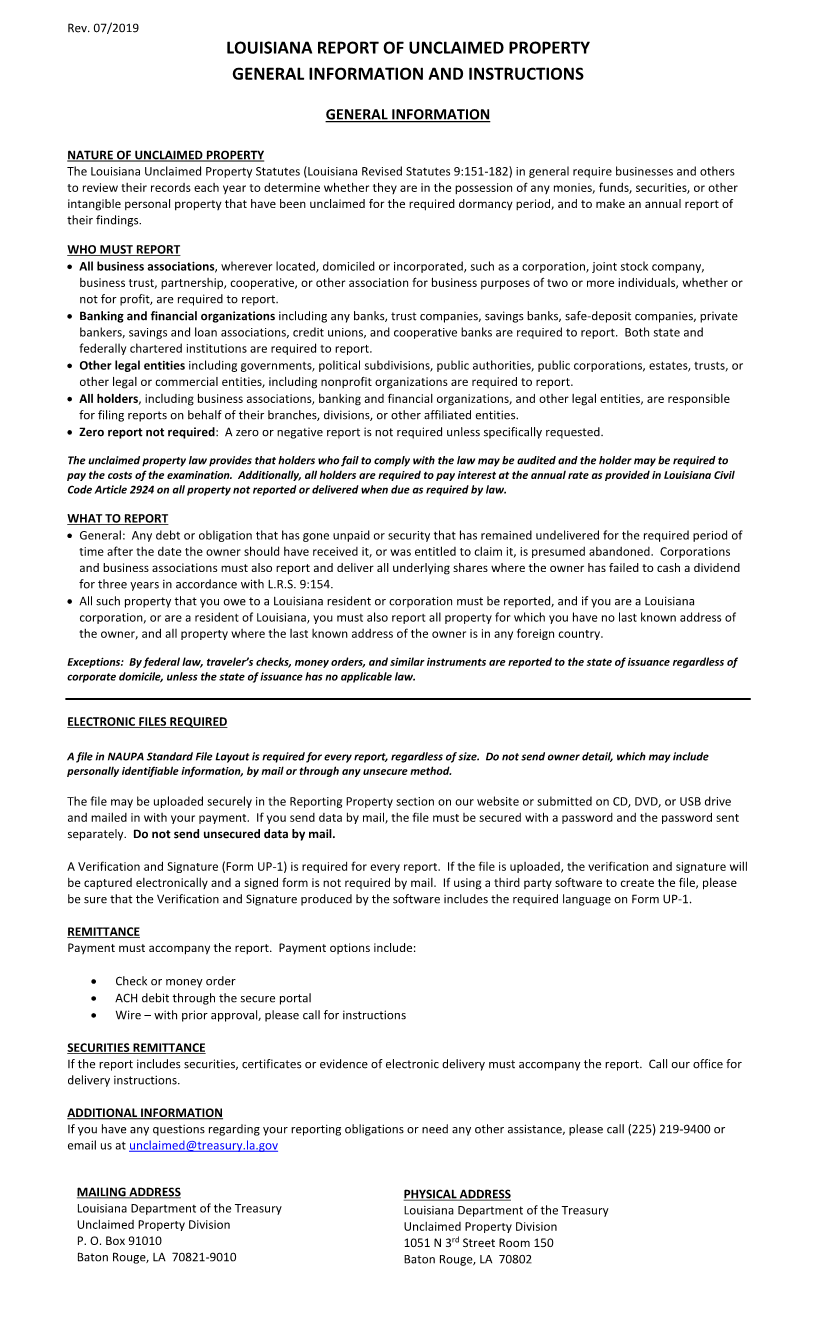

Rev. 07/2019 LOUISIANA REPORT OF UNCLAIMED PROPERTY GENERAL INFORMATION AND INSTRUCTIONS GENERAL INFORMATION NATURE OF UNCLAIMED PROPERTY The Louisiana Unclaimed Property Statutes (Louisiana Revised Statutes 9:151-182) in general require businesses and others to review their records each year to determine whether they are in the possession of any monies, funds, securities, or other intangible personal property that have been unclaimed for the required dormancy period, and to make an annual report of their findings. WHO MUST REPORT • All business associations, wherever located, domiciled or incorporated, such as a corporation, joint stock company, business trust, partnership, cooperative, or other association for business purposes of two or more individuals, whether or not for profit, are required to report. • Banking and financial organizations including any banks, trust companies, savings banks, safe-deposit companies, private bankers, savings and loan associations, credit unions, and cooperative banks are required to report. Both state and federally chartered institutions are required to report. • Other legal entities including governments, political subdivisions, public authorities, public corporations, estates, trusts, or other legal or commercial entities, including nonprofit organizations are required to report. • All holders, including business associations, banking and financial organizations, and other legal entities, are responsible for filing reports on behalf of their branches, divisions, or other affiliated entities. • Zero report not required: A zero or negative report is not required unless specifically requested. The unclaimed property law provides that holders who fail to comply with the law may be audited and the holder may be required to pay the costs of the examination. Additionally, all holders are required to pay interest at the annual rate as provided in Louisiana Civil Code Article 2924 on all property not reported or delivered when due as required by law. WHAT TO REPORT • General: Any debt or obligation that has gone unpaid or security that has remained undelivered for the required period of time after the date the owner should have received it, or was entitled to claim it, is presumed abandoned. Corporations and business associations must also report and deliver all underlying shares where the owner has failed to cash a dividend for three years in accordance with L.R.S. 9:154. • All such property that you owe to a Louisiana resident or corporation must be reported, and if you are a Louisiana corporation, or are a resident of Louisiana, you must also report all property for which you have no last known address of the owner, and all property where the last known address of the owner is in any foreign country. Exceptions: By federal law, traveler’s checks, money orders, and similar instruments are reported to the state of issuance regardless of corporate domicile, unless the state of issuance has no applicable law. ELECTRONIC FILES REQUIRED A file in NAUPA Standard File Layout is required for every report, regardless of size. Do not send owner detail, which may include personally identifiable information, by mail or through any unsecure method. The file may be uploaded securely in the Reporting Property section on our website or submitted on CD, DVD, or USB drive and mailed in with your payment. If you send data by mail, the file must be secured with a password and the password sent separately. Do not send unsecured data by mail. A Verification and Signature (Form UP-1) is required for every report. If the file is uploaded, the verification and signature will be captured electronically and a signed form is not required by mail. If using a third party software to create the file, please be sure that the Verification and Signature produced by the software includes the required language on Form UP-1. REMITTANCE Payment must accompany the report. Payment options include: • Check or money order • ACH debit through the secure portal • Wire – with prior approval, please call for instructions SECURITIES REMITTANCE If the report includes securities, certificates or evidence of electronic delivery must accompany the report. Call our office for delivery instructions. ADDITIONAL INFORMATION If you have any questions regarding your reporting obligations or need any other assistance, please call (225) 219-9400 or email us at unclaimed@treasury.la.gov MAILING ADDRESS PHYSICAL ADDRESS Louisiana Department of the Treasury Louisiana Department of the Treasury Unclaimed Property Division Unclaimed Property Division P. O. Box 91010 1051 N 3 rdStreet Room 150 Baton Rouge, LA 70821-9010 Baton Rouge, LA 70802