Enlarge image

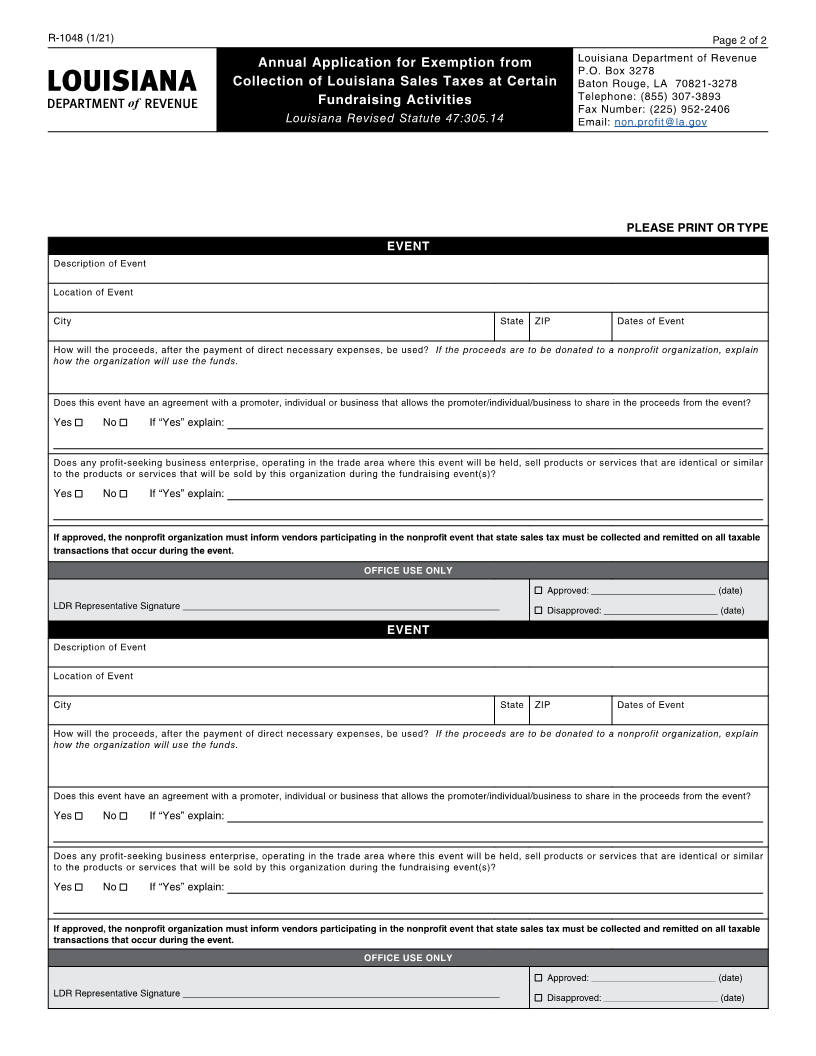

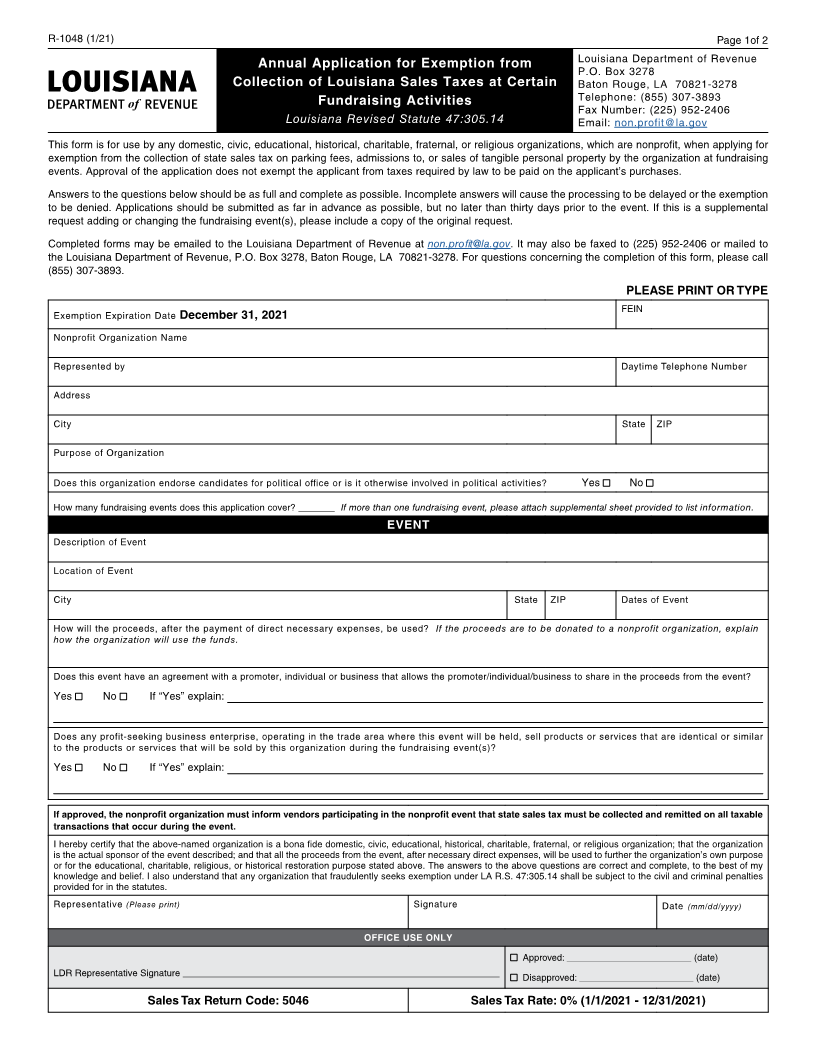

R-1048 (1/21) Page 1of 2 Annual Application for Exemption from Louisiana Department of Revenue P.O. Box 3278 Collection of Louisiana Sales Taxes at Certain Baton Rouge, LA 70821-3278 Fundraising Activities Telephone: (855) 307-3893 Fax Number: (225) 952-2406 Louisiana Revised Statute 47:305.14 Email: non.profit@la.gov This form is for use by any domestic, civic, educational, historical, charitable, fraternal, or religious organizations, which are nonprofit, when applying for exemption from the collection of state sales tax on parking fees, admissions to, or sales of tangible personal property by the organization at fundraising events. Approval of the application does not exempt the applicant from taxes required by law to be paid on the applicant’s purchases. Answers to the questions below should be as full and complete as possible. Incomplete answers will cause the processing to be delayed or the exemption to be denied. Applications should be submitted as far in advance as possible, but no later than thirty days prior to the event. If this is a supplemental request adding or changing the fundraising event(s), please include a copy of the original request. Completed forms may be emailed to the Louisiana Department of Revenue at non.profit@la.gov. It may also be faxed to (225) 952-2406 or mailed to the Louisiana Department of Revenue, P.O. Box 3278, Baton Rouge, LA 70821-3278. For questions concerning the completion of this form, please call (855) 307-3893. PLEASE PRINT OR TYPE FEIN Exemption Expiration Date December 31, 2021 Nonprofit Organization Name Represented by Daytime Telephone Number Address City State ZIP Purpose of Organization Does this organization endorse candidates for political office or is it otherwise involved in political activities? Yes ■ No ■ How many fundraising events does this application cover? _______ If more than one fundraising event, please attach supplemental sheet provided to list information. EVENT Description of Event Location of Event City State ZIP Dates of Event How will the proceeds, after the payment of direct necessary expenses, be used? If the proceeds are to be donated to a nonprofit organization, explain how the organization will use the funds. Does this event have an agreement with a promoter, individual or business that allows the promoter/individual/business to share in the proceeds from the event? Yes ■ No ■ If “Yes” explain: Does any profit-seeking business enterprise, operating in the trade area where this event will be held, sell products or services that are identical or similar to the products or services that will be sold by this organization during the fundraising event(s)? Yes ■ No ■ If “Yes” explain: If approved, the nonprofit organization must inform vendors participating in the nonprofit event that state sales tax must be collected and remitted on all taxable transactions that occur during the event. I hereby certify that the above-named organization is a bona fide domestic, civic, educational, historical, charitable, fraternal, or religious organization; that the organization is the actual sponsor of the event described; and that all the proceeds from the event, after necessary direct expenses, will be used to further the organization’s own purpose or for the educational, charitable, religious, or historical restoration purpose stated above. The answers to the above questions are correct and complete, to the best of my knowledge and belief. I also understand that any organization that fraudulently seeks exemption under LA R.S. 47:305.14 shall be subject to the civil and criminal penalties provided for in the statutes. Representative (Please print) Signature Date (mm/dd/yyyy) OFFICE USE ONLY ■ Approved: ________________________ (date) LDR Representative Signature ___________________________________________________________________ ■ Disapproved: ______________________ (date) Sales Tax Return Code: 5046 Sales Tax Rate: 0% (1/1/2021 - 12/31/2021)