Enlarge image

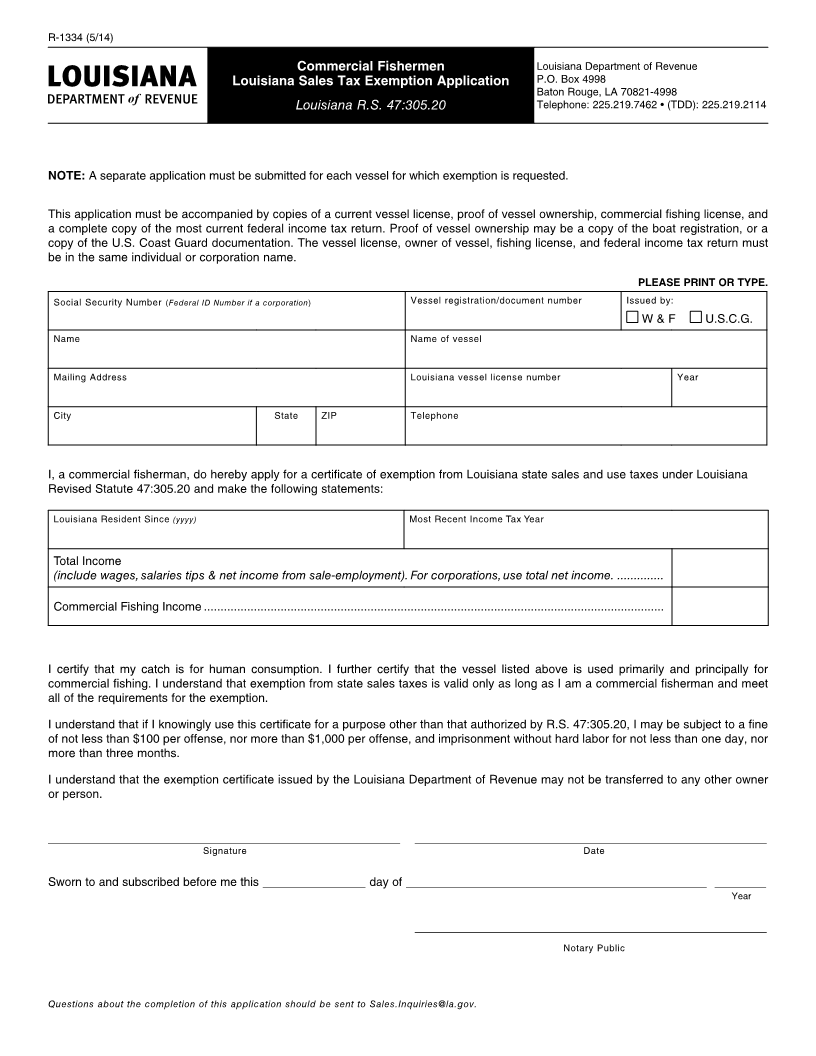

R-1334 (5/14)

Commercial Fishermen Louisiana Department of Revenue

louisiana sales Tax Exemption application P.O. Box 4998

Baton Rouge, LA 70821-4998

Louisiana R.S. 47:305.20 Telephone: 225.219.7462 • (TDD): 225.219.2114

NOTE: A separate application must be submitted for each vessel for which exemption is requested.

This application must be accompanied by copies of a current vessel license, proof of vessel ownership, commercial fishing license, and

a complete copy of the most current federal income tax return. Proof of vessel ownership may be a copy of the boat registration, or a

copy of the U.S. Coast Guard documentation. The vessel license, owner of vessel, fishing license, and federal income tax return must

be in the same individual or corporation name.

PlEasE PriNT Or TyPE.

Social Security Number (Federal ID Number if a corporation) Vessel registration/document number Issued by:

W & F U.S.C.G.

Name Name of vessel

Mailing Address Louisiana vessel license number Year

City State ZIP Telephone

( )

I, a commercial fisherman, do hereby apply for a certificate of exemption from Louisiana state sales and use taxes under Louisiana

Revised Statute 47:305.20 and make the following statements:

Louisiana Resident Since (yyyy) Most Recent Income Tax Year

Total Income

(include wages, salaries tips & net income from sale-employment). For corporations, use total net income. ..............

Commercial Fishing Income ..........................................................................................................................................

I certify that my catch is for human consumption. I further certify that the vessel listed above is used primarily and principally for

commercial fishing. I understand that exemption from state sales taxes is valid only as long as I am a commercial fisherman and meet

all of the requirements for the exemption.

I understand that if I knowingly use this certificate for a purpose other than that authorized by R.S. 47:305.20, I may be subject to a fine

of not less than $100 per offense, nor more than $1,000 per offense, and imprisonment without hard labor for not less than one day, nor

more than three months.

I understand that the exemption certificate issued by the Louisiana Department of Revenue may not be transferred to any other owner

or person.

________________________________________________ ________________________________________________

Signature Date

Sworn to and subscribed before me this ______________ day of _________________________________________ _______

Year

________________________________________________

Notary Public

Questions about the completion of this application should be sent to Sales.Inquiries@la.gov.