Enlarge image

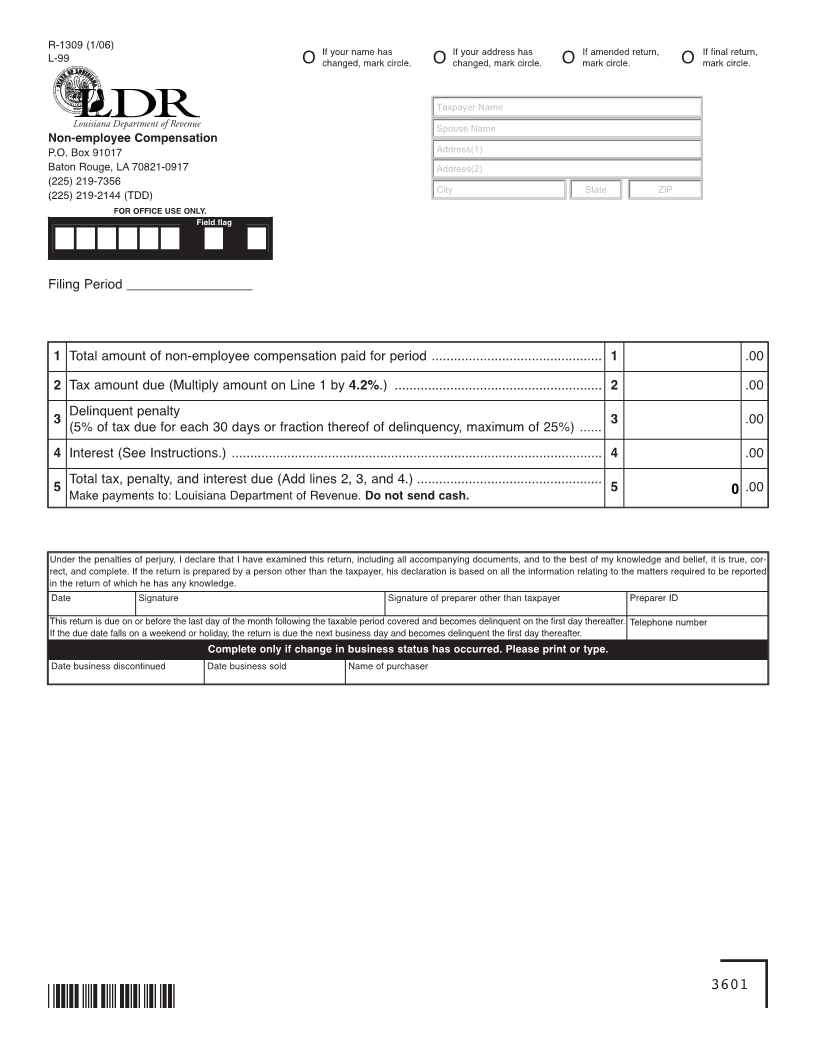

R-1309 (1/06) If your name has If your address has If amended return, If final return,

L-99 O changed, mark circle. O changed, mark circle. O mark circle. O mark circle.

Taxpayer Name

Spouse Name

Non-employee Compensation

P.O. Box 91017 Address(1)

Baton Rouge, LA 70821-0917 Address(2)

(225) 219-7356

(225) 219-2144 (TDD) City State ZIP

FOR OFFICE USE ONLY.

Field flag

Filing Period _________________

1 Total amount of non-employee compensation paid for period .............................................. 1 .00

2 Tax amount due (Multiply amount on Line 1 by 4.2%.) ........................................................ 2 .00

Delinquent penalty

3 3 .00

(5% of tax due for each 30 days or fraction thereof of delinquency, maximum of 25%) ......

4 Interest (See Instructions.) .................................................................................................... 4 .00

Total tax, penalty, and interest due (Add lines 2, 3, and 4.) ..................................................

5 5 0 .00

Make payments to: Louisiana Department of Revenue. Do not send cash.

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and belief, it is true, cor-

rect, and complete. If the return is prepared by a person other than the taxpayer, his declaration is based on all the information relating to the matters required to be reported

in the return of which he has any knowledge.

Date Signature Signature of preparer other than taxpayer Preparer ID

This return is due on or before the last day of the month following the taxable period covered and becomes delinquent on the first day thereafter. Telephone number

If the due date falls on a weekend or holiday, the return is due the next business day and becomes delinquent the first day thereafter.

Complete only if change in business status has occurred. Please print or type.

Date business discontinued Date business sold Name of purchaser

3601