- 3 -

Enlarge image

|

R -10610i (1/21)

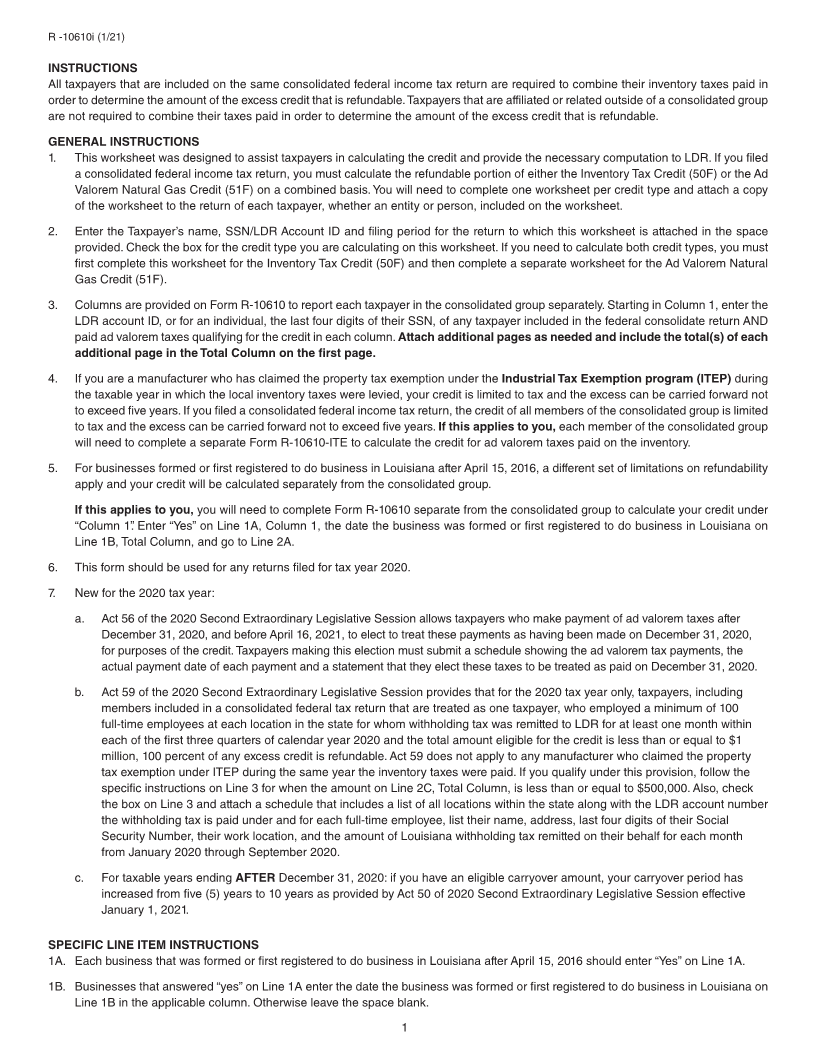

INSTRUCTIONS

All taxpayers that are included on the same consolidated federal income tax return are required to combine their inventory taxes paid in

order to determine the amount of the excess credit that is refundable. Taxpayers that are affiliated or related outside of a consolidated group

are not required to combine their taxes paid in order to determine the amount of the excess credit that is refundable.

GENERAL INSTRUCTIONS

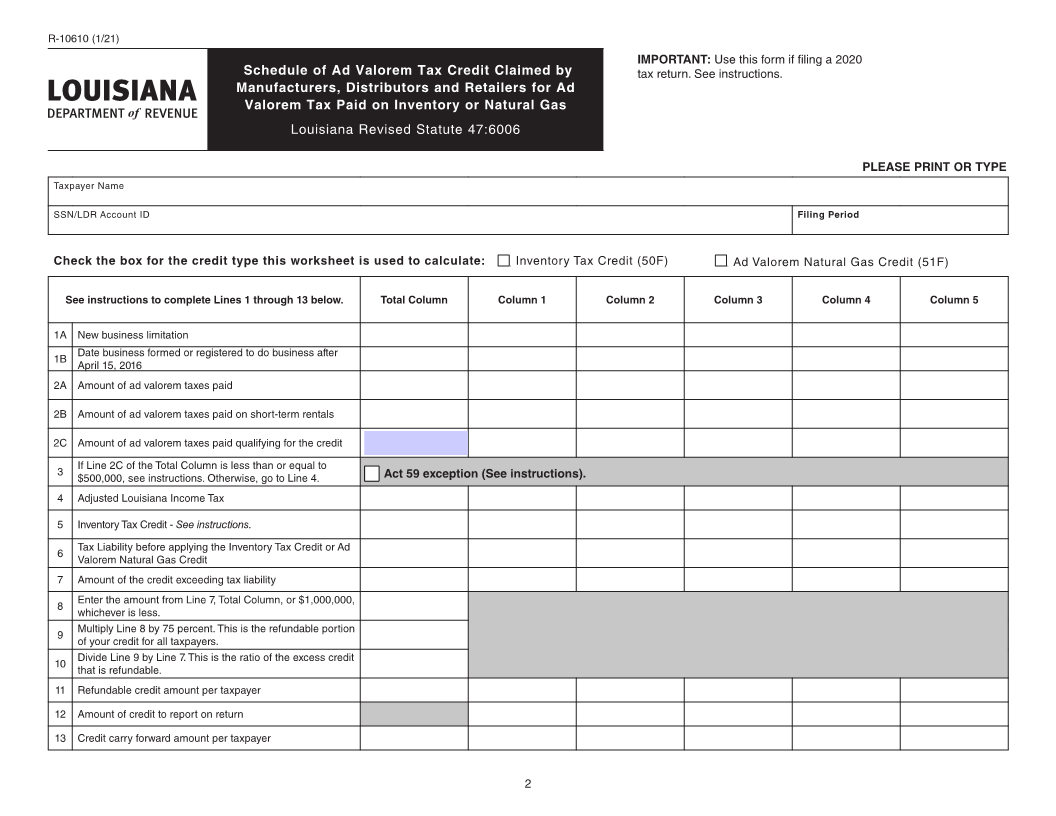

1. This worksheet was designed to assist taxpayers in calculating the credit and provide the necessary computation to LDR. If you filed

a consolidated federal income tax return, you must calculate the refundable portion of either the Inventory Tax Credit (50F) or the Ad

Valorem Natural Gas Credit (51F) on a combined basis. You will need to complete one worksheet per credit type and attach a copy

of the worksheet to the return of each taxpayer, whether an entity or person, included on the worksheet.

2. Enter the Taxpayer’s name, SSN/LDR Account ID and filing period for the return to which this worksheet is attached in the space

provided. Check the box for the credit type you are calculating on this worksheet. If you need to calculate both credit types, you must

first complete this worksheet for the Inventory Tax Credit (50F) and then complete a separate worksheet for the Ad Valorem Natural

Gas Credit (51F).

3. Columns are provided on Form R-10610 to report each taxpayer in the consolidated group separately. Starting in Column 1, enter the

LDR account ID, or for an individual, the last four digits of their SSN, of any taxpayer included in the federal consolidate return AND

paid ad valorem taxes qualifying for the credit in each column. Attach additional pages as needed and include the total(s) of each

additional page in the Total Column on the first page.

4. If you are a manufacturer who has claimed the property tax exemption under the Industrial Tax Exemption program (ITEP) during

the taxable year in which the local inventory taxes were levied, your credit is limited to tax and the excess can be carried forward not

to exceed five years. If you filed a consolidated federal income tax return, the credit of all members of the consolidated group is limited

to tax and the excess can be carried forward not to exceed five years. If this applies to you, each member of the consolidated group

will need to complete a separate Form R-10610-ITE to calculate the credit for ad valorem taxes paid on the inventory.

5. For businesses formed or first registered to do business in Louisiana after April 15, 2016, a different set of limitations on refundability

apply and your credit will be calculated separately from the consolidated group.

If this applies to you, you will need to complete Form R-10610 separate from the consolidated group to calculate your credit under

“Column 1”. Enter “Yes” on Line 1A, Column 1, the date the business was formed or first registered to do business in Louisiana on

Line 1B, Total Column, and go to Line 2A.

6. This form should be used for any returns filed for tax year 2020.

7. New for the 2020 tax year:

a. Act 56 of the 2020 Second Extraordinary Legislative Session allows taxpayers who make payment of ad valorem taxes after

December 31, 2020, and before April 16, 2021, to elect to treat these payments as having been made on December 31, 2020,

for purposes of the credit. Taxpayers making this election must submit a schedule showing the ad valorem tax payments, the

actual payment date of each payment and a statement that they elect these taxes to be treated as paid on December 31, 2020.

b. Act 59 of the 2020 Second Extraordinary Legislative Session provides that for the 2020 tax year only, taxpayers, including

members included in a consolidated federal tax return that are treated as one taxpayer, who employed a minimum of 100

full-time employees at each location in the state for whom withholding tax was remitted to LDR for at least one month within

each of the first three quarters of calendar year 2020 and the total amount eligible for the credit is less than or equal to $1

million, 100 percent of any excess credit is refundable. Act 59 does not apply to any manufacturer who claimed the property

tax exemption under ITEP during the same year the inventory taxes were paid. If you qualify under this provision, follow the

specific instructions on Line 3 for when the amount on Line 2C, Total Column, is less than or equal to $500,000. Also, check

the box on Line 3 and attach a schedule that includes a list of all locations within the state along with the LDR account number

the withholding tax is paid under and for each full-time employee, list their name, address, last four digits of their Social

Security Number, their work location, and the amount of Louisiana withholding tax remitted on their behalf for each month

from January 2020 through September 2020.

c. For taxable years ending AFTER December 31, 2020: if you have an eligible carryover amount, your carryover period has

increased from five (5) years to 10 years as provided by Act 50 of 2020 Second Extraordinary Legislative Session effective

January 1, 2021.

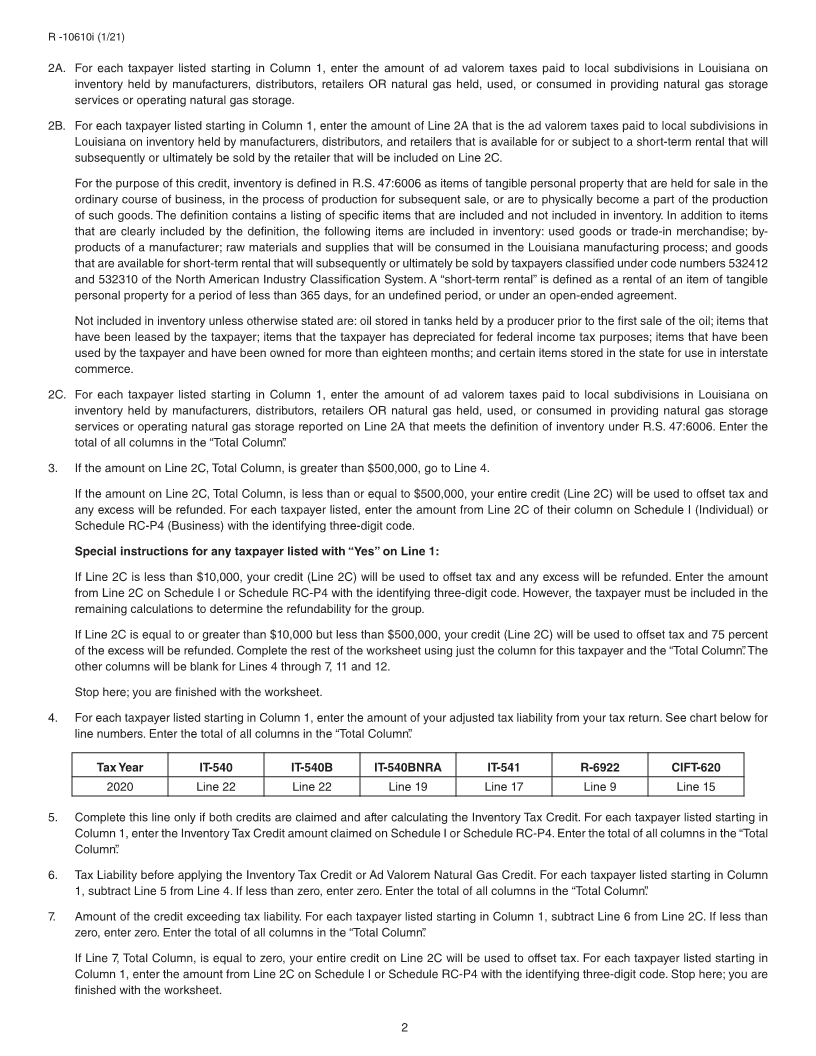

SPECIFIC LINE ITEM INSTRUCTIONS

1A. Each business that was formed or first registered to do business in Louisiana after April 15, 2016 should enter “Yes” on Line 1A.

1B. Businesses that answered “yes” on Line 1A enter the date the business was formed or first registered to do business in Louisiana on

Line 1B in the applicable column. Otherwise leave the space blank.

1

|