Enlarge image

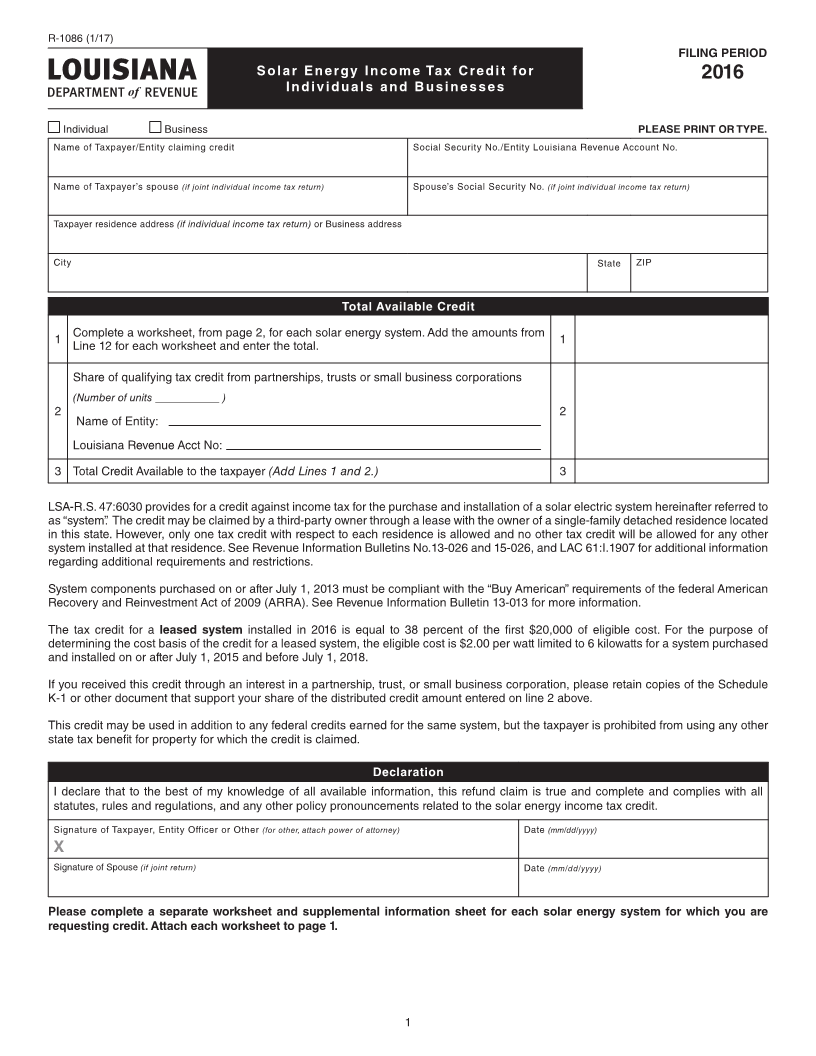

R-1086 (1/17)

FILING PERIOD

Solar Energy Income Tax Credit for 2016

Individuals and Businesses

Individual Business PLEASE PRINT OR TYPE.

Name of Taxpayer/Entity claiming credit Social Security No./Entity Louisiana Revenue Account No.

Name of Taxpayer’s spouse (if joint individual income tax return) Spouse’s Social Security No. (if joint individual income tax return)

Taxpayer residence address (if individual income tax return) or Business address

City State ZIP

Total Available Credit

Complete a worksheet, from page 2, for each solar energy system. Add the amounts from

1 1

Line 12 for each worksheet and enter the total.

Share of qualifying tax credit from partnerships, trusts or small business corporations

(Number of units ____________ )

2 2

Name of Entity:

Louisiana Revenue Acct No:

3 Total Credit Available to the taxpayer (Add Lines 1 and 2.) 3

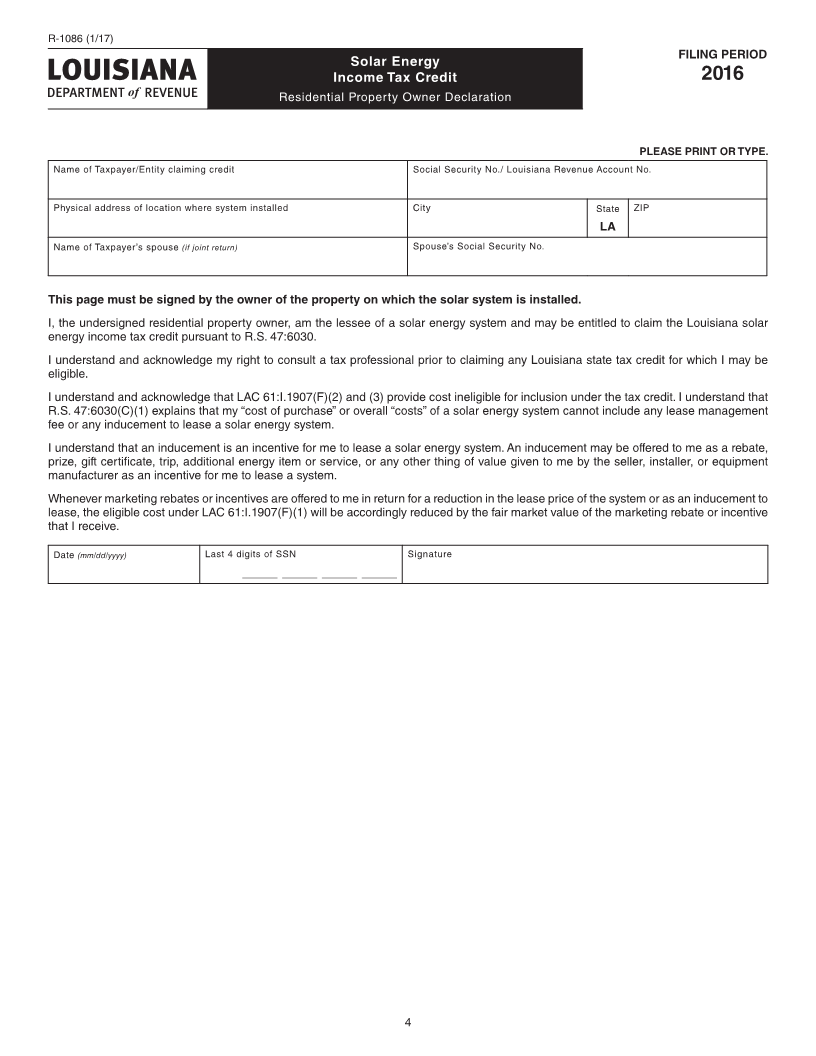

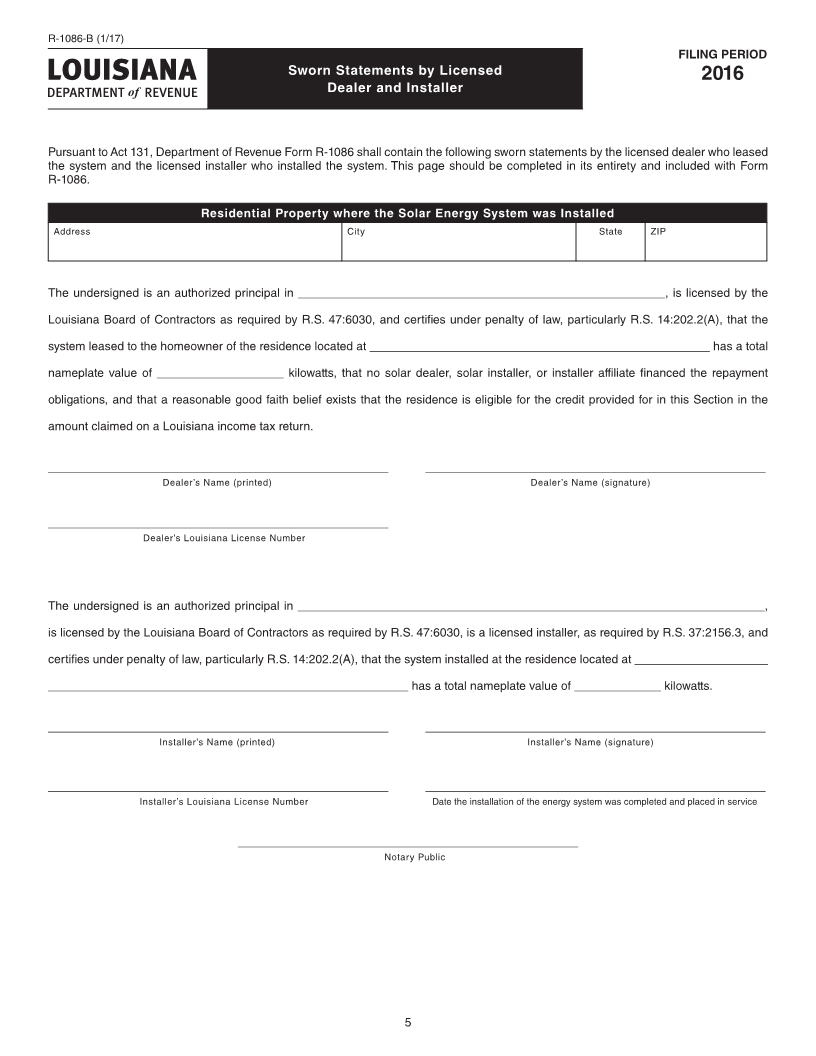

LSA-R.S. 47:6030 provides for a credit against income tax for the purchase and installation of a solar electric system hereinafter referred to

as “system”. The credit may be claimed by a third-party owner through a lease with the owner of a single-family detached residence located

in this state. However, only one tax credit with respect to each residence is allowed and no other tax credit will be allowed for any other

system installed at that residence. See Revenue Information Bulletins No.13-026 and 15-026, and LAC 61:I.1907 for additional information

regarding additional requirements and restrictions.

System components purchased on or after July 1, 2013 must be compliant with the “Buy American” requirements of the federal American

Recovery and Reinvestment Act of 2009 (ARRA). See Revenue Information Bulletin 13-013 for more information.

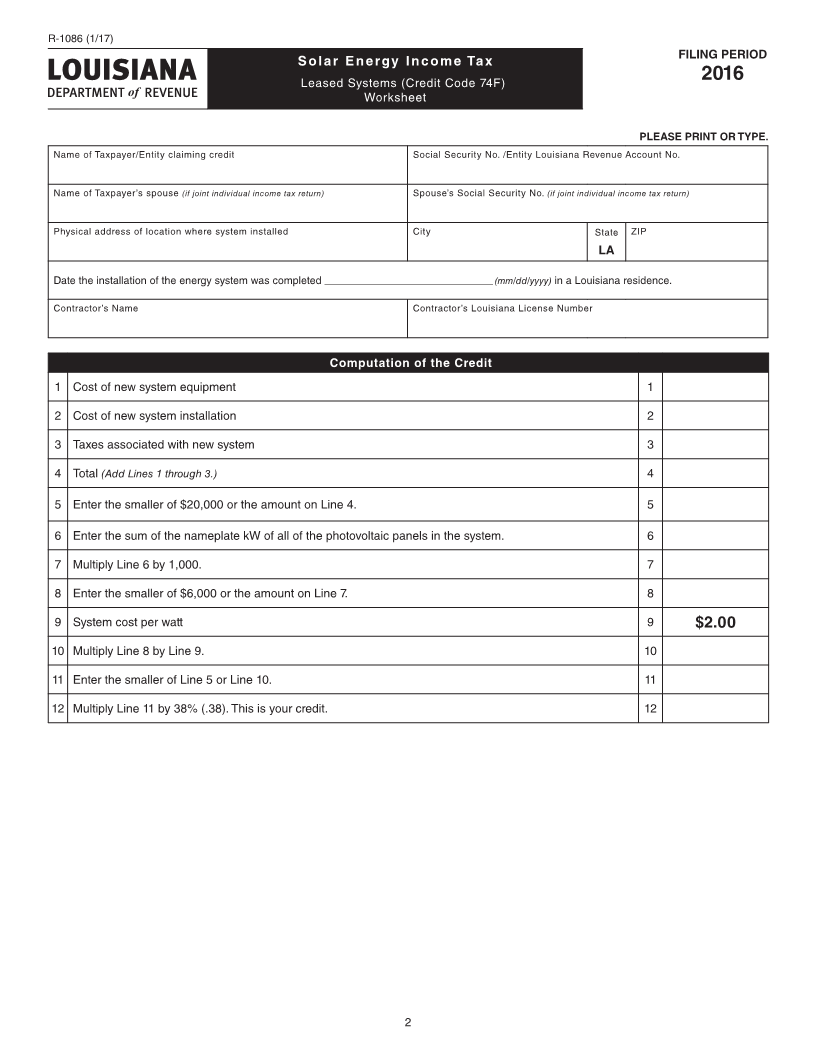

The tax credit for a leased system installed in 2016 is equal to 38 percent of the first $20,000 of eligible cost. For the purpose of

determining the cost basis of the credit for a leased system, the eligible cost is $2.00 per watt limited to 6 kilowatts for a system purchased

and installed on or after July 1, 2015 and before July 1, 2018.

If you received this credit through an interest in a partnership, trust, or small business corporation, please retain copies of the Schedule

K-1 or other document that support your share of the distributed credit amount entered on line 2 above.

This credit may be used in addition to any federal credits earned for the same system, but the taxpayer is prohibited from using any other

state tax benefit for property for which the credit is claimed.

Declaration

I declare that to the best of my knowledge of all available information, this refund claim is true and complete and complies with all

statutes, rules and regulations, and any other policy pronouncements related to the solar energy income tax credit.

Signature of Taxpayer, Entity Officer or Other (for other, attach power of attorney) Date (mm/dd/yyyy)

X

Signature of Spouse (if joint return) Date (mm/dd/yyyy)

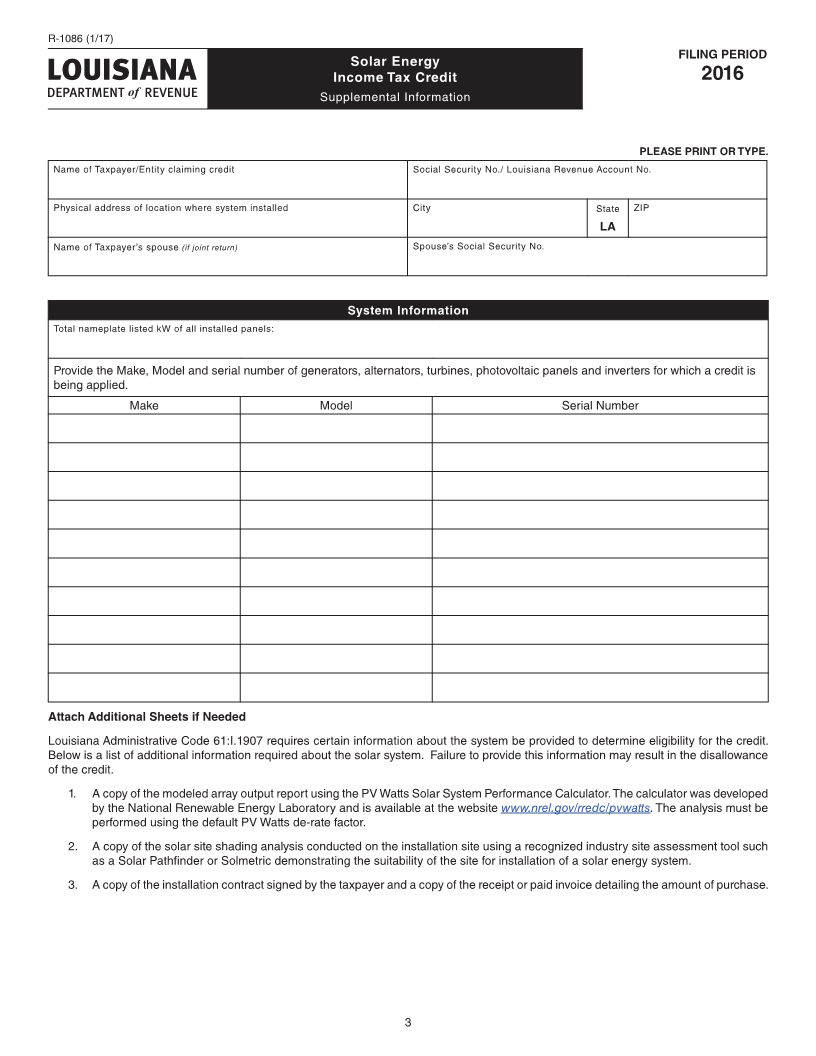

Please complete a separate worksheet and supplemental information sheet for each solar energy system for which you are

requesting credit. Attach each worksheet to page 1.

1