Enlarge image

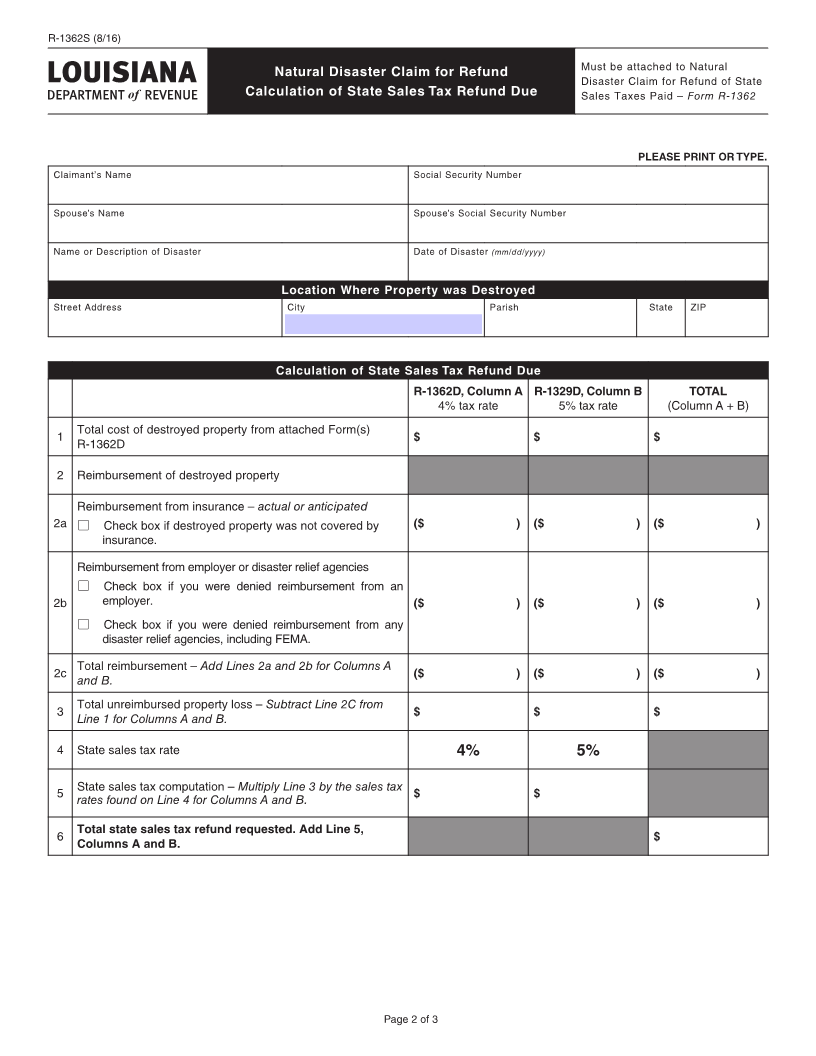

R-1362 (8/16)

Return completed form to:

Natural Disaster Claim for Refund of State Louisiana Department of Revenue

Sales Taxes Paid P.O. Box 91138

Baton Rouge, LA 70821-9138

Must attach Forms R-1362S and R-1362D

PLEASE PRINT OR TYPE.

Claimant’s Name DOB (mm/dd/yyyy) Social Security Number

Spouse’s Name DOB (mm/dd/yyyy) Spouse’s Social Security Number

Mailing Address ■ Check box to indicate address change City State ZIP

Resident of Louisiana Since (mm/yyyy) Telephone (Daytime)

Location and Description of Destruction

Street Address (including apartment number) City ZIP

Parish Date of Disaster (mm/dd/yyyy) Name or Description of Disaster

Primary Cause of Destruction: Type of Home:

■ Flood ■ Wind ■ Other_________________________ ■ House ■ Apartment/Condo ■ Mobile Home

Area(s) of the home that received damage: Total Number of Areas

■ Kitchen ■ Living Room ■ Dining Room ■ Bedroom(s) (how many rooms) ______ that Received Damage

■ Breakfast Area ■ Den ■ Garage/Carport ■ Bathroom(s) (how many rooms) ______

■ Patio ■ Outdoor Structure ■ Other ______________

1 Total amount of unreimbursed property loss from Form R-1362S, Line 3, Total Column. $

2 Total amount of state sales tax requested to be refunded from Form R-1362S, Line 6, Total Column. $

Certified Statement of Natural Disaster Refund Claim

The above individual, being duly sworn, deposes and says that the following statement is true and correct, that he is entitled to the refund

requested, and that he is not delinquent with the State of Louisiana in the payment of any state taxes.

The property described on the schedule was destroyed by a natural disaster in a “natural disaster area” so declared by the President

of the United States. I hereby certify:

• That the destroyed property was held for personal use at my residence, was not owned by a business, partnership, or corporation,

and was not otherwise used by any person for commercial purposes;

• That the property was movable, both at the time of its purchase and at the time of its destruction;

• That I paid the Louisiana state sales/use tax on my purchase of the destroyed property in the amounts now requested to be

refunded, and that the property was not acquired by gift, purchased outside the state, or otherwise without payment by me of the

Louisiana sales/use tax; and,

• That all expected and actual reimbursements from insurance and other sources have been included.

Natural disaster refund claims must be notarized to be processed. Filing or submitting false information or false representation

on this refund claim may result in jail time of 5 years and/or fines up to $5,000 under Revised Statute 14:133.

SWORN TO AND SUBSCRIBED BEFORE ME THIS _____________________ day of _____________________, ________

year

Claimant’s Name (please print) Claimant’s Signature

Spouse’s Name (please print) Spouse’s Signature

Paid Preparer Name if other than taxpayer (please print) Signature of Paid Preparer Paid Preparer Telephone Number

( )

Notary Name (please print) Notary Signature Notary Number

Page 1 of 3