Enlarge image

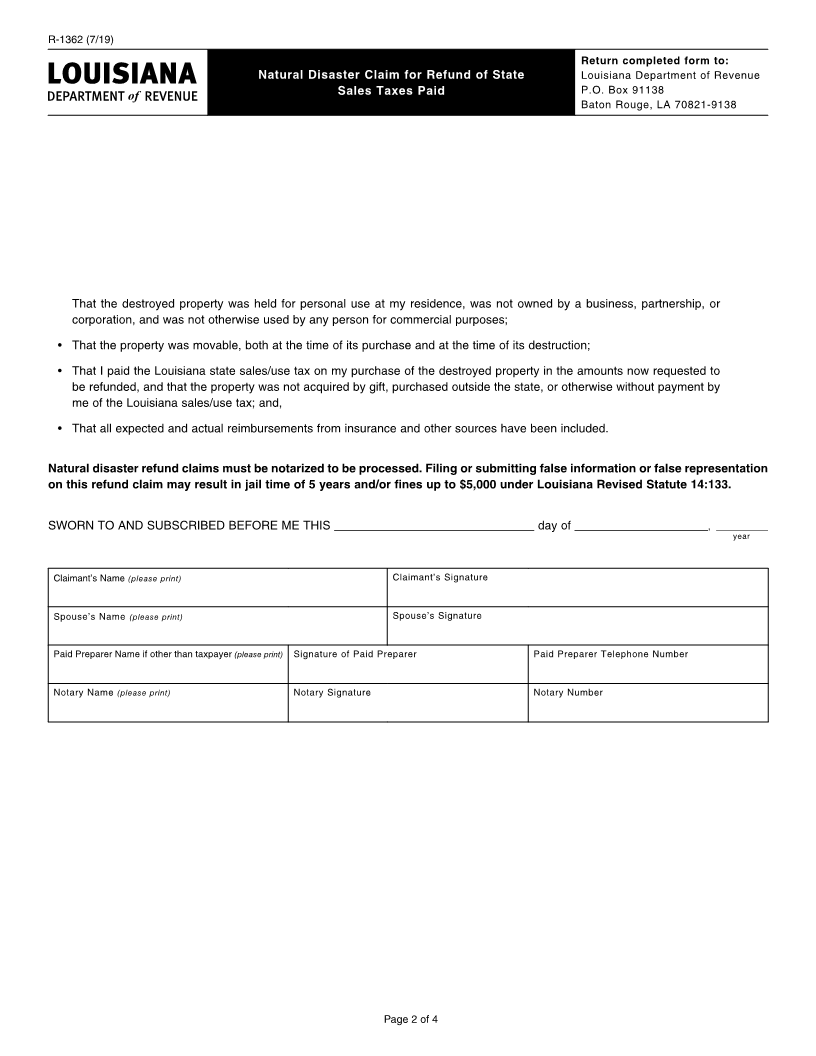

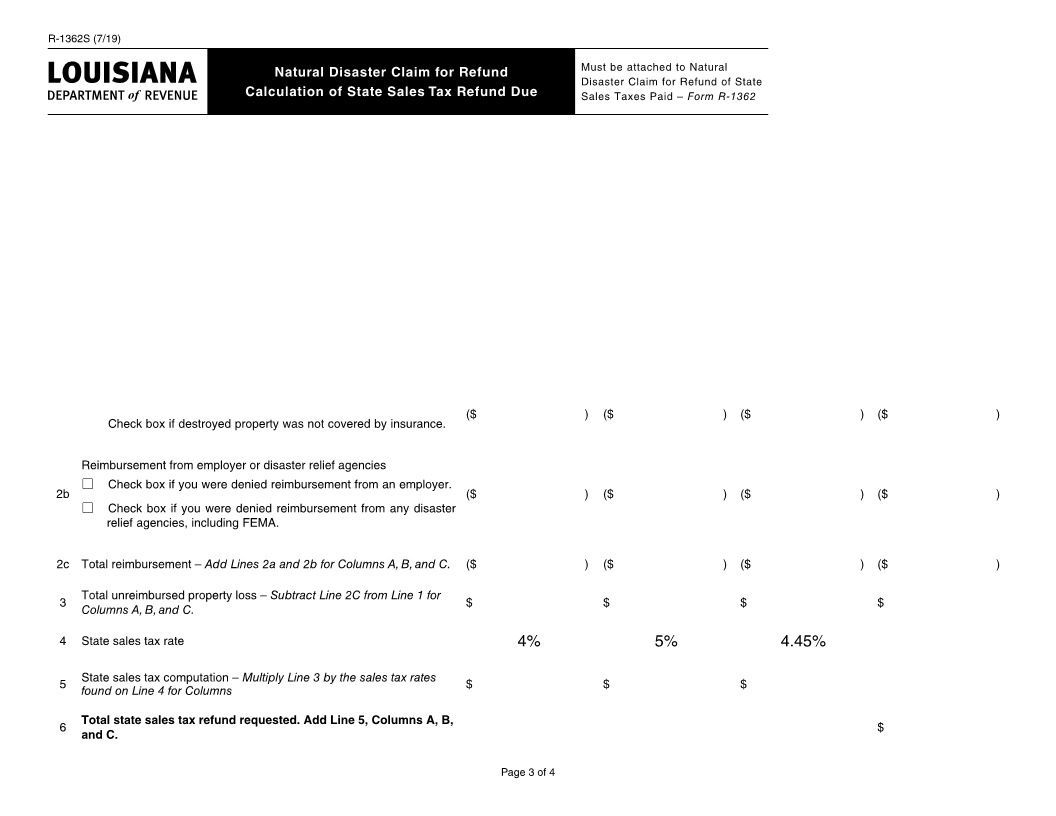

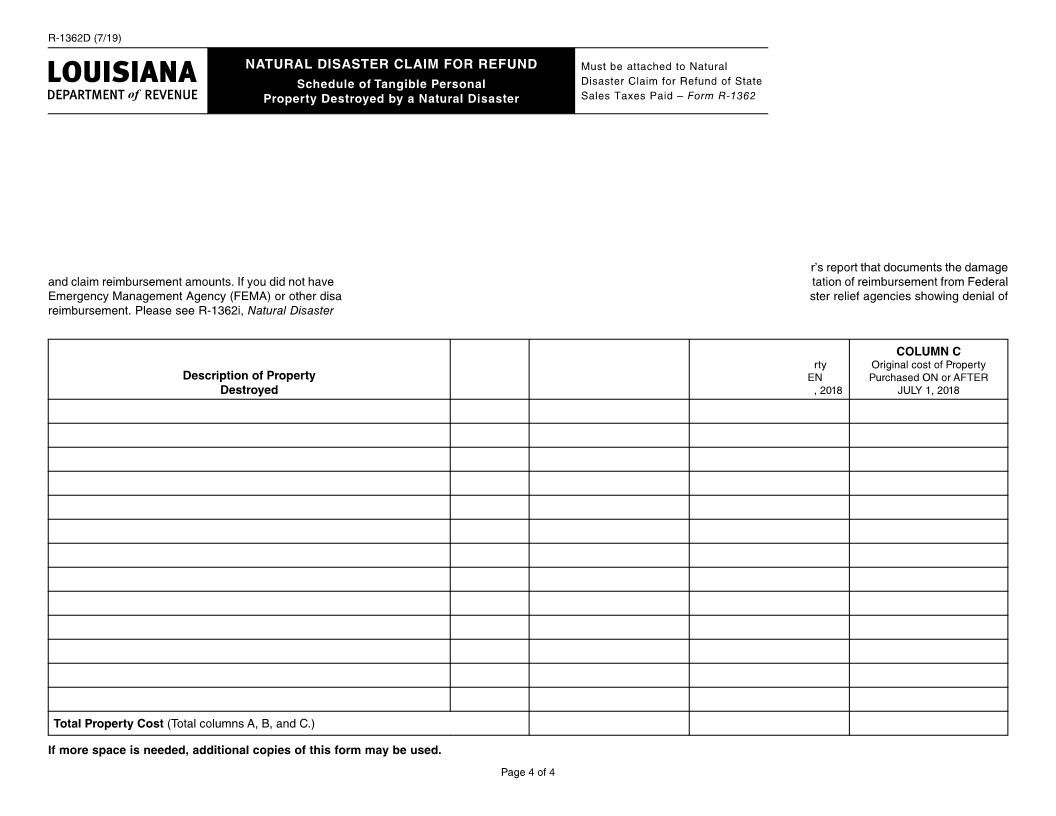

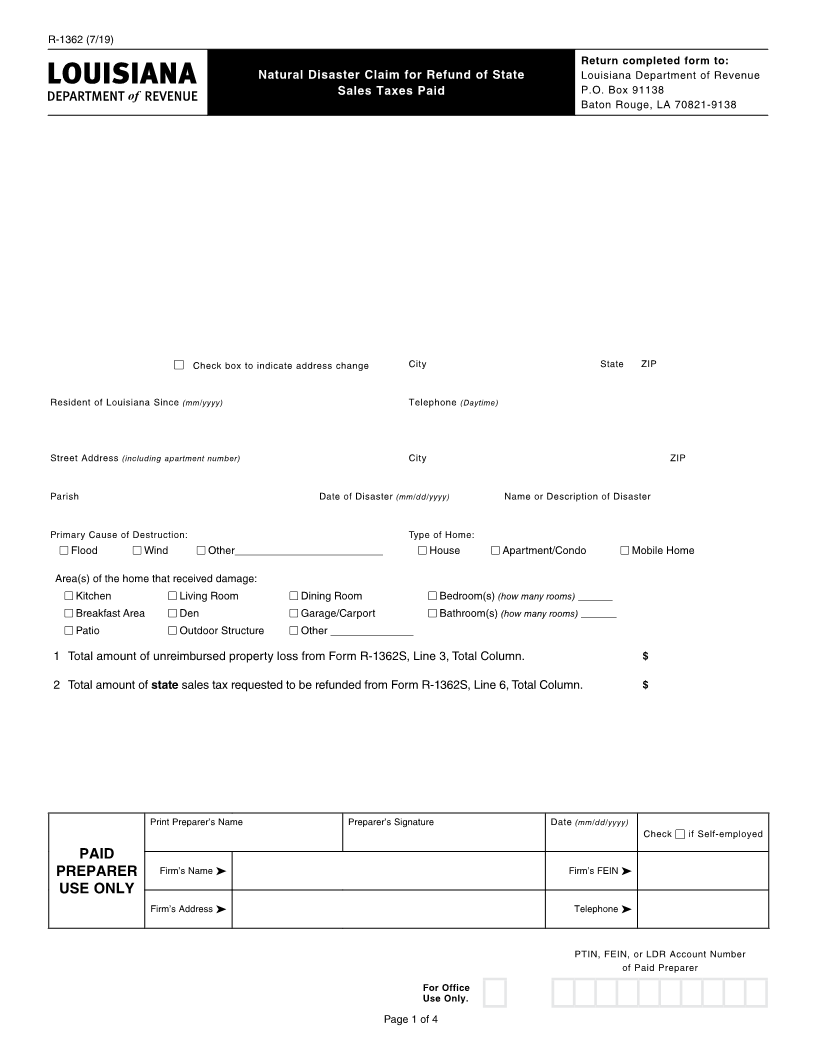

R-1362 (7/19) Return completed form to: Natural Disaster Claim for Refund of State Louisiana Department of Revenue Sales Taxes Paid P.O. Box 91138 Baton Rouge, LA 70821-9138 Must attach Form R-1362S, Calculation of State Sales Tax Refund Due and Form R-1362D, Schedule of Tangible Personal Property Destroyed by a Natural Disaster Louisiana residents whose property was destroyed by a natural disaster in a parish that has been declared by the President of the United States to be eligible for federal assistance, may use this form to claim a refund of the state sales tax paid on the destroyed property, if the loss was not fully reimbursed by insurance or otherwise as authorized by Louisiana Revised Statute 47:315.1. PLEASE PRINT OR TYPE Claimant’s Name DOB (mm/dd/yyyy) Social Security Number Spouse’s Name DOB (mm/dd/yyyy) Spouse’s Social Security Number Mailing Address ■ Check box to indicate address change City State ZIP Resident of Louisiana Since (mm/yyyy) Telephone (Daytime) Location and Description of Destruction Street Address (including apartment number) City ZIP Parish Date of Disaster (mm/dd/yyyy) Name or Description of Disaster Primary Cause of Destruction: Type of Home: ■ Flood ■ Wind ■ Other_________________________ ■ House ■ Apartment/Condo ■ Mobile Home Area(s) of the home that received damage: Total Number of Areas ■ Kitchen ■ Living Room ■ Dining Room ■ Bedroom(s) (how many rooms) ______ that Received Damage ■ Breakfast Area ■ Den ■ Garage/Carport ■ Bathroom(s) (how many rooms) ______ ■ Patio ■ Outdoor Structure ■ Other ______________ 1 Total amount of unreimbursed property loss from Form R-1362S, Line 3, Total Column. $ 2 Total amount of state sales tax requested to be refunded from Form R-1362S, Line 6, Total Column. $ Print Preparer’s Name Preparer’s Signature Date (mm/dd/yyyy) Check ■ if Self-employed PAID PREPARER Firm’s Name ➤ Firm’s FEIN ➤ USE ONLY Firm’s Address ➤ Telephone ➤ PTIN, FEIN, or LDR Account Number of Paid Preparer For Office Use Only. Page 1 of 4