Enlarge image

R-540CU-R

“Online” doesn’t mean “tax free”

Louisiana’s Consumer Use Tax protects Louisiana businesses from unfair out-of-state competition.

When out-of-state retailers don’t collect sales tax, they enjoy an unfair edge over local businesses.

The Consumer Use Tax helps to ensure adequate funding for schools, public safety, healthcare, and other

services upon which Louisiana residents rely.

The Consumer Use Tax applies to retail purchases from companies with no physical presence in Louisiana

such as online retailers, mail order catalogues, and TV shopping networks. Eligible purchases include:

• Appliances

• Books

• Clothing

• Computers

• DVDs and CDs

• Electronics

• Furniture

• Music and movie downloads

• Software

• Tobacco products

Even when online or other retailers do not charge sales tax, Louisiana state law still applies the use tax to these

purchases.

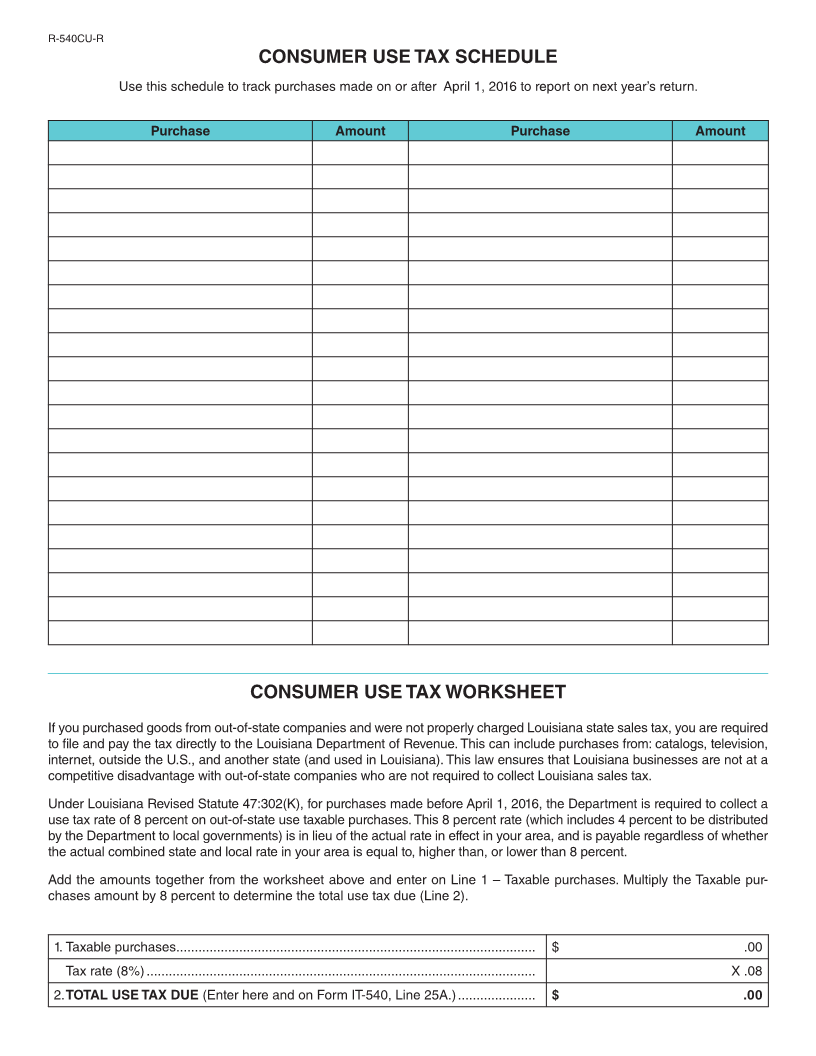

For purchases made before April 1, 2016, Louisiana’s Consumer Use Tax is calculated at a combined rate of

8 percent: 4% State and 4% Local.

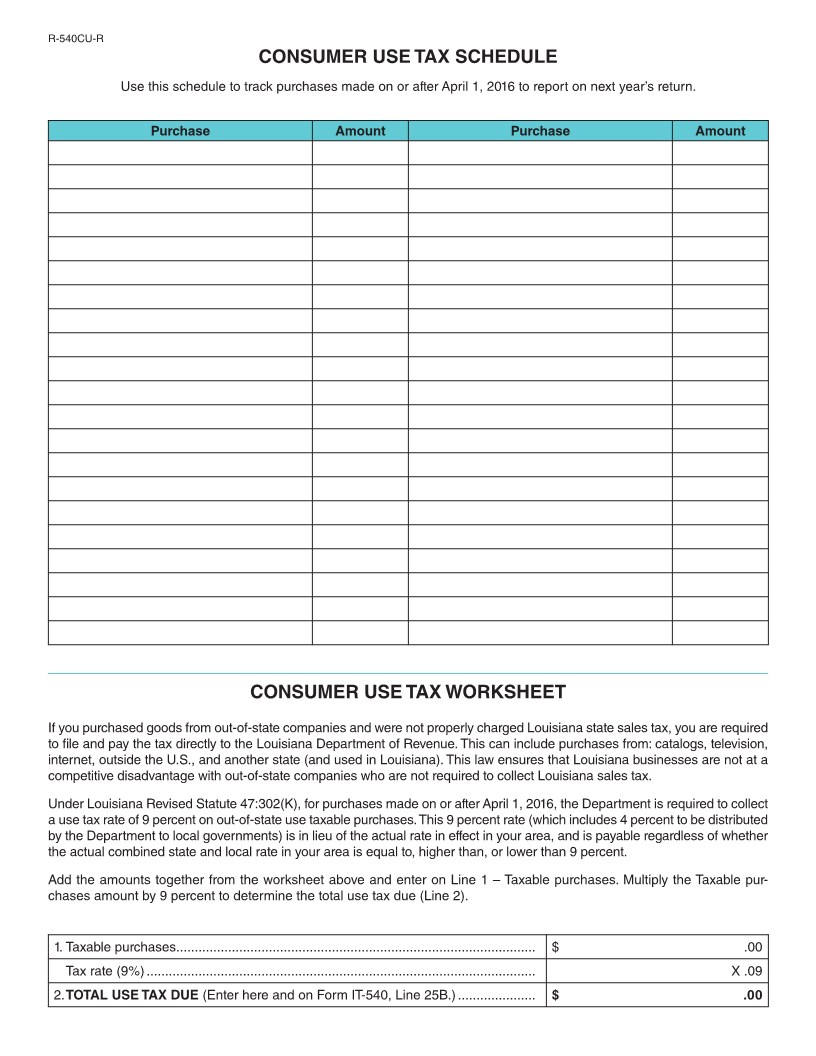

For purchases made on or after April 1, 2016, Louisiana’s Consumer Use Tax is calculated at a combined rate

of 9 percent: 5% State and 4% Local.

Visit Revenue.Louisiana.Gov/ConsumerUse for more information