Enlarge image

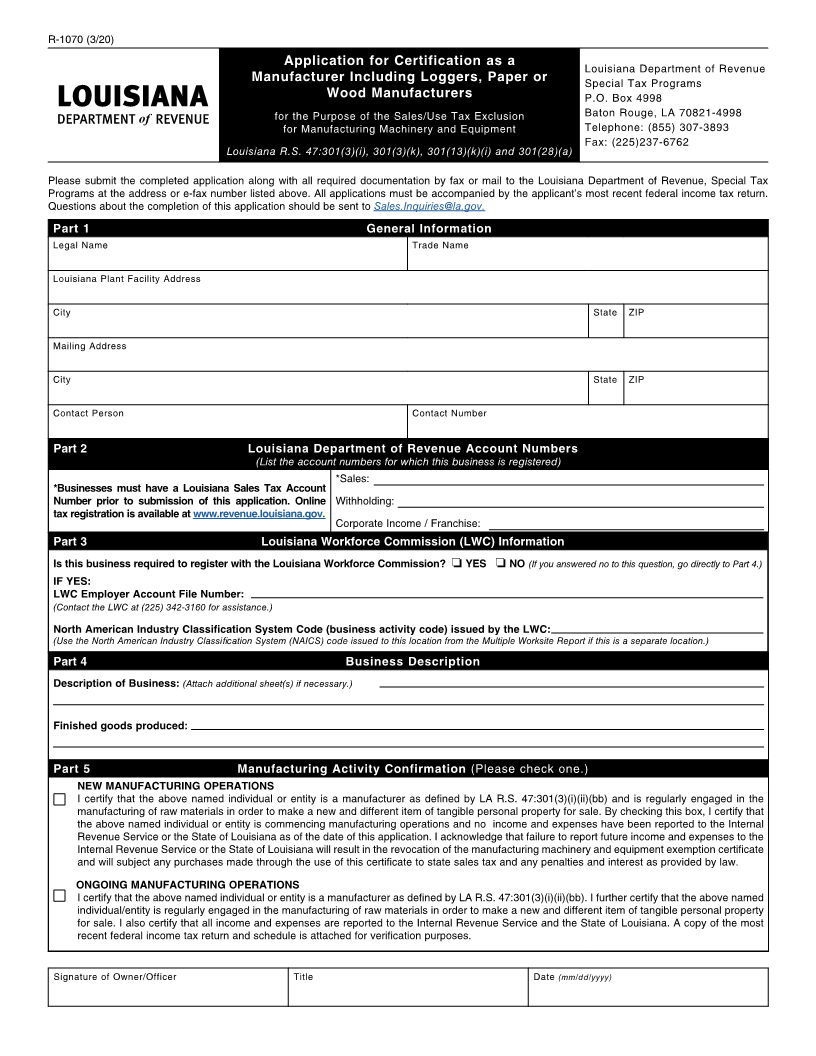

R-1070 ( /3 20) Application for Certification as a Louisiana Department of Revenue Manufacturer Including Loggers, Paper or Special Tax Programs Wood Manufacturers P.O. Box 4998 for the Purpose of the Sales/Use Tax Exclusion Baton Rouge, LA 70821-4998 for Manufacturing Machinery and Equipment Telephone: (855) 307-3893 Fax: (225)237-6762 Louisiana R.S. 47:301(3)(i), 301(3)(k), 301(13)(k)(i) and 301(28)(a) Please submit the completed application along with all required documentation by fax or mail to the Louisiana Department of Revenue, Special Tax Programs at the address or e-fax number listed above. All applications must be accompanied by the applicant’s most recent federal income tax return. Questions about the completion of this application should be sent to Sales.Inquiries@la.gov. Part 1 General Information Legal Name Trade Name Louisiana Plant Facility Address City State ZIP Mailing Address City State ZIP Contact Person Contact Number Part 2 Louisiana Department of Revenue Account Numbers (List the account numbers for which this business is registered) *Sales: *Businesses must have a Louisiana Sales Tax Account Number prior to submission of this application. Online Withholding: tax registration is available at www.revenue.louisiana.gov. Corporate Income / Franchise: Part 3 Louisiana Workforce Commission (LWC) Information Is this business required to register with the Louisiana Workforce Commission? ❏ YES ❏ NO (If you answered no to this question, go directly to Part 4.) IF YES: LWC Employer Account File Number: (Contact the LWC at (225) 342-3160 for assistance.) North American Industry Classification System Code (business activity code) issued by the LWC: (Use the North American Industry Classification System (NAICS) code issued to this location from the Multiple Worksite Report if this is a separate location.) Part 4 Business Description Description of Business: (Attach additional sheet(s) if necessary.) Finished goods produced: Part 5 Manufacturing Activity Confirmation (Please check one.) NEW MANUFACTURING OPERATIONS ■ I certify that the above named individual or entity is a manufacturer as defined by LA R.S. 47:301(3)(i)(ii)(bb) and is regularly engaged in the manufacturing of raw materials in order to make a new and different item of tangible personal property for sale. By checking this box, I certify that the above named individual or entity is commencing manufacturing operations and no income and expenses have been reported to the Internal Revenue Service or the State of Louisiana as of the date of this application. I acknowledge that failure to report future income and expenses to the Internal Revenue Service or the State of Louisiana will result in the revocation of the manufacturing machinery and equipment exemption certificate and will subject any purchases made through the use of this certificate to state sales tax and any penalties and interest as provided by law. ONGOING MANUFACTURING OPERATIONS ■ I certify that the above named individual or entity is a manufacturer as defined by LA R.S. 47:301(3)(i)(ii)(bb). I further certify that the above named individual/entity is regularly engaged in the manufacturing of raw materials in order to make a new and different item of tangible personal property for sale. I also certify that all income and expenses are reported to the Internal Revenue Service and the State of Louisiana. A copy of the most recent federal income tax return and schedule is attached for verification purposes. Signature of Owner/Officer Title Date (mm/dd/yyyy)