Enlarge image

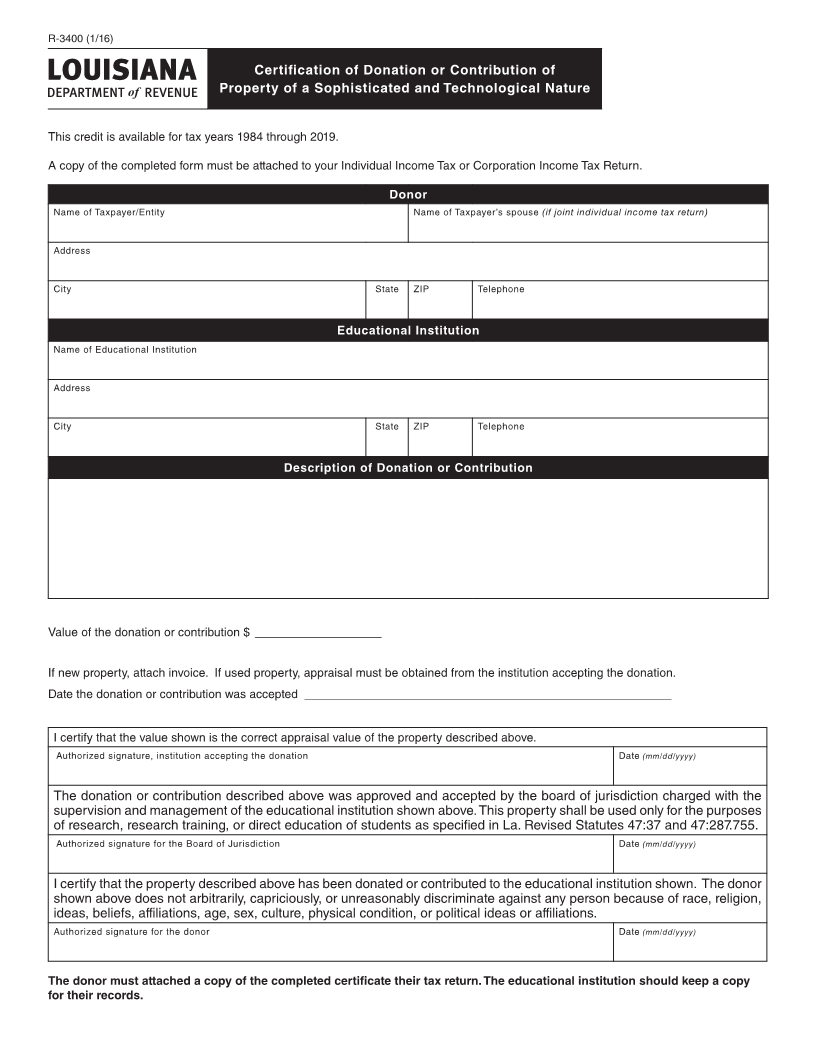

R-3400 (1/16)

Certification of Donation or Contribution of

Property of a Sophisticated and Technological Nature

This credit is available for tax years 1984 through 2019.

A copy of the completed form must be attached to your Individual Income Tax or Corporation Income Tax Return.

Donor

Name of Taxpayer/Entity Name of Taxpayer’s spouse (if joint individual income tax return)

Address

City State ZIP Telephone

Educational Institution

Name of Educational Institution

Address

City State ZIP Telephone

Description of Donation or Contribution

Value of the donation or contribution $ ___________________

If new property, attach invoice. If used property, appraisal must be obtained from the institution accepting the donation.

Date the donation or contribution was accepted _______________________________________________________

I certify that the value shown is the correct appraisal value of the property described above.

Authorized signature, institution accepting the donation Date (mm/dd/yyyy)

The donation or contribution described above was approved and accepted by the board of jurisdiction charged with the

supervision and management of the educational institution shown above. This property shall be used only for the purposes

of research, research training, or direct education of students as specified in La. Revised Statutes 47:37 and 47:287.755.

Authorized signature for the Board of Jurisdiction Date (mm/dd/yyyy)

I certify that the property described above has been donated or contributed to the educational institution shown. The donor

shown above does not arbitrarily, capriciously, or unreasonably discriminate against any person because of race, religion,

ideas, beliefs, affiliations, age, sex, culture, physical condition, or political ideas or affiliations.

Authorized signature for the donor Date (mm/dd/yyyy)

The donor must attached a copy of the completed certificate their tax return. The educational institution should keep a copy

for their records.