Enlarge image

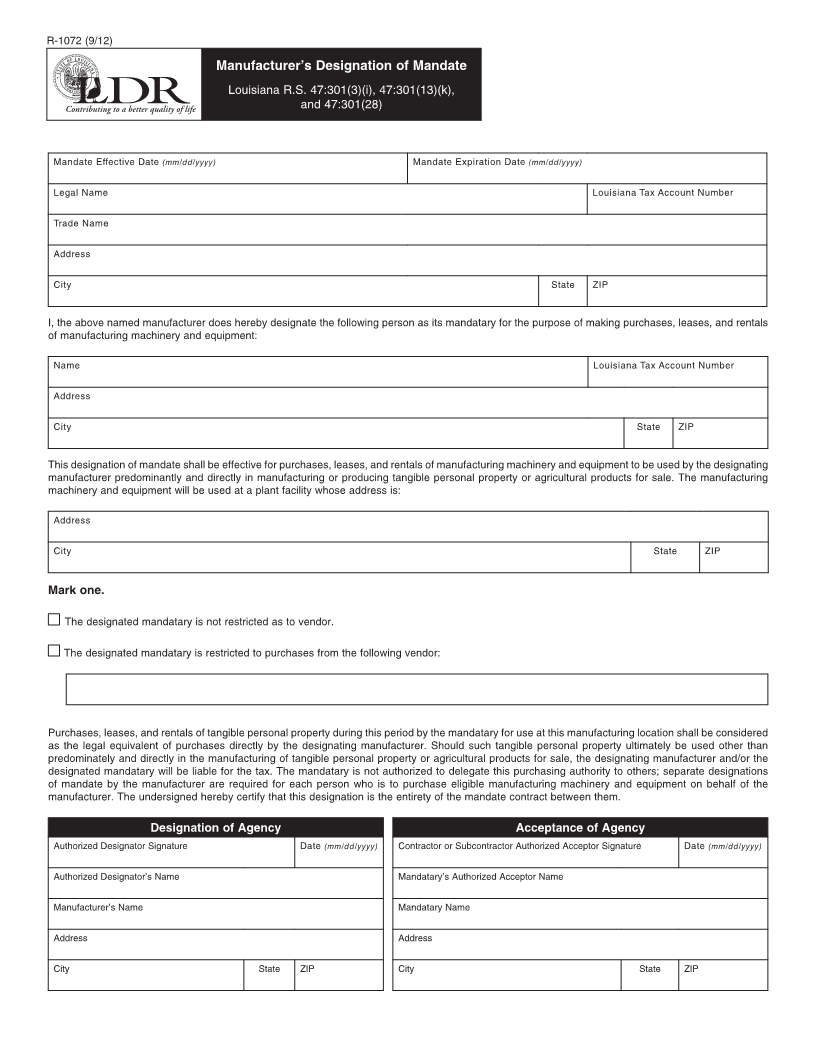

R-1072 (9/12)

Manufacturer’s Designation of Mandate

Louisiana R.S. 47:301(3)(i), 47:301(13)(k),

and 47:301(28)

Mandate Effective Date (mm/dd/yyyy) Mandate Expiration Date (mm/dd/yyyy)

Legal Name Louisiana Tax Account Number

Trade Name

Address

City State ZIP

I, the above named manufacturer does hereby designate the following person as its mandatary for the purpose of making purchases, leases, and rentals

of manufacturing machinery and equipment:

Name Louisiana Tax Account Number

Address

City State ZIP

This designation of mandate shall be effective for purchases, leases, and rentals of manufacturing machinery and equipment to be used by the designating

manufacturer predominantly and directly in manufacturing or producing tangible personal property or agricultural products for sale. The manufacturing

machinery and equipment will be used at a plant facility whose address is:

Address

City State ZIP

Mark one.

The designated mandatary is not restricted as to vendor.

The designated mandatary is restricted to purchases from the following vendor:

Purchases, leases, and rentals of tangible personal property during this period by the mandatary for use at this manufacturing location shall be considered

as the legal equivalent of purchases directly by the designating manufacturer. Should such tangible personal property ultimately be used other than

predominately and directly in the manufacturing of tangible personal property or agricultural products for sale, the designating manufacturer and/or the

designated mandatary will be liable for the tax. The mandatary is not authorized to delegate this purchasing authority to others; separate designations

of mandate by the manufacturer are required for each person who is to purchase eligible manufacturing machinery and equipment on behalf of the

manufacturer. The undersigned hereby certify that this designation is the entirety of the mandate contract between them.

Designation of Agency Acceptance of Agency

Authorized Designator Signature Date (mm/dd/yyyy) Contractor or Subcontractor Authorized Acceptor Signature Date (mm/dd/yyyy)

Authorized Designator’s Name Mandatary’s Authorized Acceptor Name

Manufacturer’s Name Mandatary Name

Address Address

City State ZIP City State ZIP