Enlarge image

R-540-G1 (7/15)

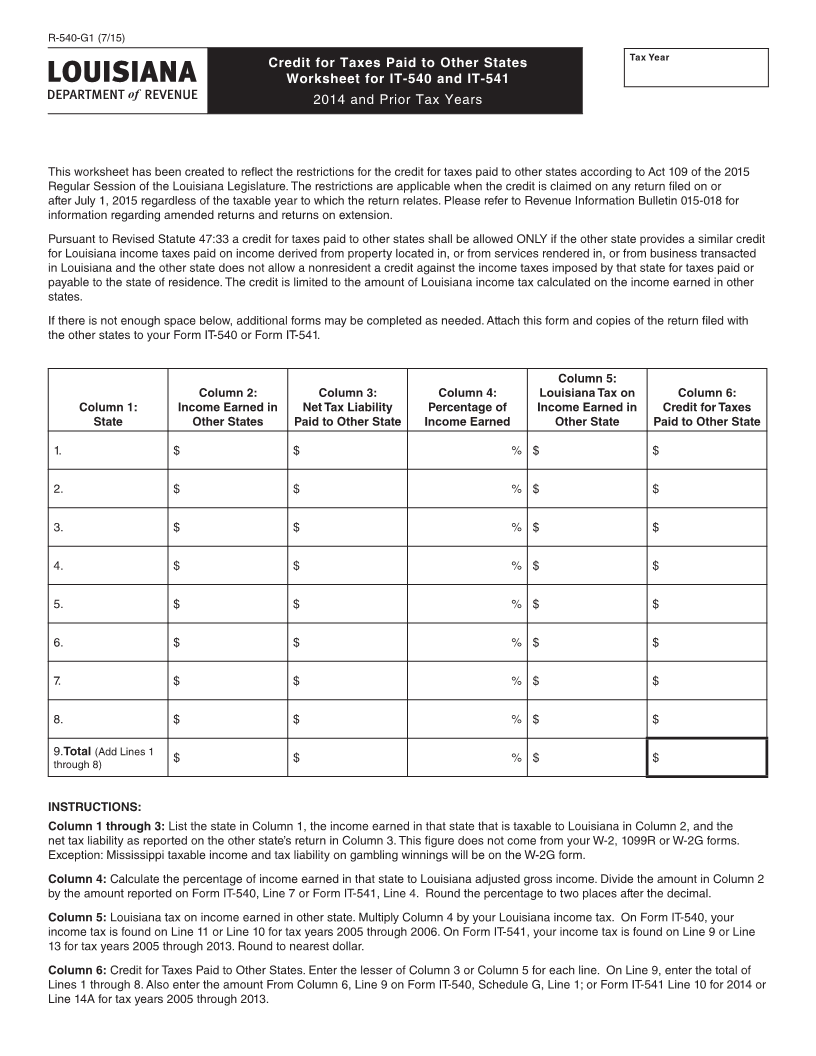

Tax Year

Credit for Taxes Paid to Other States

Worksheet for IT-540 and IT-541

2014 and Prior Tax Years

This worksheet has been created to reflect the restrictions for the credit for taxes paid to other states according to Act 109 of the 2015

Regular Session of the Louisiana Legislature. The restrictions are applicable when the credit is claimed on any return filed on or

after July 1, 2015 regardless of the taxable year to which the return relates. Please refer to Revenue Information Bulletin 015-018 for

information regarding amended returns and returns on extension.

Pursuant to Revised Statute 47:33 a credit for taxes paid to other states shall be allowed ONLY if the other state provides a similar credit

for Louisiana income taxes paid on income derived from property located in, or from services rendered in, or from business transacted

in Louisiana and the other state does not allow a nonresident a credit against the income taxes imposed by that state for taxes paid or

payable to the state of residence. The credit is limited to the amount of Louisiana income tax calculated on the income earned in other

states.

If there is not enough space below, additional forms may be completed as needed. Attach this form and copies of the return filed with

the other states to your Form IT-540 or Form IT-541.

Column 5:

Column 2: Column 3: Column 4: Louisiana Tax on Column 6:

Column 1: Income Earned in Net Tax Liability Percentage of Income Earned in Credit for Taxes

State Other States Paid to Other State Income Earned Other State Paid to Other State

1. $ $ % $ $

2. $ $ % $ $

3. $ $ % $ $

4. $ $ % $ $

5. $ $ % $ $

6. $ $ % $ $

7. $ $ % $ $

8. $ $ % $ $

9.Total (Add Lines 1

through 8) $ $ % $ $

INSTRUCTIONS:

Column 1 through 3: List the state in Column 1, the income earned in that state that is taxable to Louisiana in Column 2, and the

net tax liability as reported on the other state’s return in Column 3. This figure does not come from your W-2, 1099R or W-2G forms.

Exception: Mississippi taxable income and tax liability on gambling winnings will be on the W-2G form.

Column 4: Calculate the percentage of income earned in that state to Louisiana adjusted gross income. Divide the amount in Column 2

by the amount reported on Form IT-540, Line 7 or Form IT-541, Line 4. Round the percentage to two places after the decimal.

Column 5: Louisiana tax on income earned in other state. Multiply Column 4 by your Louisiana income tax. On Form IT-540, your

income tax is found on Line 11 or Line 10 for tax years 2005 through 2006. On Form IT-541, your income tax is found on Line 9 or Line

13 for tax years 2005 through 2013. Round to nearest dollar.

Column 6: Credit for Taxes Paid to Other States. Enter the lesser of Column 3 or Column 5 for each line. On Line 9, enter the total of

Lines 1 through 8. Also enter the amount From Column 6, Line 9 on Form IT-540, Schedule G, Line 1; or Form IT-541 Line 10 for 2014 or

Line 14A for tax years 2005 through 2013.