Enlarge image

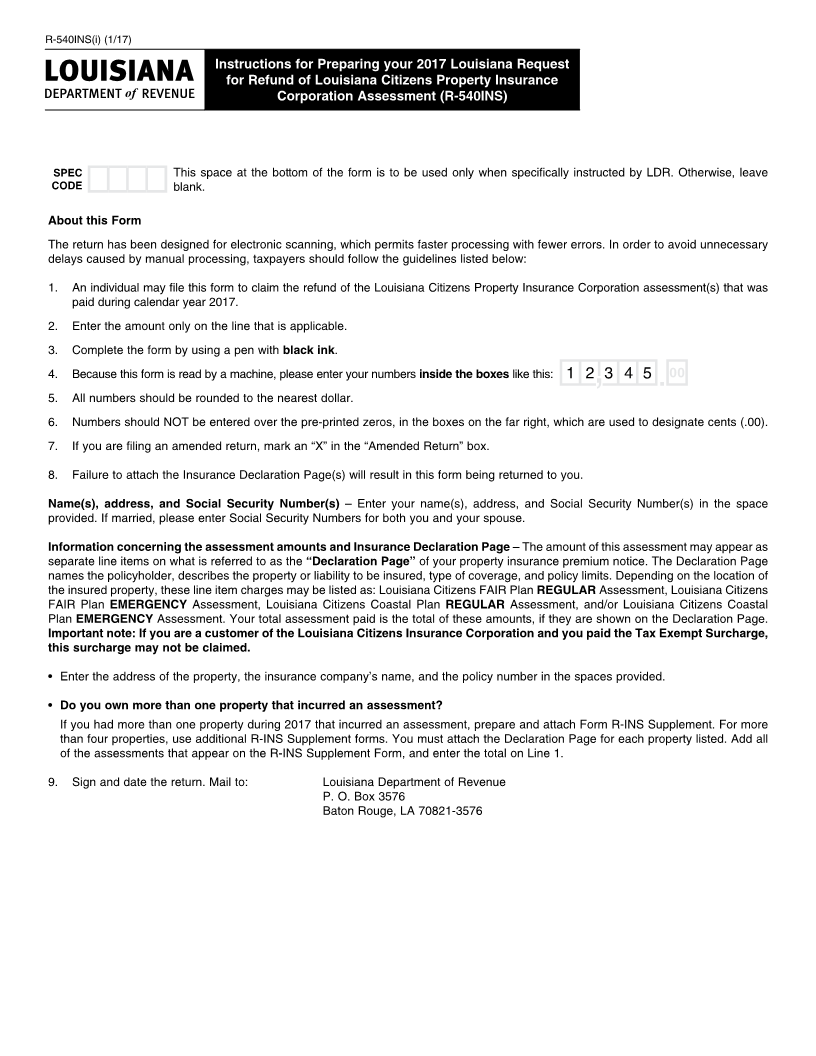

R-540INS (1/17)

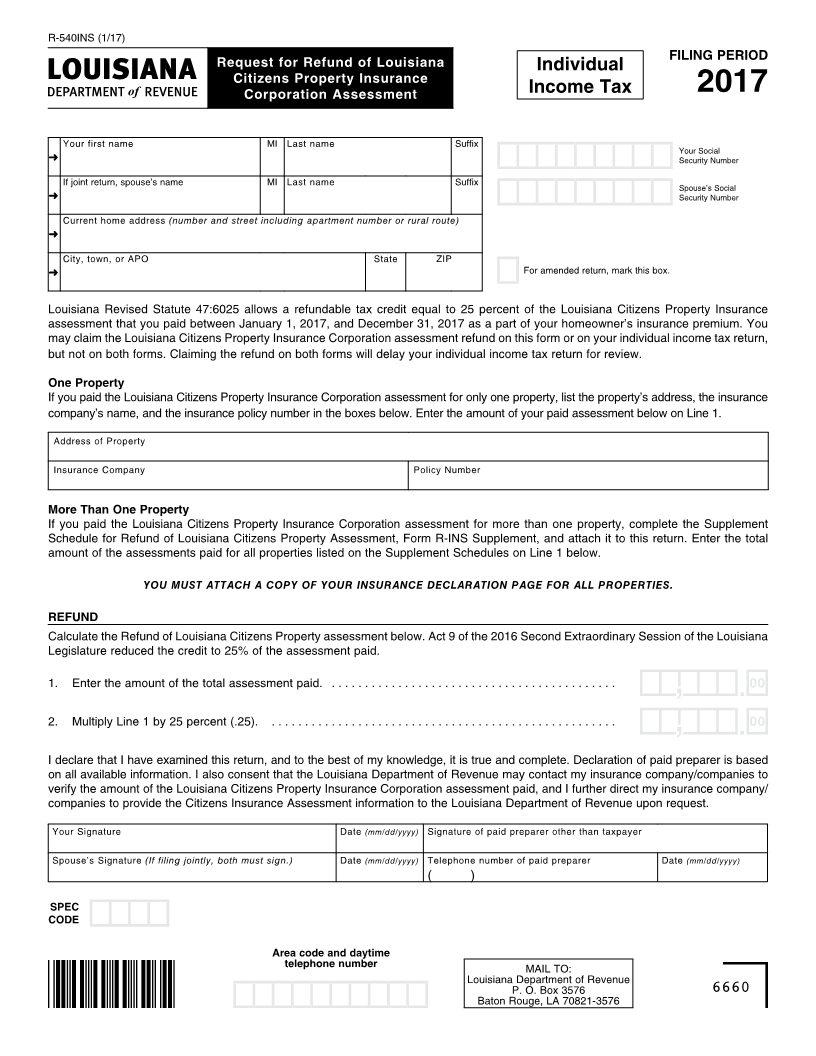

FILING PERIOD

Request for Refund of Louisiana Individual

Citizens Property Insurance

Corporation Assessment Income Tax 2017

Your first name MI Last name Suffix Your Social

➜ Security Number

If joint return, spouse’s name MI Last name Suffix Spouse’s Social

➜ Security Number

Current home address (number and street including apartment number or rural route)

➜

City, town, or APO State ZIP

➜ For amended return, mark this box.

Louisiana Revised Statute 47:6025 allows a refundable tax credit equal to 25 percent of the Louisiana Citizens Property Insurance

assessment that you paid between January 1, 2017, and December 31, 2017 as a part of your homeowner’s insurance premium. You

may claim the Louisiana Citizens Property Insurance Corporation assessment refund on this form or on your individual income tax return,

but not on both forms. Claiming the refund on both forms will delay your individual income tax return for review.

One Property

If you paid the Louisiana Citizens Property Insurance Corporation assessment for only one property, list the property’s address, the insurance

company’s name, and the insurance policy number in the boxes below. Enter the amount of your paid assessment below on Line 1.

Address of Property

Insurance Company Policy Number

More Than One Property

If you paid the Louisiana Citizens Property Insurance Corporation assessment for more than one property, complete the Supplement

Schedule for Refund of Louisiana Citizens Property Assessment, Form R-INS Supplement, and attach it to this return. Enter the total

amount of the assessments paid for all properties listed on the Supplement Schedules on Line 1 below.

YOU MUST ATTACH A COPY OF YOUR INSURANCE DECLARATION PAGE FOR ALL PROPERTIES.

REFUND

Calculate the Refund of Louisiana Citizens Property assessment below. Act 9 of the 2016 Second Extraordinary Session of the Louisiana

Legislature reduced the credit to 25% of the assessment paid.

1. Enter the amount of the total assessment paid. ...........................................

2. Multiply Line 1 by 25 percent (.25). ....................................................

I declare that I have examined this return, and to the best of my knowledge, it is true and complete. Declaration of paid preparer is based

on all available information. I also consent that the Louisiana Department of Revenue may contact my insurance company/companies to

verify the amount of the Louisiana Citizens Property Insurance Corporation assessment paid, and I further direct my insurance company/

companies to provide the Citizens Insurance Assessment information to the Louisiana Department of Revenue upon request.

Your Signature Date (mm/dd/yyyy) Signature of paid preparer other than taxpayer

Spouse’s Signature (If filing jointly, both must sign.) Date (mm/dd/yyyy) Telephone number of paid preparer Date (mm/dd/yyyy)

( )

SPEC

CODE

Area code and daytime

telephone number MAIL TO:

Louisiana Department of Revenue

P. O. Box 3576 6660

Baton Rouge, LA 70821-3576