Enlarge image

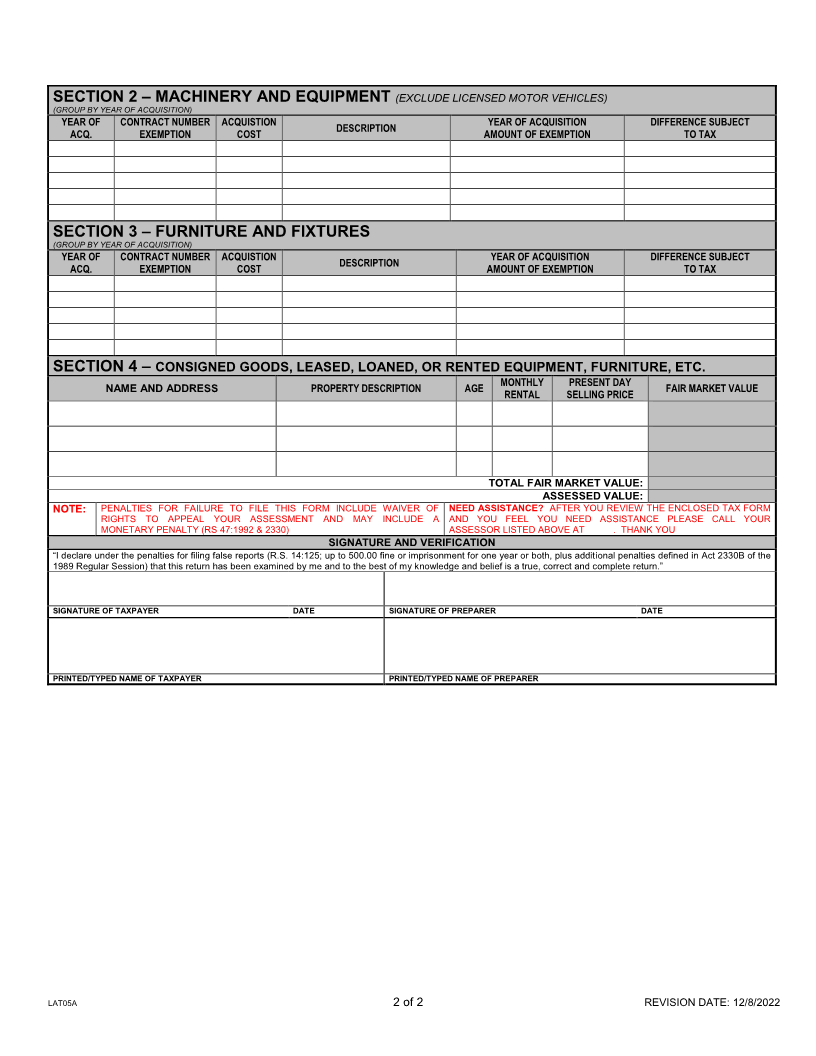

LAT 5A – TAX EXEMPT ANALYSIS 20__ PERSONAL PROPERTY TAX FORM

RETURN TO: NAME/ADDRESS: (INDICATE ANY CHANGES)

CONFIDENTIAL RS: 47:2327. Only the Assessor, the governing authority, and Legal Citation & Instructions: This report shall be filed with the

Louisiana Tax Commission shall use this form filled out by Assessor of the parish indicated by April 1 stor within forty-five days

the taxpayer solely for the purpose of administering this after receipt, whichever is later, in accordance with RS 47:2324.

statute.

ASSESSMENT

PROPERTY LOCATION: WARD: NUMBER:

(E911/PHYSICAL ADDRESS)

NAME OF BUSINESS: TYPE OF BUSINESS:

OWNER OR CONTACT: PHONE:

EMAIL ADDRESS:

IMPORTANT! USE ATTACHMENTS IF NECESSARY

ATTACH THIS FORM TO FORM LAT 5

SHADED AREAS FOR ASSESSOR’S USE ONLY – USE ATTACHMENTS IF NECESSARY

SECTION 1 – BUILDINGS

YEAR OF CONTRACT NUMBER ACQUISTION COST AMOUNT OF EXEMPTION DIFFERENCE SUBJECT

ACQUISITION EXEMPTION TO TAX

LAT05A 1 of 2 REVISION DATE: 12/8/2022