Enlarge image

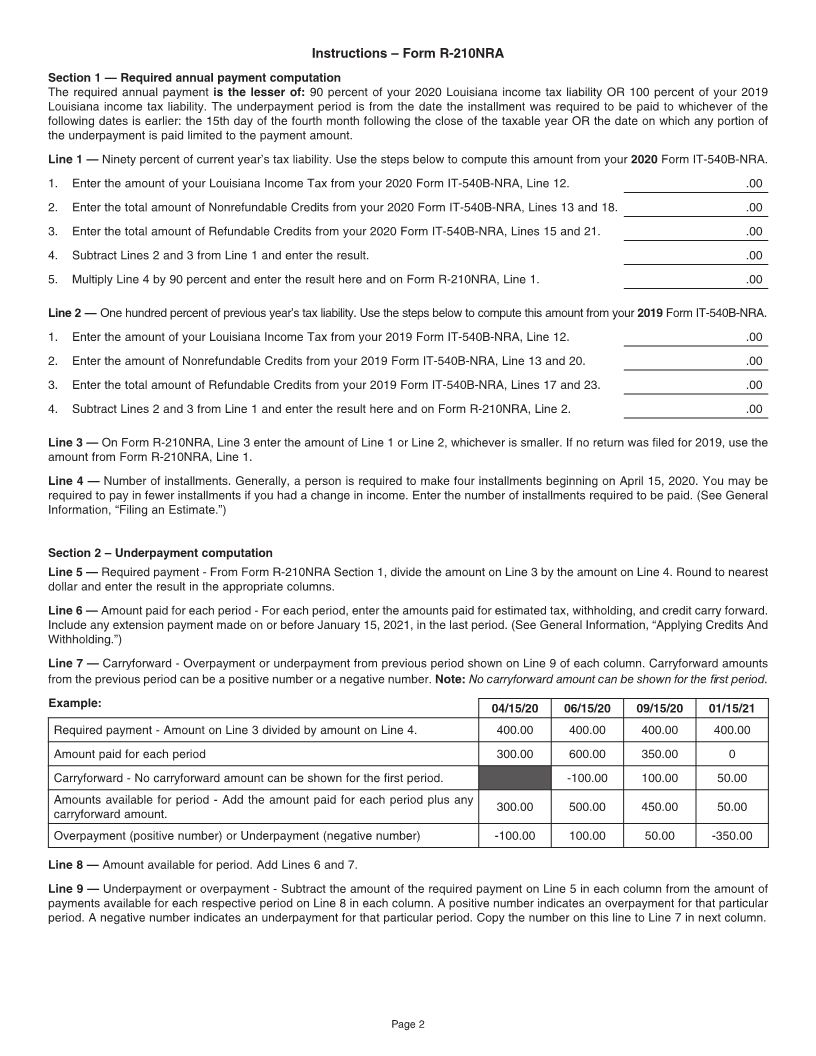

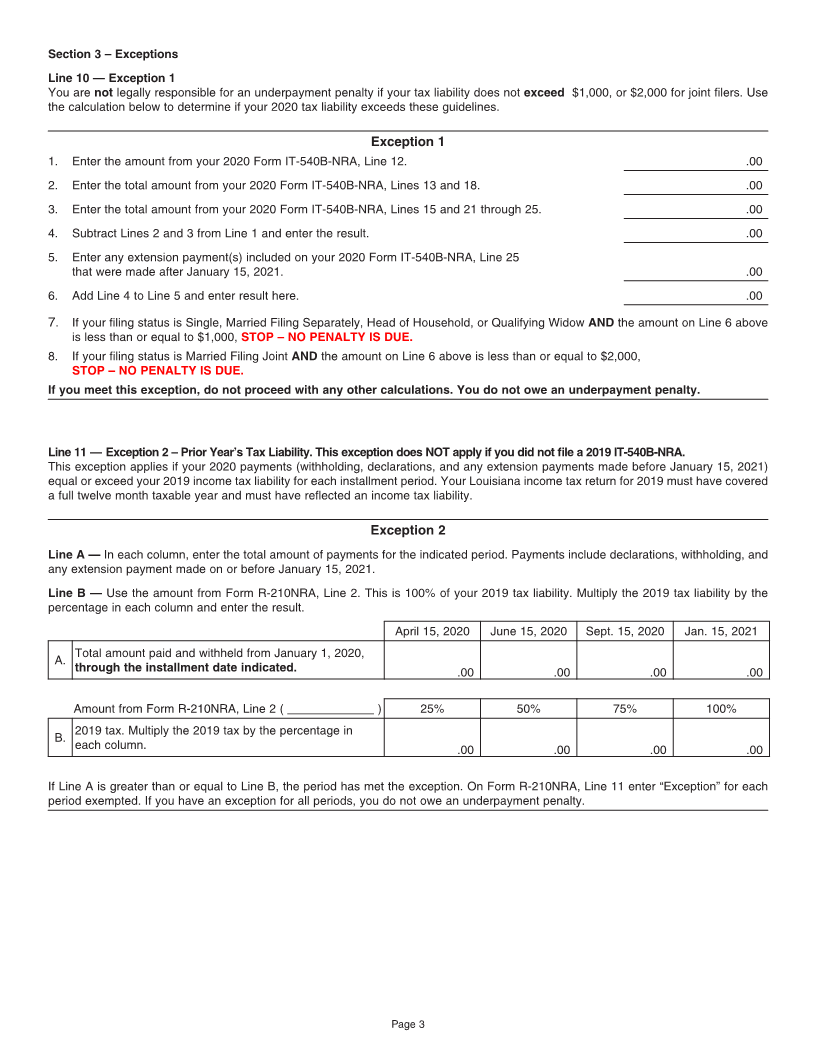

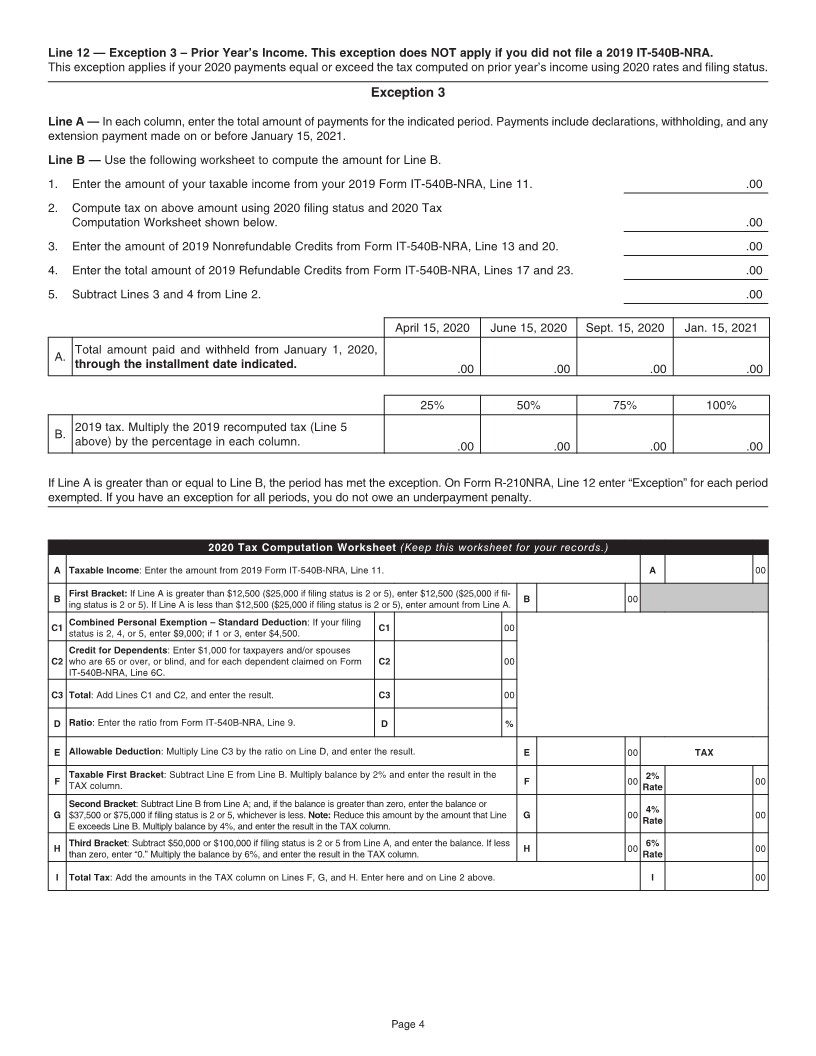

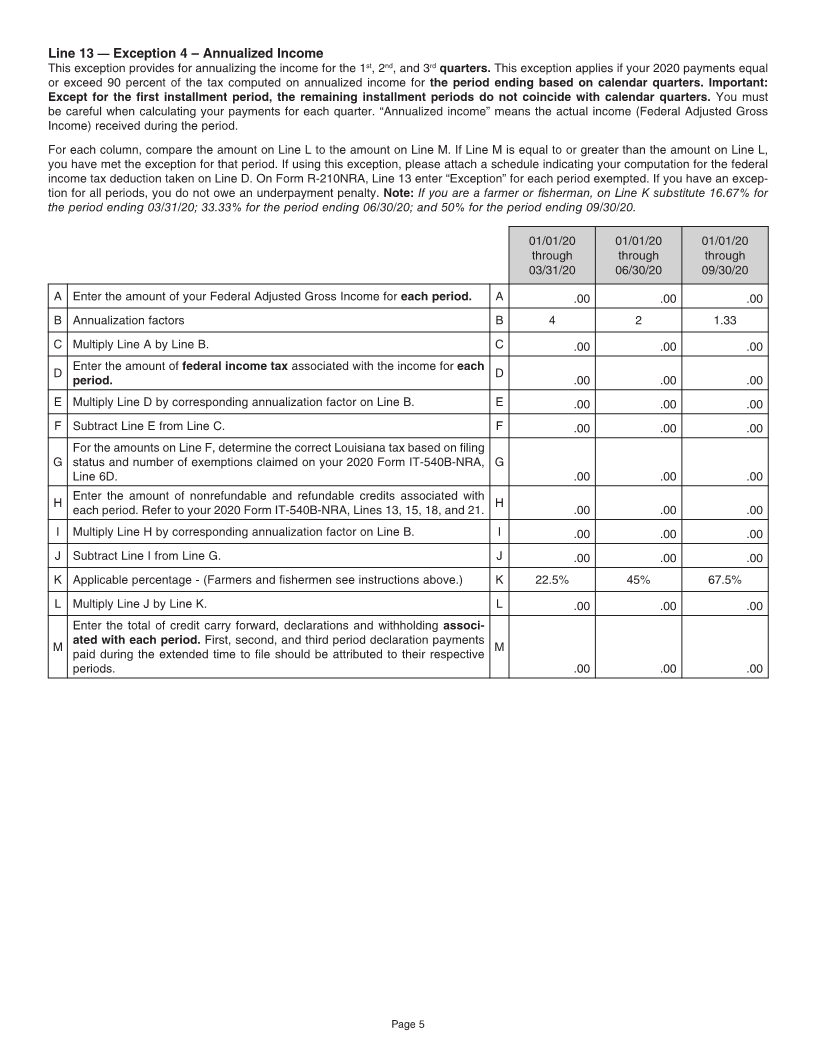

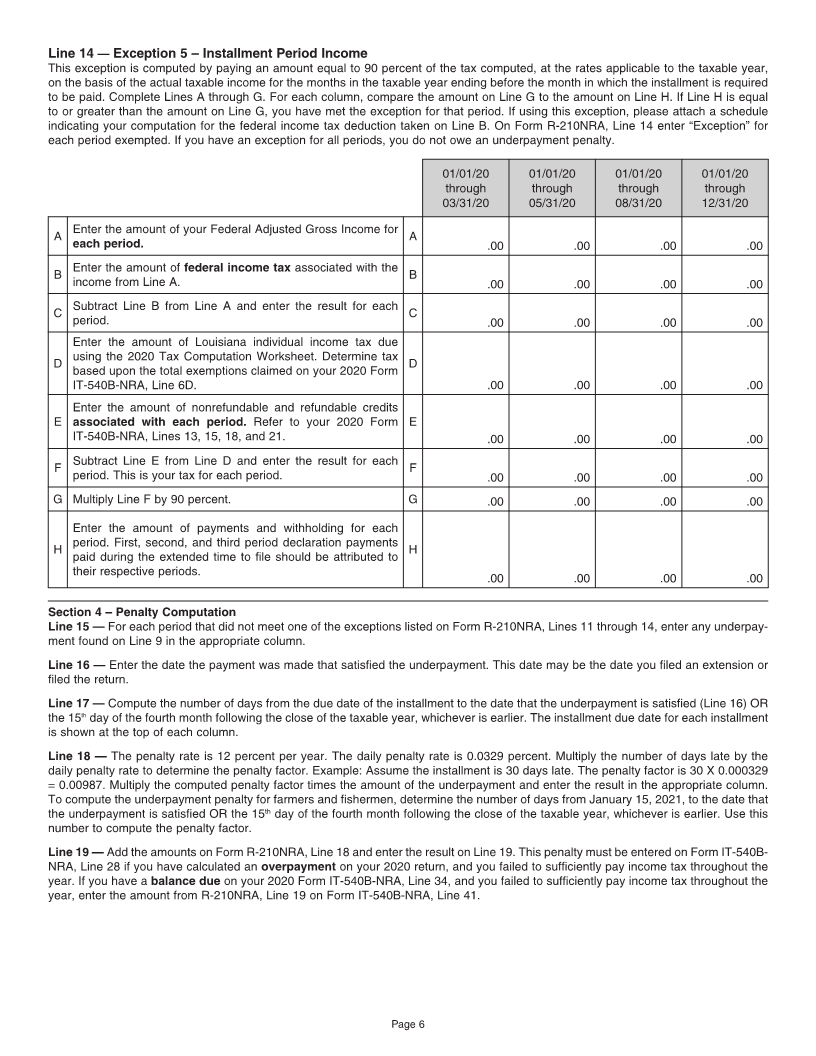

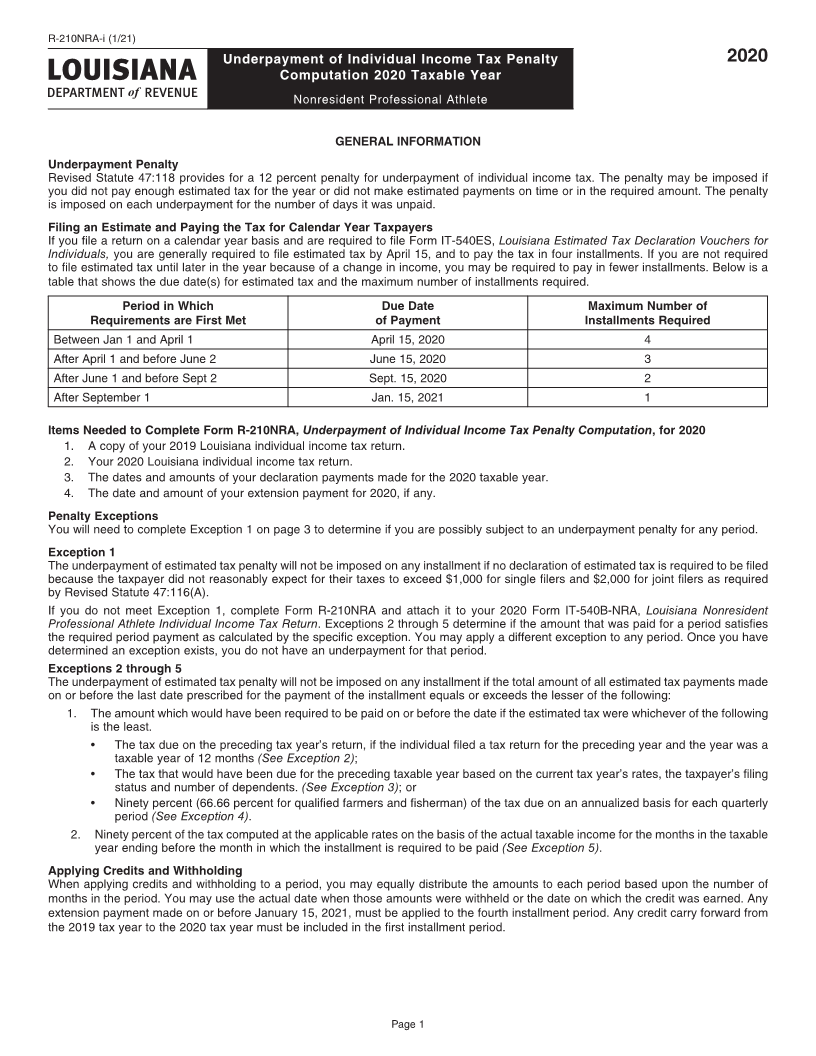

R-210NRA-i (1/21) Underpayment of Individual Income Tax Penalty 2020 Computation 2020 Taxable Year Nonresident Professional Athlete GENERAL INFORMATION Underpayment Penalty Revised Statute 47:118 provides for a 12 percent penalty for underpayment of individual income tax. The penalty may be imposed if you did not pay enough estimated tax for the year or did not make estimated payments on time or in the required amount. The penalty is imposed on each underpayment for the number of days it was unpaid. Filing an Estimate and Paying the Tax for Calendar Year Taxpayers If you file a return on a calendar year basis and are required to file Form IT-540ES, Louisiana Estimated Tax Declaration Vouchers for Individuals, you are generally required to file estimated tax by April 15, and to pay the tax in four installments. If you are not required to file estimated tax until later in the year because of a change in income, you may be required to pay in fewer installments. Below is a table that shows the due date(s) for estimated tax and the maximum number of installments required. Period in Which Due Date Maximum Number of Requirements are First Met of Payment Installments Required Between Jan 1 and April 1 April 15, 2020 4 After April 1 and before June 2 June 15, 2020 3 After June 1 and before Sept 2 Sept. 15, 2020 2 After September 1 Jan. 15, 2021 1 Items Needed to Complete Form R-210NRA, Underpayment of Individual Income Tax Penalty Computation, for 2020 1. A copy of your 2019 Louisiana individual income tax return. 2. Your 2020 Louisiana individual income tax return. 3. The dates and amounts of your declaration payments made for the 2020 taxable year. 4. The date and amount of your extension payment for 2020, if any. Penalty Exceptions You will need to complete Exception 1 on page 3 to determine if you are possibly subject to an underpayment penalty for any period. Exception 1 The underpayment of estimated tax penalty will not be imposed on any installment if no declaration of estimated tax is required to be filed because the taxpayer did not reasonably expect for their taxes to exceed $1,000 for single filers and $2,000 for joint filers as required by Revised Statute 47:116(A). If you do not meet Exception 1, complete Form R-210NRA and attach it to your 2020 Form IT-540B-NRA, Louisiana Nonresident Professional Athlete Individual Income Tax Return. Exceptions 2 through 5 determine if the amount that was paid for a period satisfies the required period payment as calculated by the specific exception. You may apply a different exception to any period. Once you have determined an exception exists, you do not have an underpayment for that period. Exceptions 2 through 5 The underpayment of estimated tax penalty will not be imposed on any installment if the total amount of all estimated tax payments made on or before the last date prescribed for the payment of the installment equals or exceeds the lesser of the following: 1. The amount which would have been required to be paid on or before the date if the estimated tax were whichever of the following is the least. • The tax due on the preceding tax year’s return, if the individual filed a tax return for the preceding year and the year was a taxable year of 12 months (See Exception 2); • The tax that would have been due for the preceding taxable year based on the current tax year’s rates, the taxpayer’s filing status and number of dependents. (See Exception 3); or • Ninety percent (66.66 percent for qualified farmers and fisherman) of the tax due on an annualized basis for each quarterly period (See Exception 4). 2. Ninety percent of the tax computed at the applicable rates on the basis of the actual taxable income for the months in the taxable year ending before the month in which the installment is required to be paid (See Exception 5). Applying Credits and Withholding When applying credits and withholding to a period, you may equally distribute the amounts to each period based upon the number of months in the period. You may use the actual date when those amounts were withheld or the date on which the credit was earned. Any extension payment made on or before January 15, 2021, must be applied to the fourth installment period. Any credit carry forward from the 2019 tax year to the 2020 tax year must be included in the first installment period. Page 1