Enlarge image

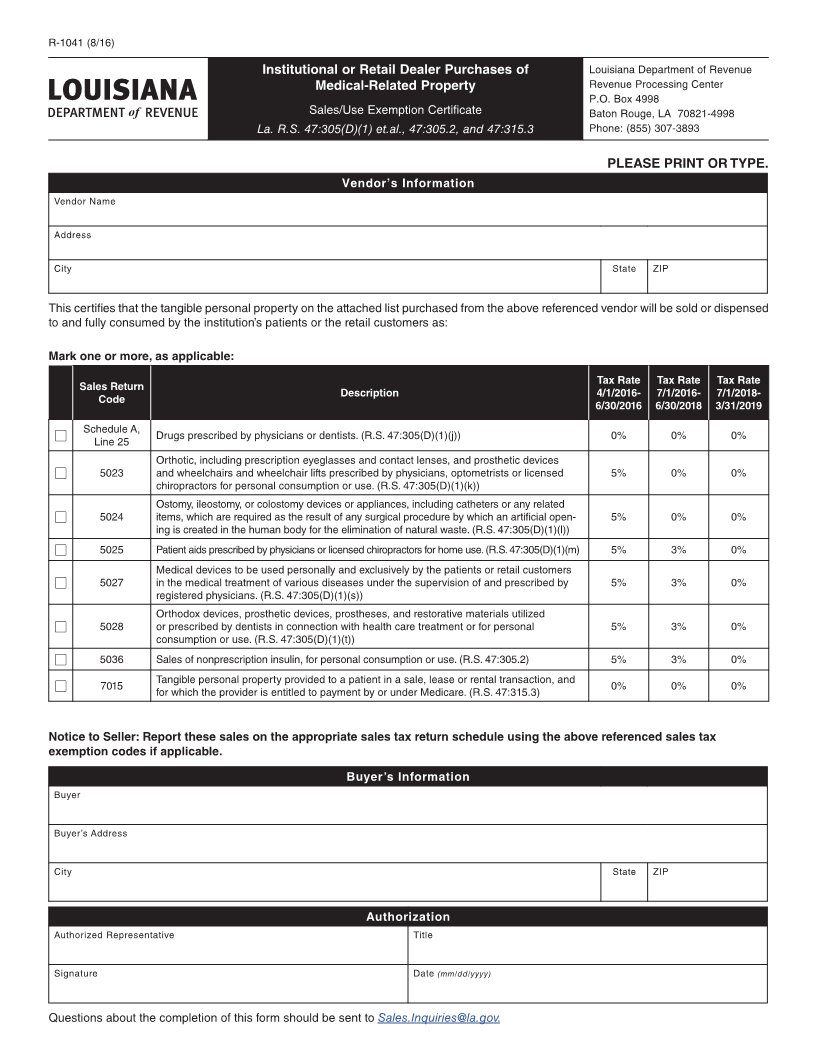

R-1041 (8/16)

Institutional or Retail Dealer Purchases of Louisiana Department of Revenue

Medical-Related Property Revenue Processing Center

P.O. Box 4998

Sales/Use Exemption Certificate Baton Rouge, LA 70821-4998

La. R.S. 47:305(D)(1) et.al., 47:305.2, and 47:315.3 Phone: (855) 307-3893

PLEASE PRINT OR TYPE.

Vendor’s Information

Vendor Name

Address

City State ZIP

This certifies that the tangible personal property on the attached list purchased from the above referenced vendor will be sold or dispensed

to and fully consumed by the institution’s patients or the retail customers as:

Mark one or more, as applicable:

Tax Rate Tax Rate Tax Rate

Sales Return Description 4/1/2016- 7/1/2016- 7/1/2018-

Code 6/30/2016 6/30/2018 3/31/2019

Schedule A,

■ Line 25 Drugs prescribed by physicians or dentists. (R.S. 47:305(D)(1)(j)) 0% 0% 0%

Orthotic, including prescription eyeglasses and contact lenses, and prosthetic devices

■ 5023 and wheelchairs and wheelchair lifts prescribed by physicians, optometrists or licensed 5% 0% 0%

chiropractors for personal consumption or use. (R.S. 47:305(D)(1)(k))

Ostomy, ileostomy, or colostomy devices or appliances, including catheters or any related

■ 5024 items, which are required as the result of any surgical procedure by which an artificial open- 5% 0% 0%

ing is created in the human body for the elimination of natural waste. (R.S. 47:305(D)(1)(l))

■ 5025 Patient aids prescribed by physicians or licensed chiropractors for home use. (R.S. 47:305(D)(1)(m) 5% 3% 0%

Medical devices to be used personally and exclusively by the patients or retail customers

■ 5027 in the medical treatment of various diseases under the supervision of and prescribed by 5% 3% 0%

registered physicians. (R.S. 47:305(D)(1)(s))

Orthodox devices, prosthetic devices, prostheses, and restorative materials utilized

■ 5028 or prescribed by dentists in connection with health care treatment or for personal 5% 3% 0%

consumption or use. (R.S. 47:305(D)(1)(t))

■ 5036 Sales of nonprescription insulin, for personal consumption or use. (R.S. 47:305.2) 5% 3% 0%

■ 7015 Tangible personal property provided to a patient in a sale, lease or rental transaction, and 0% 0% 0%

for which the provider is entitled to payment by or under Medicare. (R.S. 47:315.3)

Notice to Seller: Report these sales on the appropriate sales tax return schedule using the above referenced sales tax

exemption codes if applicable.

Buyer’s Information

Buyer

Buyer’s Address

City State ZIP

Authorization

Authorized Representative Title

Signature Date (mm/dd/yyyy)

Questions about the completion of this form should be sent to Sales.Inquiries@la.gov.