Enlarge image

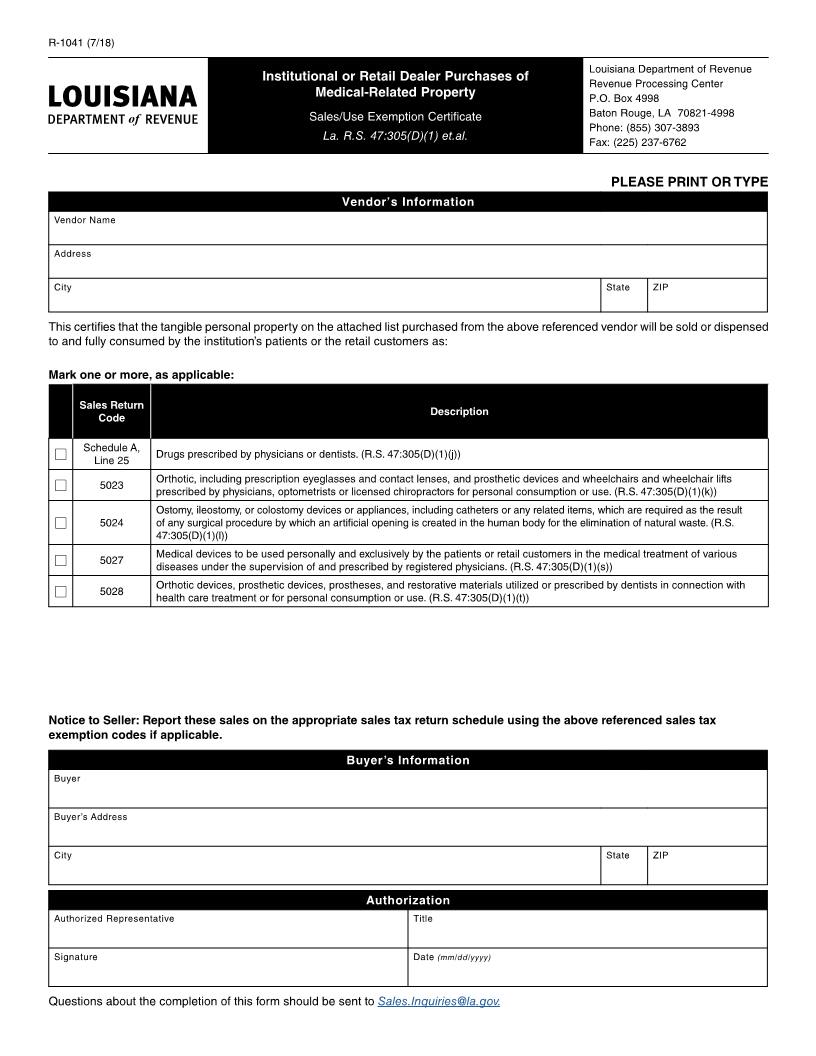

R-1041 (7/18)

Louisiana Department of Revenue

Institutional or Retail Dealer Purchases of Revenue Processing Center

Medical-Related Property P.O. Box 4998

Sales/Use Exemption Certificate Baton Rouge, LA 70821-4998

Phone: (855) 307-3893

La. R.S. 47:305(D)(1) et.al. Fax: (225) 237-6762

PLEASE PRINT OR TYPE

Vendor’s Information

Vendor Name

Address

City State ZIP

This certifies that the tangible personal property on the attached list purchased from the above referenced vendor will be sold or dispensed

to and fully consumed by the institution’s patients or the retail customers as:

Mark one or more, as applicable:

Sales Return Description

Code

Schedule A,

■ Line 25 Drugs prescribed by physicians or dentists. (R.S. 47:305(D)(1)(j))

■ 5023 Orthotic, including prescription eyeglasses and contact lenses, and prosthetic devices and wheelchairs and wheelchair lifts

prescribed by physicians, optometrists or licensed chiropractors for personal consumption or use. (R.S. 47:305(D)(1)(k))

Ostomy, ileostomy, or colostomy devices or appliances, including catheters or any related items, which are required as the result

■ 5024 of any surgical procedure by which an artificial opening is created in the human body for the elimination of natural waste. (R.S.

47:305(D)(1)(l))

■ 5027 Medical devices to be used personally and exclusively by the patients or retail customers in the medical treatment of various

diseases under the supervision of and prescribed by registered physicians. (R.S. 47:305(D)(1)(s))

■ 5028 Orthotic devices, prosthetic devices, prostheses, and restorative materials utilized or prescribed by dentists in connection with

health care treatment or for personal consumption or use. (R.S. 47:305(D)(1)(t))

Notice to Seller: Report these sales on the appropriate sales tax return schedule using the above referenced sales tax

exemption codes if applicable.

Buyer’s Information

Buyer

Buyer’s Address

City State ZIP

Authorization

Authorized Representative Title

Signature Date (mm/dd/yyyy)

Questions about the completion of this form should be sent to Sales.Inquiries@la.gov.